Investors add to Altcoin funds as Bitcoin outflows mount

Bitcoin (BTC, 0.34%) investment products recorded their eighth consecutive week of outflows, totaling $3.8 million, but alternative coin (altcoin) funds continued to attract fresh capital, according to a report Monday.

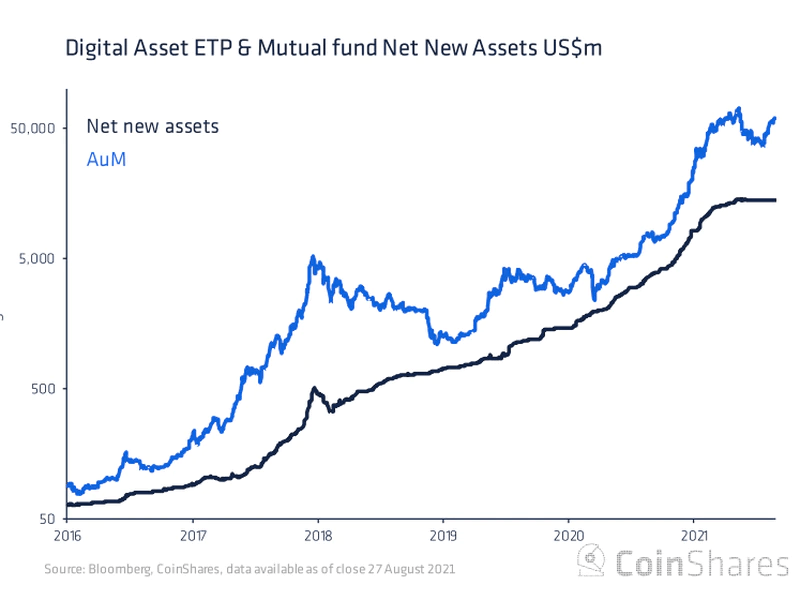

Overall, crypto funds netted inflows totaling $24 million during the week ending Aug. 27, down about $3 million versus the prior week, according to the report by digital asset investment manager CoinShares.

-

Altcoins, or cryptocurrencies other than bitcoin, now represent 32% of total digital assets under management, close to the record 35% set in mid-May.

-

Cardano-focused funds saw inflows totaling $10.1 million over the past week, as the price of its associated cryptocurrency cardano (ADA, 1.54%) doubled over the past month.

-

ethereum (ETH, 7.95%) funds saw inflows totaling $17 million last week, with a relatively stable digital asset fund market share of about 25%, according to CoinShares.

Crypto fund assets under management (Source: CoinShares)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.