IOTA Market Update: IOTA named the key innovator of the European Research program

- The European Commission says that IOTA as "a key innovator".

- IOTA/USD stays in the range as the upside momentum fades away.

IOTA is the 24th largest digital asset with the current market value of $842 million. The coin has stayed mostly unchanged since the beginning of Thursday and lost 1.4% in the recent 24 hours. At the time of writing, IOT/USD is changing hands at marginally above $0.3014. The coin has been range-bound with bullish bias after a collapse to $0.2963.

The European Commission named IOTA as "a key innovator"

The cryptocurrency project has been recognized as a key innovator for its contribution to the European Research program focused on solving the main issues faced by the EU society in the realms of transport and energy.

The European Commission approved IOTA’s proposal for CityxChange project in 2018 after a heavy review process. The initiative aims to build a peer-to-peer marketplace for trading renewable energy within a city, while IOTA’s technology will help create an automatic communication energy-positive buildings.

The +CityxChange project is broken down into multiple work packages, each focusing on a different area of the future energy positive smart city. Each work package is composed of multiple tasks. IOTA is involved in a total of 12 tasks, ranging from standard project management activities, development and planning the commercialization and exploitation of new technology.

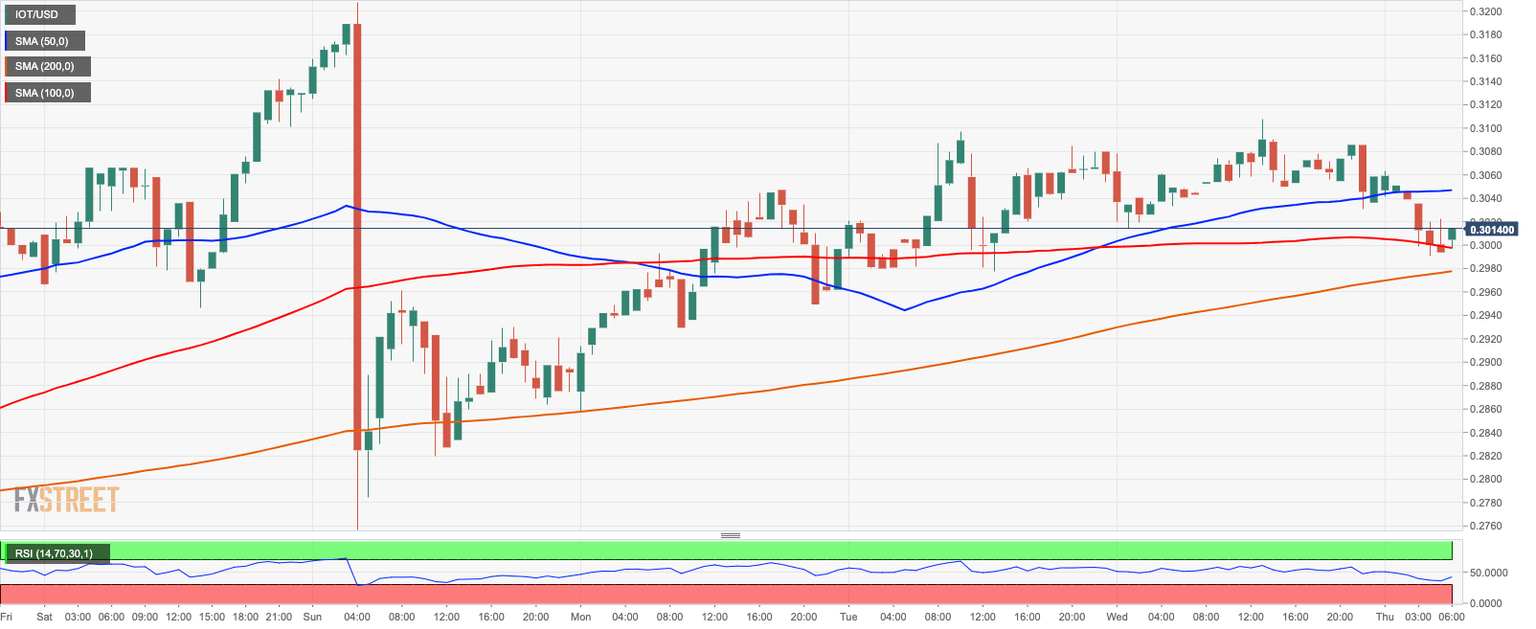

IOTA/USD: The technical picture

IOT/USD regained ground above $0.30. This pivotal level is reinforced by 1-hour SMA100 and now serves as a local support. The further recovery may be extended towards 1-hour SMA50 at $0.3050. The next resistance is created by $0.3090-$0.4000. This area has been limiting the upside momentum since August 4. On the downside, if the price moves sustainably below $0.3000, the sell-off may be extended to $0.2840 (4-hour SMA100) and $0.2757 (August 2 low).

IOT/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst