Gold ETFs bleed $2.4B so far this year as Bitcoin ETFs hit record volumes

Gold-tracking exchange-traded funds (ETFs) have lost billions in outflows this year in stark contrast to ETFs tracking the spot price of Bitcoin (BTC $52,146).

The leading 14 gold ETFs have seen outflows of $2.4 billion this year, according to Bloomberg intelligence analyst Eric Balchunas on Feb. 14.

Meanwhile it’s a pretty bad scene right now in the gold ETFs category… via @SirYappityyapp in our just published weekly flow note pic.twitter.com/C0T17JZpiA

— Eric Balchunas (@EricBalchunas) February 14, 2024

Only three had seen minor inflows in 2024, including VanEck Merk Gold Shares, FT Vest Gold Strategy Target Income ETF, and Proshares UltraShort Gold, while the largest outflows came from BlackRock's iShares Gold Trust Micro and iShares Gold Trust, losing $230.4 million and $423.6 million, respectively.

Conversely, the ten approved spot Bitcoin ETFs have seen aggregate inflows of $3.89 billion this year, according to preliminary data from Farside, while hitting record volumes.

“Not only is Bitcoin sucking up funds, but gold is hemorrhaging AUM at an alarming rate across many ETFs,” commented portfolio manager “Bitcoin Munger."

Balchunas, however, commented that he didn’t think gold ETF investors were necessarily mass migrating to Bitcoin ETFs, “but rather just US equity FOMO.”

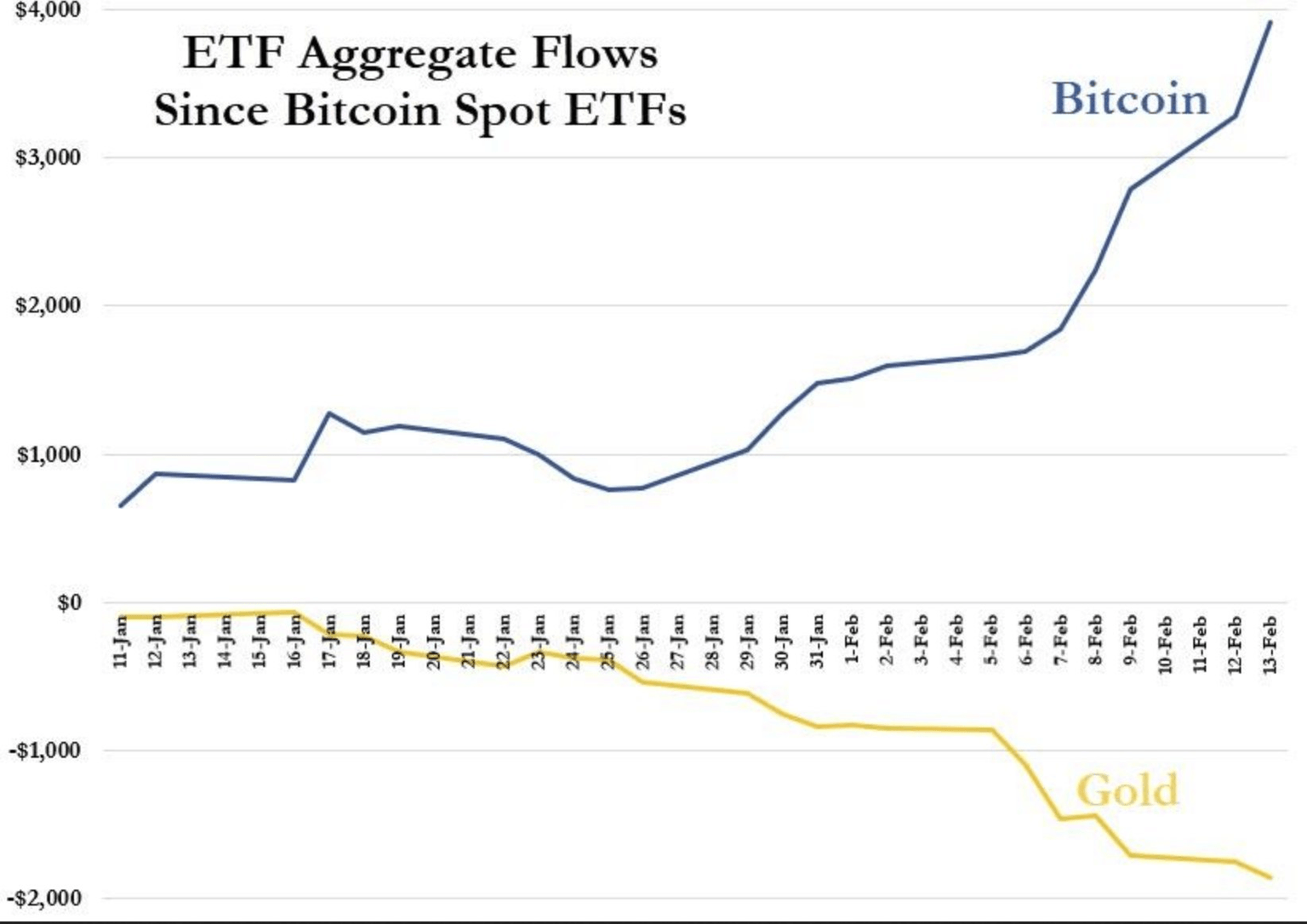

Bitcoin pioneer Jameson Lopp meanwhile shared a chart comparing the two ETFs, asking about the well-being of gold investor and Bitcoin detractor Peter Schiff.

ETF aggregate flows since spot BTC ETF launch. Source X/@lopp

The divergence has been exacerbated by falling gold prices in 2024. The commodity has lost 3.4% since the beginning of the year, falling to a two-month low of $1,993 per ounce on Feb. 14.

Meanwhile, Bitcoin prices have increased 23.5% over the same period, with the asset hitting a two-year high of $52,483 on Feb. 14.

Related: ‘Substitution’ of gold for Bitcoin is now underway, says Cathie Wood

In a report earlier this month, the World Gold Council said that global gold ETF outflows and a “reduction in speculative positioning” were major contributors to gold’s lackluster performance before adding:

Long-term Treasuries and the US dollar, on the back of strong upside US economic surprises, were also headwinds.

In January, Bloomberg senior commodity strategist Mike McGlone predicted that gold would outperform Bitcoin in 2024, but he appears to be a little off the mark at the moment.

Both assets have often been compared for their shared store of value properties and a go-to investment during times of economic and geopolitical turmoil.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.