Have the main coins returned to mid-term growth?

The last Sunday of 2021 is neither bullish nor bearish as some coins remain trading in the green zone, while others have entered the correction phase.

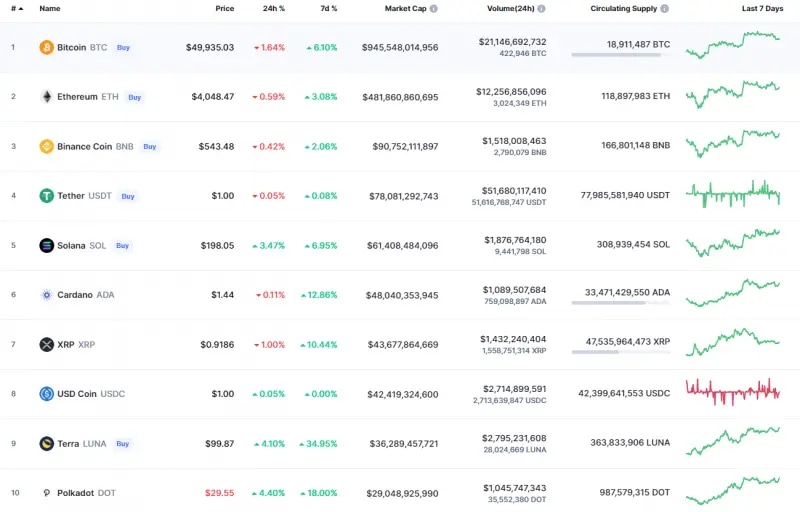

Top coins by CoinMarketCap

BTC/USD

Despite today's slight fall, the rate of Bitcoin (BTC) has increased by 6% over the last seven days.

BTC/USD chart by TradingView

Bitcoin (BTC) remains trading in a channel, accumulating power for a possible upward movement. Until the rate remains above the $47,000 mark, bulls control the situation on the market.

If buyers can fix above the vital area of $50,000, there are high chances to see BTC near the purple level at $53,300 until the end of the year.

Bitcoin is trading at $49,892 at press time.

ETH/USD

Even though the rate of Ethereum (ETH) is almost unchanged since yesterday, its growth has not been so grear compared to BTC's price change.

ETH/USD chart by TradingView

Ethereum (ETH) is located around the zone of the most liquidity at $4,050. Sideways trading is also confirmed by a low trading volume, which means that the main altcoin has not accumulated enough energy for a further sharp move.

All in all, bulls might seize the initiative if they fix above the zone of $4,200. From another point of view, the bearish scenario may come into force if ETH returns to the support at $3,700.

Ethereum is trading at $4,044 at press time.

BNB/USD

The rate of Binance Coin (BNB) has gone down by 1%, while the price change over the last week has accounted for +1.50%.

BNB/USD chart by TradingView

Binance Coin (BNB) is trading similarly to Ethereum (ETH), as the native exchange coin is also located in the wide channel with neither clear bearish nor bullish signals. If the rate remains above $500, buyers may continue the slight rise to the nearest resistance area around $600. Such a scenario is relevant until the end of the current month. At the moment, the price is far away from the support at $489, which is the crucial level for bulls.

Binance Coin is trading at $542 at press time.

ADA/USD

Cardano (ADA) is the biggest gainer from the list taking into account the weekly price change, with a rise of 12%.

ADA/USD chart by TradingView

Cardano (ADA) is approaching the resistance at $1.479 for the third time. If bulls manage to break it and fix above, the rise may continue to the nearest zone at $2. However, such a scenario might happen within the next few weeks as buyers need to accumulate more strength for a further price rise.

ADA is trading at $1.437 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.