How long is the altcoins' dominance going to last?

Bears have seized the initiative on the last day of the week. XRP remains the only coin trading in the green zone.

Top 10 coins by CoinMarketCap

BTC/USD

Bitcoin (BTC) could not finish the week under bulls' dominance. The price of the main crypto has fallen by 5.66% over the last seven days.

BTC/USD chart by TradingView

On the daily chart, Bitcon (BTC) keeps trading above $56,000, which means that there are still high chances of seeing a restest of the peak around $62,000.

Only if bears push the rate below $59,000 will they seize the long-term initiative.

Bitcoin is trading at $57,000 at press time.

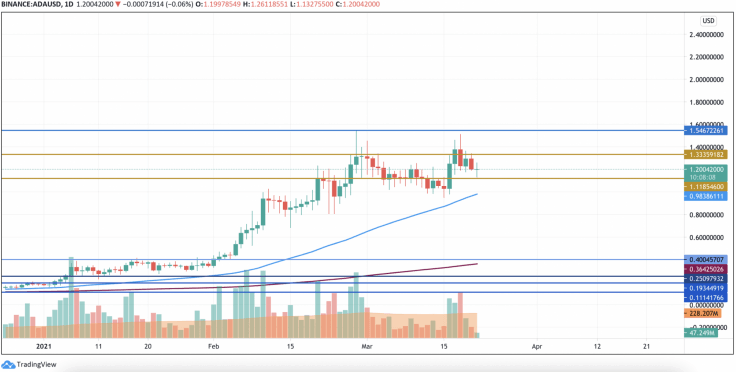

ADA/USD

Cardano (ADA) is the top loser today. The price of the coin has gone down by almost 5%.

ADA/USD chart by TradingView

Despite the price decrease, bears have not seized the initiative as the altcoin keeps trading in a range between $1.18 and $1.33. At the moment, sideways trading is the more likely scenario, which means that the upper channel boundary may be tested.

Cardano is trading at $1.20 at press time.

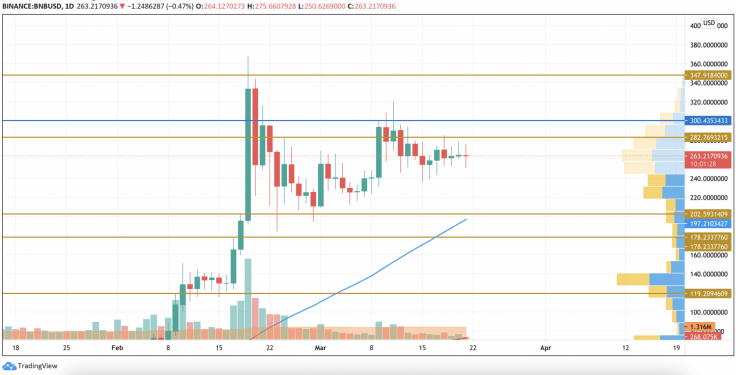

BNB/USD

Binance Coin (BNB) has lost the least today. The rate of the native exchange token has gone down by only 2%.

BNB/USD chart by TradingView

On the daily time frame, Binance Coin (BNB) is approaching the first resistance at $282. The selling volume is low, which means that there are chances to break it and go to the next zone around $300.

BNB is trading at $263 at press time.

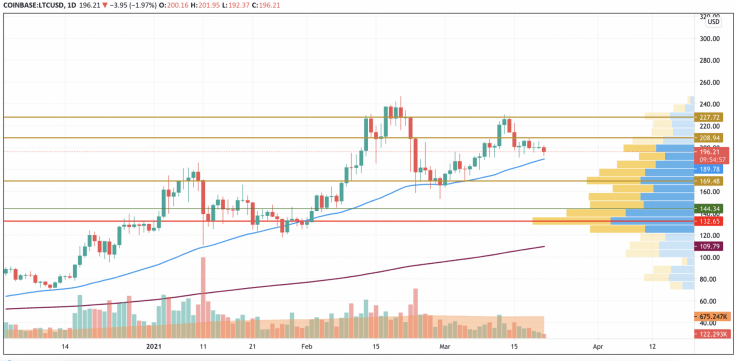

LTC/USD

Litecoin (LTC) is not an exception to our rule as the "digital silver" could not keep trading in the bullish zone.

LTC/USD chart by TradingView

Litecoin (LTC) has retested the MA 50 on the daily chart, confirming bulls' potential to keep the growth going. If buyers break the first obstacle at $208, they will move to the closest one around $227.

Litecoin is trading at $196 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.