Investors flock to Bitcoin amid concerns over high inflation - Survey

- Investors prefer to buy and hold cryptocurrency as an inflation hedge.

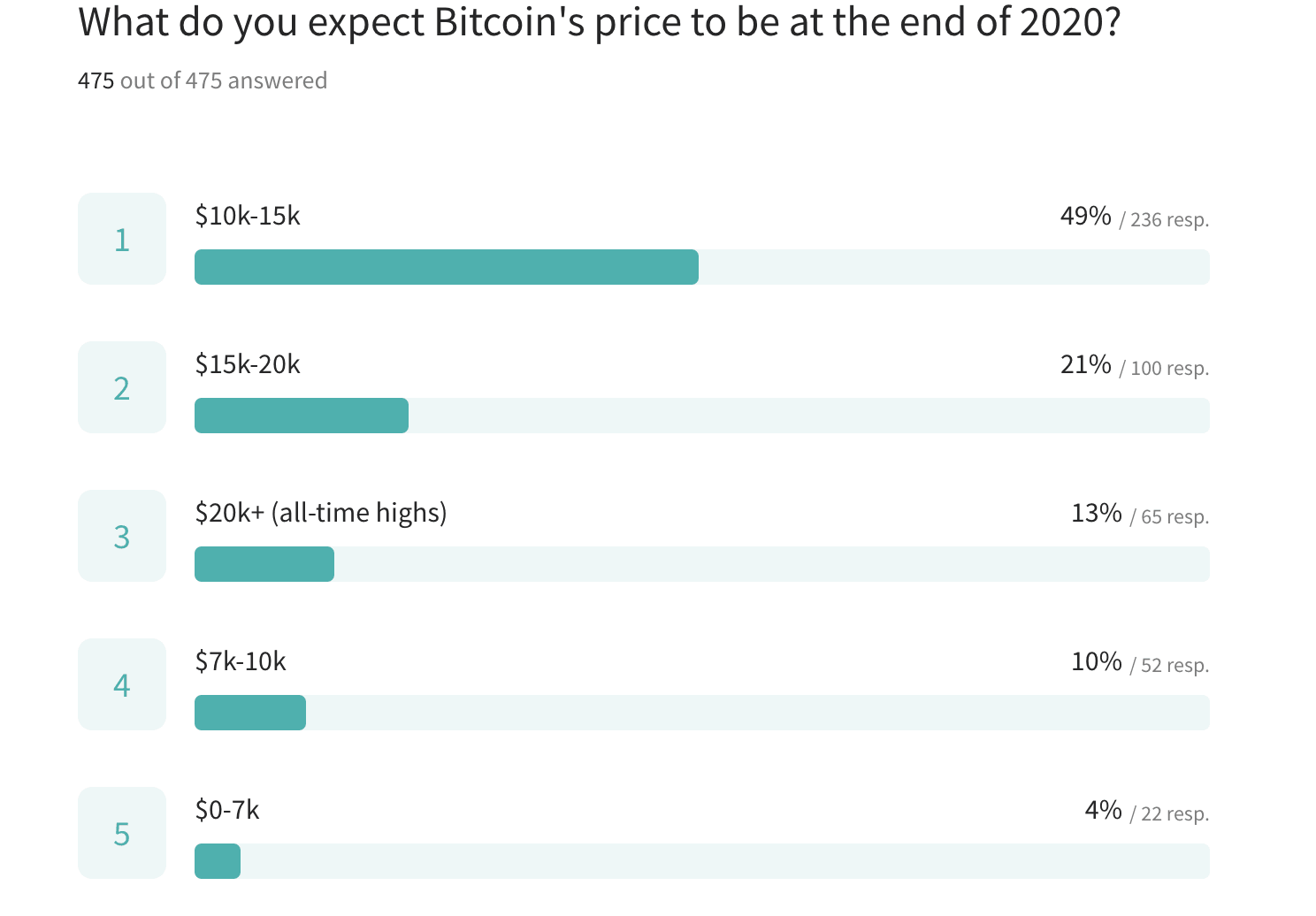

- Half of the respondents expect BTC to stay in the range of $10,000-$15,000.

Bitcoin's bullish trend is at its early stages. The meteoric price increase will be fuelled by high inflation and the skyrocketing global debt.

Various cryptocurrency experts, including Su Zhu from Three Arrows Capital and analysis from Pantera Capital, have expressed this view recently. Now, these subjective opinions are confirmed by hard facts from Bitcoin IRA Survey.

