Here’s how ApeCoin plans to recover losses and rally 80%

- ApeCoin price has returned to the $5.93 stable support level after a 15% downswing.

- This retracement is a bullish one and is likely going to result in an 80% bounce soon.

- A breakdown of the $5.02 support level will invalidate the bullish thesis for APE.

ApeCoin price has returned to where it was roughly five days ago and has followed Bitcoin’s recent downswing to arrive here. The pullback was a bullish retracement for the big crypto and the same can be said for APE, which shows massive rally potential.

ApeCoin price and bottom reversal pattern

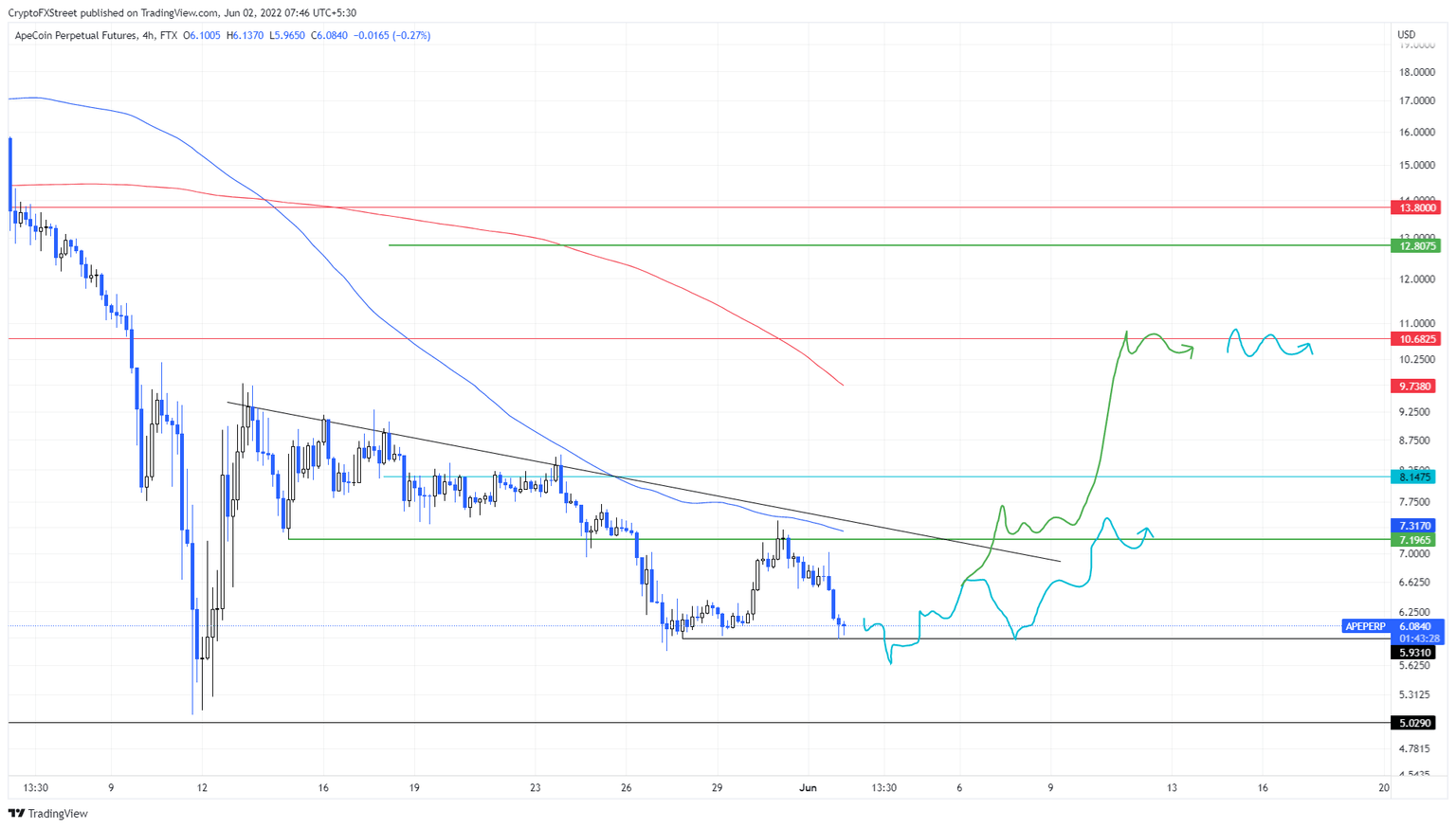

ApeCoin price bounced off the $5.93 support level on May 27 after a brief period of consolidation. This run-up propelled APE by 25%, causing it to sweep the $7.19 hurdle briefly. However, the bulls failed to keep up the momentum, resulting in a top formation.

Due to Bitcoin’s downswing, ApeCoin price followed its lead, retesting the $5.93 support level where it currently trades. While this retracement might seem bearish, there is a possibility APE forms a triple bottom aka Triple Tap setup.

This technical formation requires a dip below the $5.93 barrier, followed by a quick recovery above the initially formed range low at $5.93. The final touch will arrive as ApeCoin price retraces lower to retest the formed low, completing the setup.

The resulting upswing will likely propel ApeCoin price to the 100 four-hour and 200 four-hour moving averages at $7.31 and $9.37, respectively. In a highly bullish case, this move could extend to the next hurdle at $10.68, bringing the total gain to 80%.

APE/USDT 4-hour chart

Regardless of the bullishness seen in ApeCoin price, if Bitcoin price continues to tank, altcoins will follow suit en masse. In such a case, if APE produces a four-hour candlestick close below the $5.02 support level, it will invalidate the bullish thesis.

This development will push ApeCoin price into a price discovery phase.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.