Hedera Price Analysis: HBAR defies $50B market dip as Nvidia confirms AI partnership

- Hedera price consolidates above the $0.15 support level on Tuesday despite crypto markets shedding $50 billion on the day.

- Hedera Hashgraph price initially climbed 13% from its Tuesday opening, momentarily testing the $0.17 mark.

- Nvidia has confirmed plans to integrate Hedera blockchain into its AI program.

Hedera maintains strength above $0.15, signaling investor confidence as NVIDIA’s AI integration boosts long-term bullish sentiment and breakout potential.

Hedera holds key support as technical breakout signals long-term bullish momentum

Hedera Hashgraph (HBAR) exhibits significant resilience on Tuesday in the face of broader market turbulence. As controversy surrounding the US trade war rages, HBAR has conspicuously held steady above its opening price at the $0.15 support level.

-1744145164101.png&w=1536&q=95)

Crypto market performance, April 8 | source: Coingecko

While HBAR’s trades near its opening price for the day, its performance stands out when compared to global crypto market trends.

According to Coingecko data, the global crypto market has lost $50 billion in valuation, declining 3% to hit the $2.5 trillion mark on Tuesday.

Hedera’s mild 0.4% uptick is a significantly stronger performance relative to top-ranked altcoins like Ripple (XRP), Cardano (ADA) and Ethereum (ETH) all posting excess of 3% losses for the day.

Nvidia to integrate Hedera into its AI programs

HBAR’s resilient performance on Tuesday has been linked to a partnership inked between Hedera blockchain and chip making giant Nvidia. In a press release, Nvidia confirmed that it will integrate Hedera’s blockchain infrastructure into its upcoming artificial intelligence initiatives.

In a recent LinkedIn update, Anthony Rong, Nvidia’s Regional VP of Engineering, highlighted the significance of this collaboration. He emphasized that the inclusion of Hedera's public distributed ledger technology will play a key role in building trustworthy, real-time AI systems for enterprise and industrial use.

This partnership aims to tackle one of AI’s most pressing challenges — data integrity. By embedding Hedera's ultra-fast, energy-efficient consensus mechanism into AI pipelines, Nvidia is equipping its systems with tools to verify the origin and authenticity of training data and real-time inputs. Such transparency is becoming critical as machine learning models are deployed in sectors where precision and accountability are non-negotiable.

Industries like healthcare diagnostics, financial risk modeling, autonomous logistics, and secure supply chains stand to benefit significantly. According to Rong, Hedera’s immutable audit trails will ensure that AI-generated insights can be trusted and traced.

Why is Hedera price holding up today?

This strategic alignment appears to be shielding HBAR from the macro pressure stemming from the ongoing US trade war weighing on other altcoins.

Following the announcement, HBAR price surged as much as 13% during intraday trading, briefly tagging the $0.17 level before encountering resistance.

The bullish impulse leans into the narrative that Hedera’s low energy usage and high throughput complement Nvidia’s long-term mission to deliver environmentally-sustainable AI solutions.

