Investors drop 50 million LDO in three weeks as faith tumbles due to lack of Lido DAO price recovery

- Lido DAO price is slipping with every passing day after losing the support of the 50-, 100- and 200-day EMAs.

- The mid-term holders have been losing confidence in the asset as their supply has declined by more than 5% in 20 days.

- This shaking faith is evident in the investors’ activity as the rate at which LDO changes hands has hit a two-month low.

Lido DAO price has been on a downtrend since mid-July and is potentially going to continue down that path. While the broader market bearishness is one of the reasons behind this bearishness, the decline in support from core investors is another major one.

Lido DAO price might see some more red

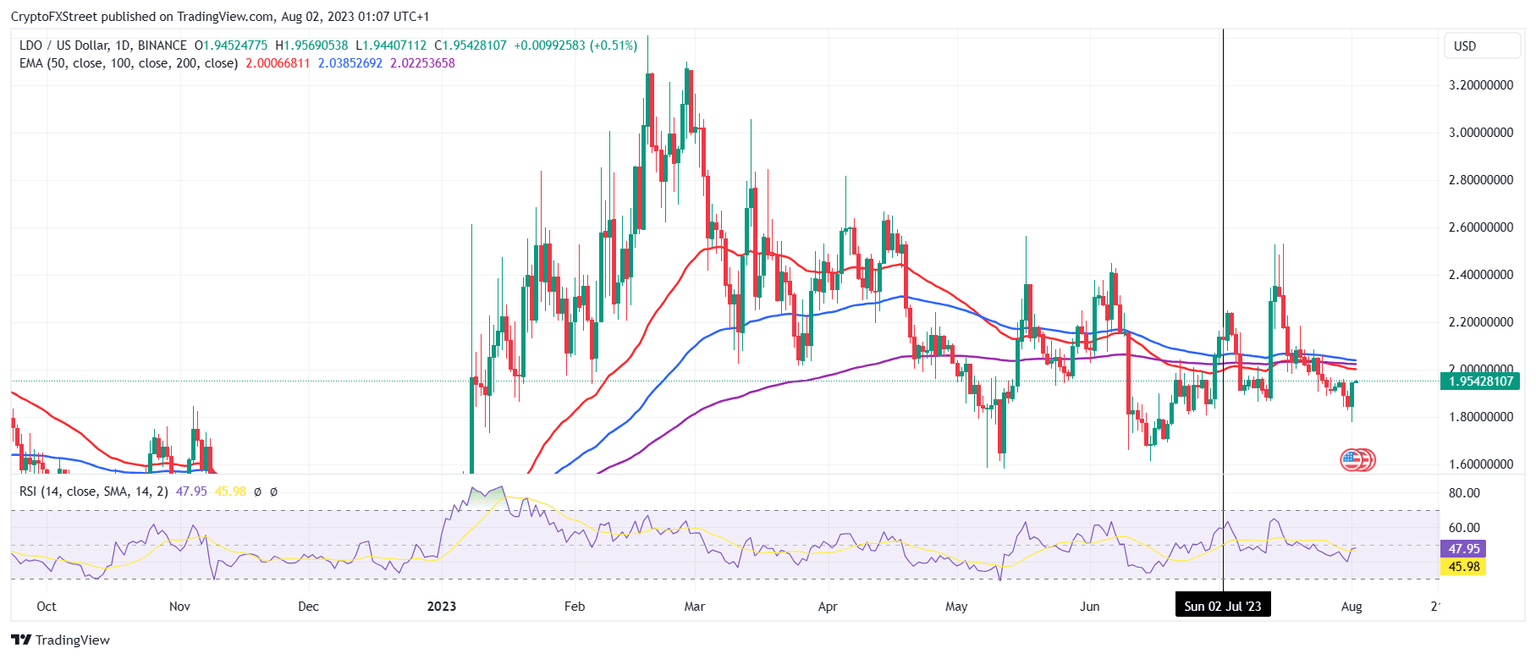

Lido DAO price, trading at $1.93, recently fell below the psychological support level of $2.00 after falling for two weeks straight. In the process, the altcoin also lost the support of three crucial support levels - the 50-, 100- and 200-day Exponential Moving Averages (EMA).

