IOTA Market Update: Team releases the IOTA 2.0 progress updates, IOT/USD strings together six straight bullish days

- IOTA has released updates regarding the IOTA 2.0 launch progress.

- The team has successfully released version 0.2.2 of the Pollen testnet

- The firm has completed drafting the mana and autopeering specifications for IOTA 2.0.

The IOTA (MIOTA) team has recently released important updates regarding the progress made towards the launch of IOTA 2.0. According to a blog post, the team has successfully released version 0.2.2 of the Pollen testnet. The latest release comes with multiple improvements such as message request management, a new beacon plugin, and a refactored worker pool.

The IOTA team noted that the process of validating messages and transactions had been prominently improved. They have also created a new API middleware, which lets users issue transactions in a JavaScript Object Notation (JSON) format. IOTA has also introduced a new GUI wallet and a more robust Grafana local dashboard to make Pollen more user friendly. Additionally, the team has improved the message drop policy. This protects the network against malicious nodes.

IOTA stated that it has completed drafting the mana and autopeering specifications for IOTA 2.0. What’s more, the team has reviewed the Chrysalis and RFC protocol and is now concentrating on completing and reviewing the specs in the next research phase.

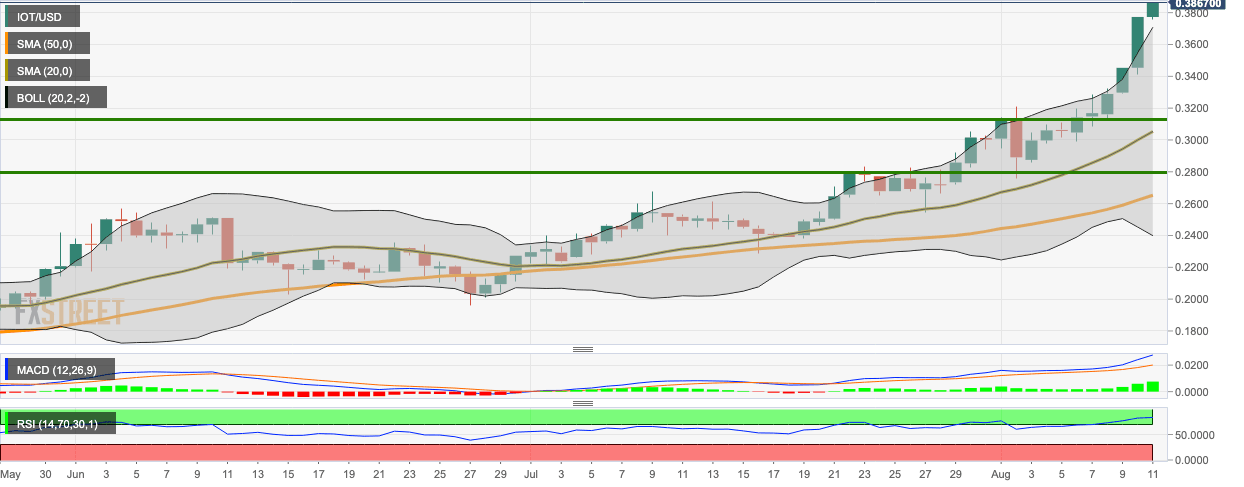

IOT/USD daily chart

IOT/USD bulls stayed in control for six straight days. The price has gone up from $0.3779 to $0.3867 in the early hours of Tuesday.

Healthy support levels lie at $0.313, $0.305 (SMA 20), $0.2792 and $0.2654 (SMA 50). The MACD shows increasing bullish momentum.

IOT/USD is hovering above the 20-day Bollinger Band and the RSI indicator is trending around 86.27 in the overbought zone. Both these indicators show that the price is presently overvalued and may face bearish correction soon.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.