HBAR price forecast: Hedera tests $0.15 floor as Nvidia deal lifts sentiment

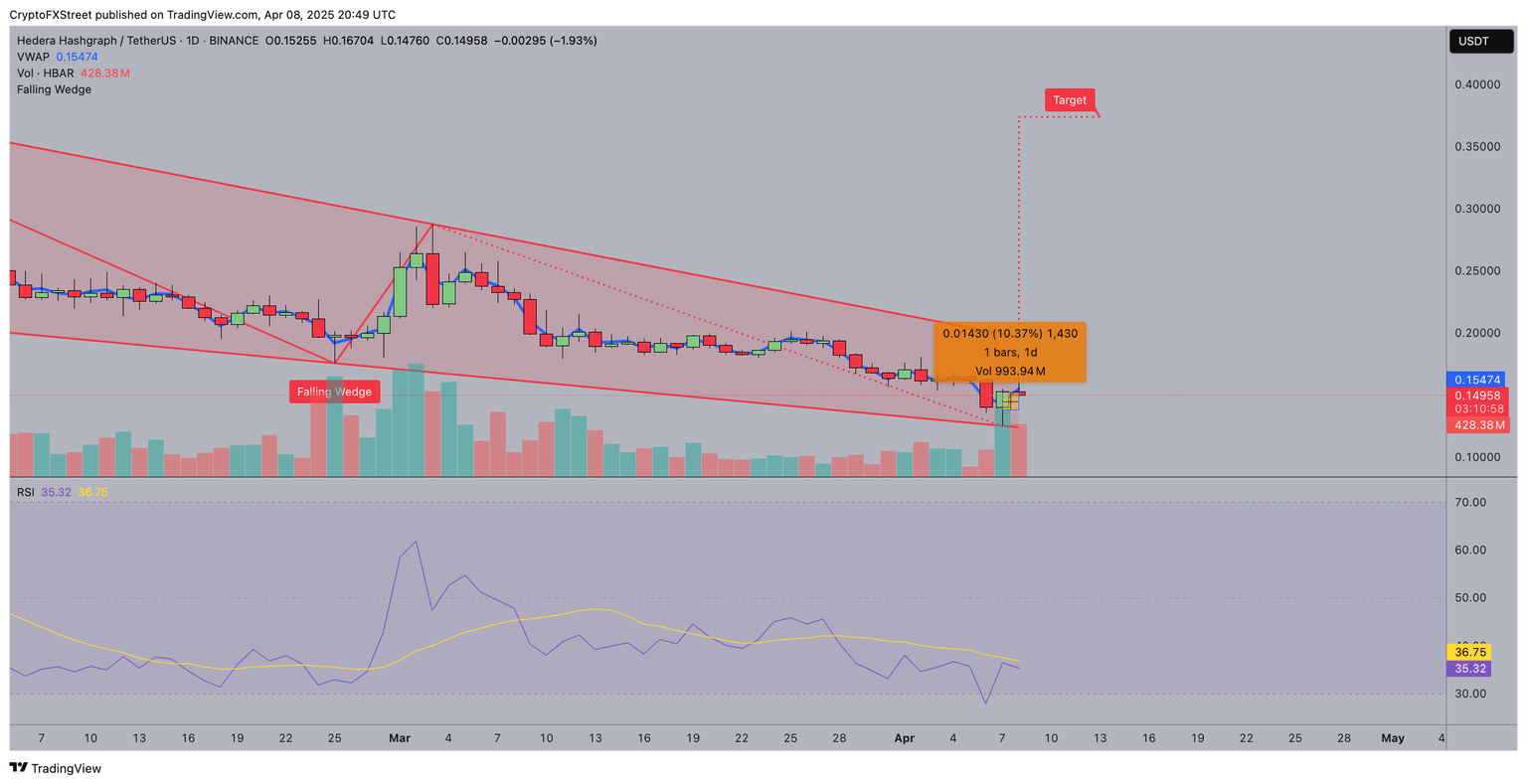

Hedera continues to defend the $0.15 support despite broader crypto volatility, highlighting investor confidence following Nvidia’s AI partnership. The chart confirms a falling wedge breakout, a classic bullish reversal pattern, with a measured move target near $0.35 — representing over 130% upside from current levels.

Volume on the breakout bar spiked to 951.88 million, signaling strong buyer conviction. Hedera’s price bounced 10.37% from local lows on that surge, validating the wedge breakout.

The VWAP now sits at $0.15531 and acts as immediate resistance. A daily close above this line is required for continuation toward $0.17, with $0.20 as the next major inflection point.

HBAR price forecast

The RSI at 35.62 suggests room for upward movement, but bearish divergence from prior highs signals caution. In this Hedera price forecast, upside remains viable if accumulation continues above the wedge resistance.

On the flipside, failure to sustain trading at $0.15 would invalidate the wedge and expose HBAR to $0.13 on the downside, a key support seen in prior consolidations.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.