Former Pimco, Millennium executives launch crypto advisory firm

- Former Millennium and Pimco executives Benoit Bosc and Michael Bressler are re-entering crypto with the launch of their new advisory firm, x2B, in November.

- x2B will focus on crypto projects for advice on raising, tokenomics, market-making, exchange listing, and treasury management.

- A former JPMorgan derivative trader, Bressler points out that traditional finance lacks deep expertise in token launches.

A couple of Wall Street's former top investment executives are back into the crypto game, with plans to open a new crypto advisory firm, Bloomberg reported on Monday.

Following his exit from crypto liquidity firm GSR in 2023, former portfolio manager at Millennium Management Benoit Bosc and ex-Pimco Executive Vice President Michael Bressler are opening x2B, a crypto consultancy firm.

Set to launch in November, x2B will focus on guiding crypto projects in fundraising, tokenomics, market-maker strategy, exchange listings, and treasury management. Their return to the crypto sector coincides with a significant market rally following Donald Trump’s victory in the US presidential election.

Bosc and Bressler’s background and transition to x2B

Bosc and Bressler previously held senior roles at GSR, a leading crypto liquidity firm, with Bosc joining in 2022 and Bressler in 2021 before their positions at Millennium and Pimco. They left GSR in 2023, following the 2022 market crash.

As of now, x2B has ten clients and will earn fees from future project tokens and cash, Bressler said, according to Bloomberg. Bosc, who traded crude Oil at Goldman Sachs for nine and a half years, said the crypto market could benefit from a “more professional and transparent” outlook.

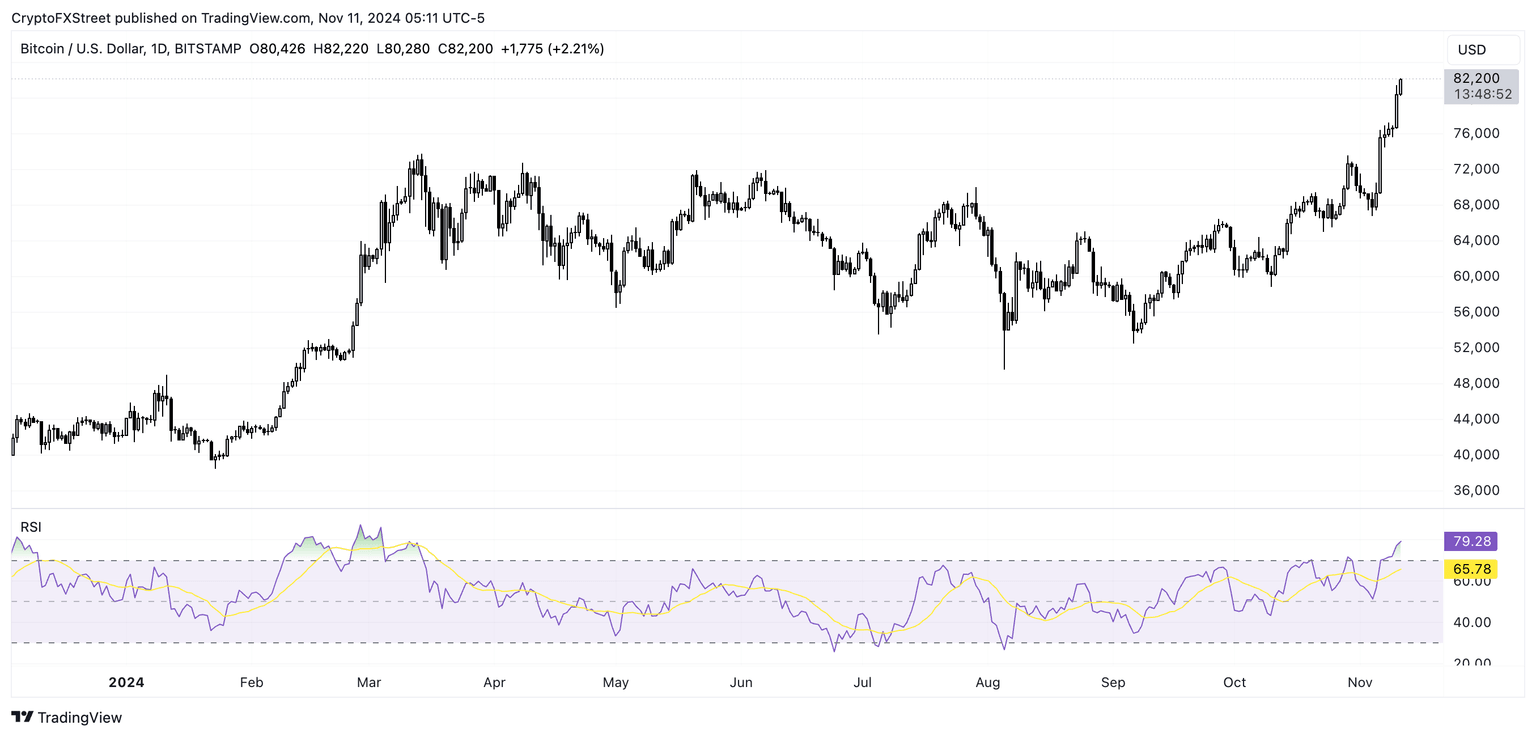

Bosc and Bressler are back in the crypto world at a time when Bitcoin (BTC) has hit $80,000 for the first time. This rally shows much bullish sentiment is expected for 2025, tapping into Donald Trump’s recent presidential victory. Industry experts said that Trump’s administration could contribute to developing the crypto space both in the United States and globally.

Source: Bitcoin 1-day chart

As of press time, Bitcoin trades at $82,000, up 2% on the day. BTC price has increased around 94% year-to-date, posting 16% gains in November so far.

Author

Reza Ali

FXStreet

Reza Ali is a seasoned crypto-journalist and analyst with over four years of dedicated experience in the crypto and fintech space. He holds a bachelor’s degree in business administration.