LDO/USD 1-day chart

As these EMAs turned into resistance levels, skepticism amongst the investors rose, and consequently, their decision to offload their holdings took precedence over accumulating more LDO at a lower price. The mid-term holders - investors holding for more than a month and less than a year - shed some of their supply over the last 20 days.

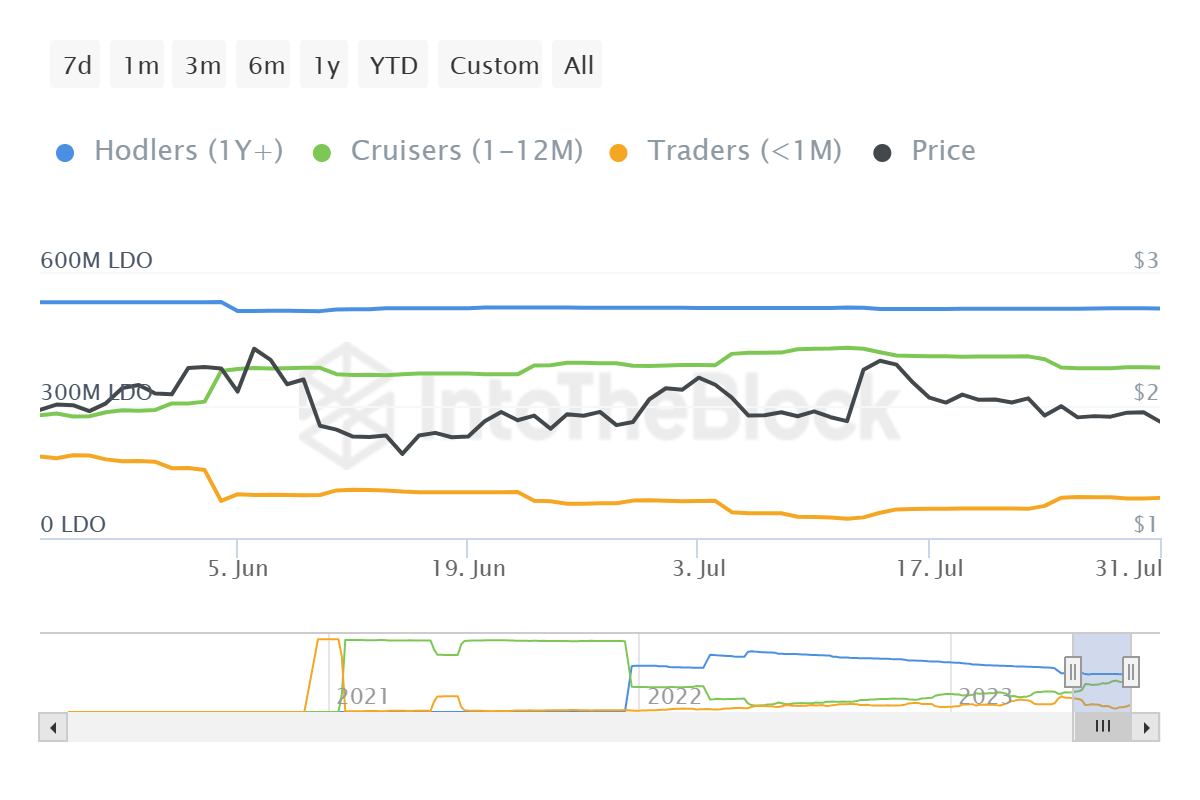

From holding 430 million LDO to now holding 380 million LDO, these investors dropped 50 million LDO, which represents 5% of the entire circulating supply. Their decision to reduce their LDO indicates an increase in bearishness in their perspective, which was also reflected in their activity these past few days.

Lido DAO holders’ supply

The velocity of Lido DAO tokens, which began declining at the beginning of July, recently hit a two-month low. The velocity is the measure of the rate at which LDO tokens change hands, i.e., move between addresses. A high velocity is a sign of an active and healthy network, and a declining velocity usually suggests an increase in fear or bearishness.

Lido DAO velocity

Such is the case with LDO holders, as they have decided to pull back and wait out the bearishness. This will result in Lido DAO price recovery taking longer since it is not finding firm support from its investors.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.38.15%2C%252002%2520Aug%2C%25202023%5D-638265337800926651.png&w=1536&q=95)