FTT price skyrockets by 35% in a day as FTX initiates revival of the bankrupt exchange

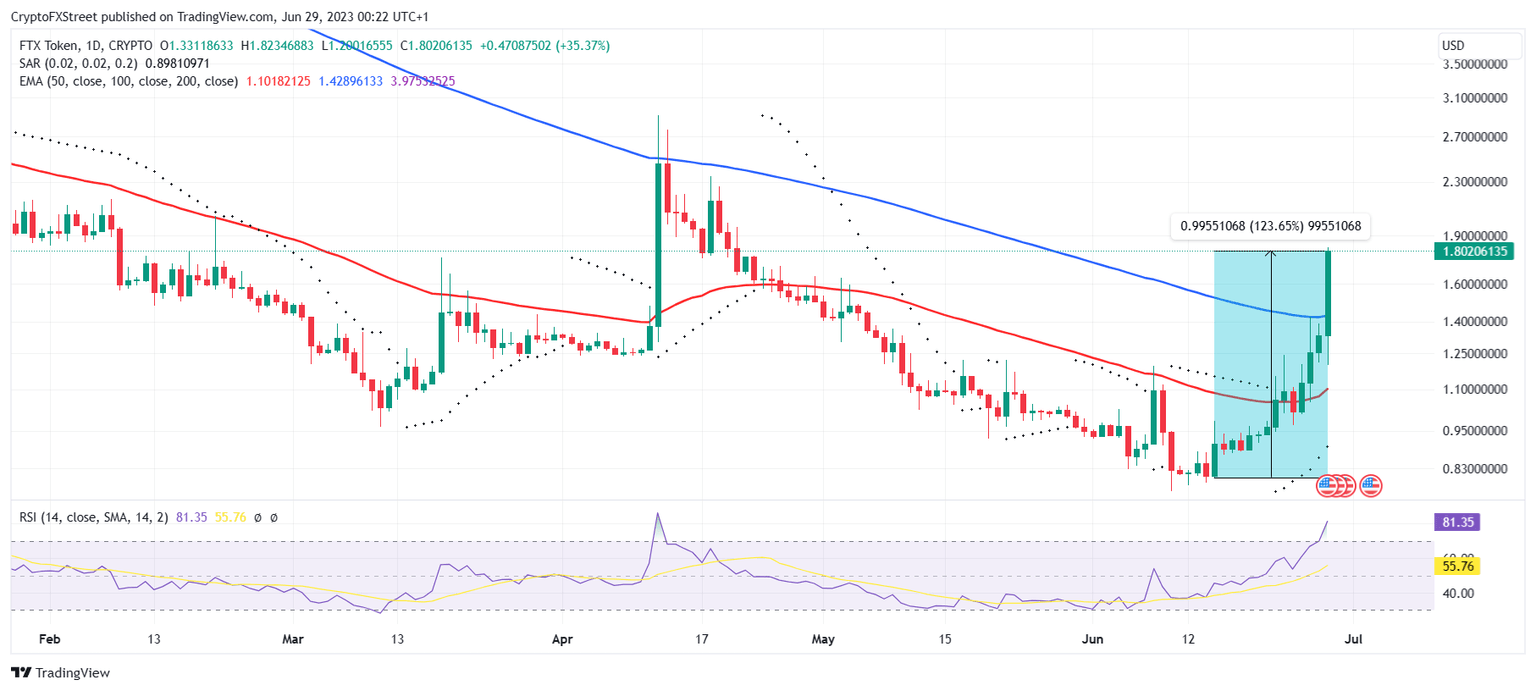

- FTT price touched $1.80 at the time of writing, rallying by 123% since June 15.

- The bankrupt exchange, led by CEO John Ray, is exploring potential joint ventures with investors.

- Sources state that existing customers might be offered a stake in the company as compensation for their losses.

FTT price is once again on the rise after news surrounding the recovery of the FTX exchange began making rounds today. While people are expecting a rather positive turn of events with this potential relaunch, some others might be looking to turn it into the poster child of caution in the crypto space.

FTT price rises at the news of relaunch

FTT price trading at $1.80 shot up by more than 35% in a little over 12 hours, bringing the total rise since June 15 to 123%. The reason behind this rally was the Wall Street Journal report, which stated that bankrupt exchange FTX might be looking to revive the exchange. Led by CEO John Ray, this initiative could bring the exchange back into the market with new management.

FTT/USD 1-day chart

According to sources, his discussions with potentially interested parties are already underway. However, the recovery team is also exploring joint ventures that could back the entire relaunch. This is expected to trigger profits for investors, but on the off chance that it does not happen, contingencies are in place.

Per popular trader Dan Gambardello, sources are claiming that the investors who lost their money during FTX's collapse may be offered to claim stakes in the exchange. This stake would act as compensation for investors, claims. Along with this, the company will also focus on rebranding the exchange. But the chances of this bringing FTX back up among the investors are dim.

This is due to the bad press that FTX has received in the last nine months since it technically ruined the crypto market. The market crashed right after the collapse of the exchange, and the impact of it was felt for months thereafter.

Even with a strong management team, a revival may fail if retail investors avoid it, fearing a repeat of November 2022. This might also keep investors and venture capitalists at bay since the exchange does not present much lucrative value at the moment.

Furthermore, the exchange will also be subject to harshness from the Securities and Exchange Commission (SEC). The SEC has been on a sworn path of bringing down crypto and would certainly not miss out on the opportunity of keeping an eye on one of the biggest "frauds" in the history of crypto.

As is, the regulatory body recently took action against Binance and Coinbase. Thus, it makes no sense for it to miss out on the opportunity of bringing down a revived FTX exchange using even the minutest flaw.

Therefore, those hyped by the revival of the FTX exchange should also keep the aforementioned points in mind.

Read more - Bankrupt FTX begins revival of international exchange, The Wall Street Journal reports

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.