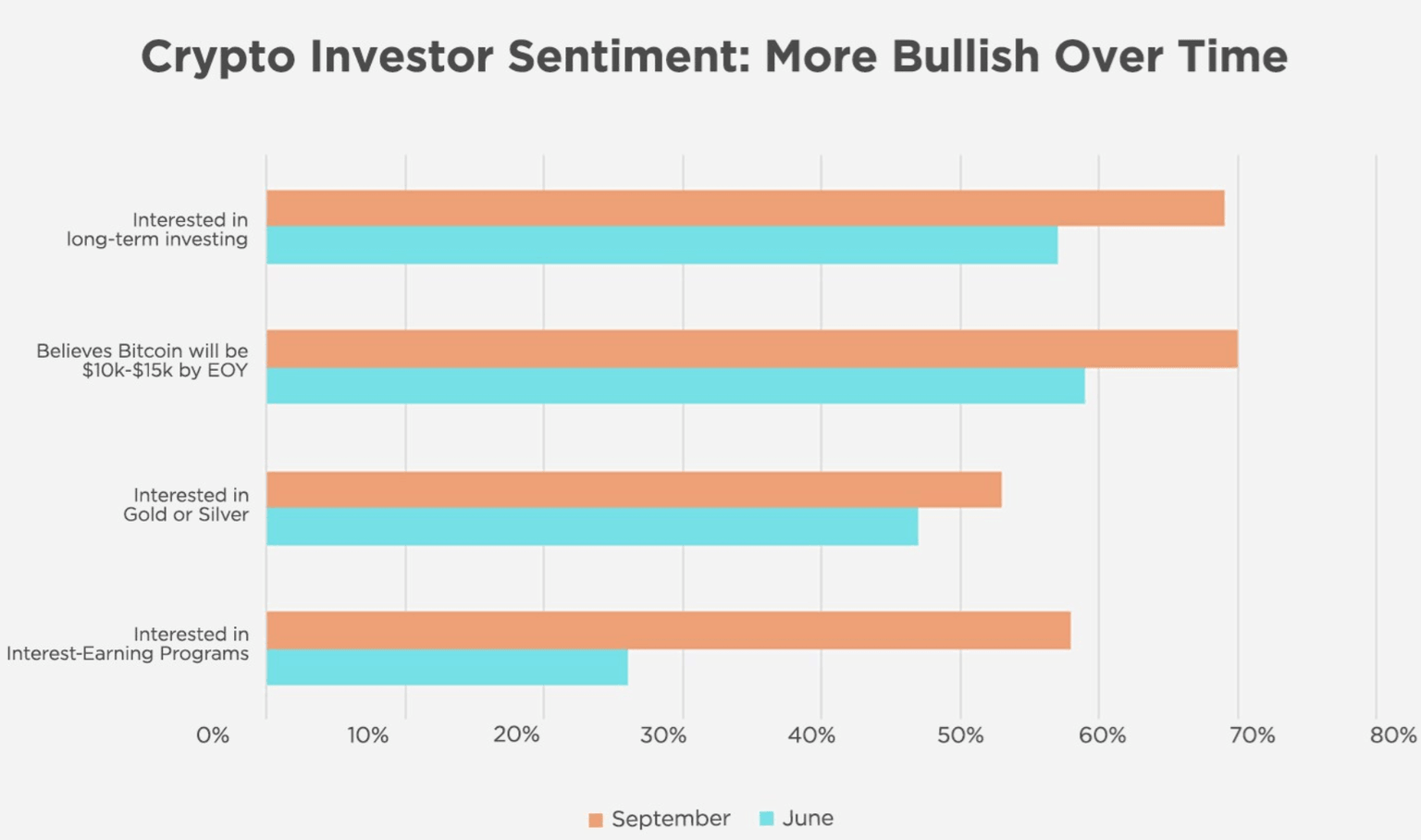

One of the world's largest platforms for secure buying digital assets and physical gold for the retirement accounts surveyed its users. They wanted to know how buyers feel about cryptocurrency assets and whether their attitude changed over time. The experts polled the respondents twice - in June 2020 and in September 2020 - and then compared the results.

As the chart below shows, nearly 70% of investors are interested in the long-term Bitcoin holding from below 60% registered in June. They cited the high-inflation of fiat currencies and excessive global debt caused by the COVID-19 as the rationale behind their decisions to invest in digital assets.

Cryptocurrency investors sentiment

Source: Bitcoin IRA

Bitcoin vs. Gold

Notably, precious metals have also enjoyed the growing investors' interest, as historically, they are regarded as a store of value and a hedge against inflation. Now Bitcoin has joined the cohort of the safe-have assets that attract significant interest during economic turbulence.

The growing popularity of Bitcoin in crisis-stricken countries confirms the theory that people flee to Bitcoin to protect their assets from devaluation. As the FXStreet previously reported, Bitcoin is most prevalent in Turkey, Brazil, and Colombia. With the rapid depreciation of the national fiat currencies, these countries have the highest percentage of cryptocurrency holders.

However, unlike gold, Bitcoin brings passive income via staking, by providing their coins for liquidity purposes. Over 60% of the respondents surveyed by Bitcoin IRA in September answered that they would like to earn interest on their crypto holdings.

Price expectations

Some famous cryptocurrency experts make ambitious Bitcoin price forecasts, citing "money printer going brr." Thus, Tyler and Cameron Winklevoss recently mentioned that Bitcoin could reach $500,000 due to fundamental problems with the U.S. dollar and the U.S. economy in general. They are concerned about inflationary monetary policies and a growing pile of debts.

The experts from the blockchain research and analysis firm Messari said Bitcoin could hit $50,000 once the institutional investors start pouring their money into the industry. Notably, the process as already started as such big names as Grayscale and MicroStrategy have been increasing their BTC exposure.

Meanwhile, the users of Bitcoin IRA are more realistic about Bitcoin prices. The survey showed that nearly 50% of the respondents expect the pioneer cryptocurrency to stay within the range of $10,000-$15,000, and only 13% hope to see at an all-time high. However, the number of people expecting BTC to slump below $7,000 is less than 4%.

Bitcoin price expectations

Source: Bitcoin IRA

At the time of writing, BTC/USD is changing hands at $10,800. The coin has been range-bound since the start of the week after a failed attempt to retest the psychological barrier of $11,000. As we have previously reported, the cluster of strong technical levels around $11,000-$11,200 limits Bitcoin's recovery for the time being. The support is created by $10,500.

Author

Tanya Abrosimova

Independent Analyst