Fed money printing fuels Crypto boom — Just as Crypto gets easier to buy

Thanks to coronavirus lockdowns, the U.S. economy is contracting faster than at any time since the Great Depression of the 1930s.

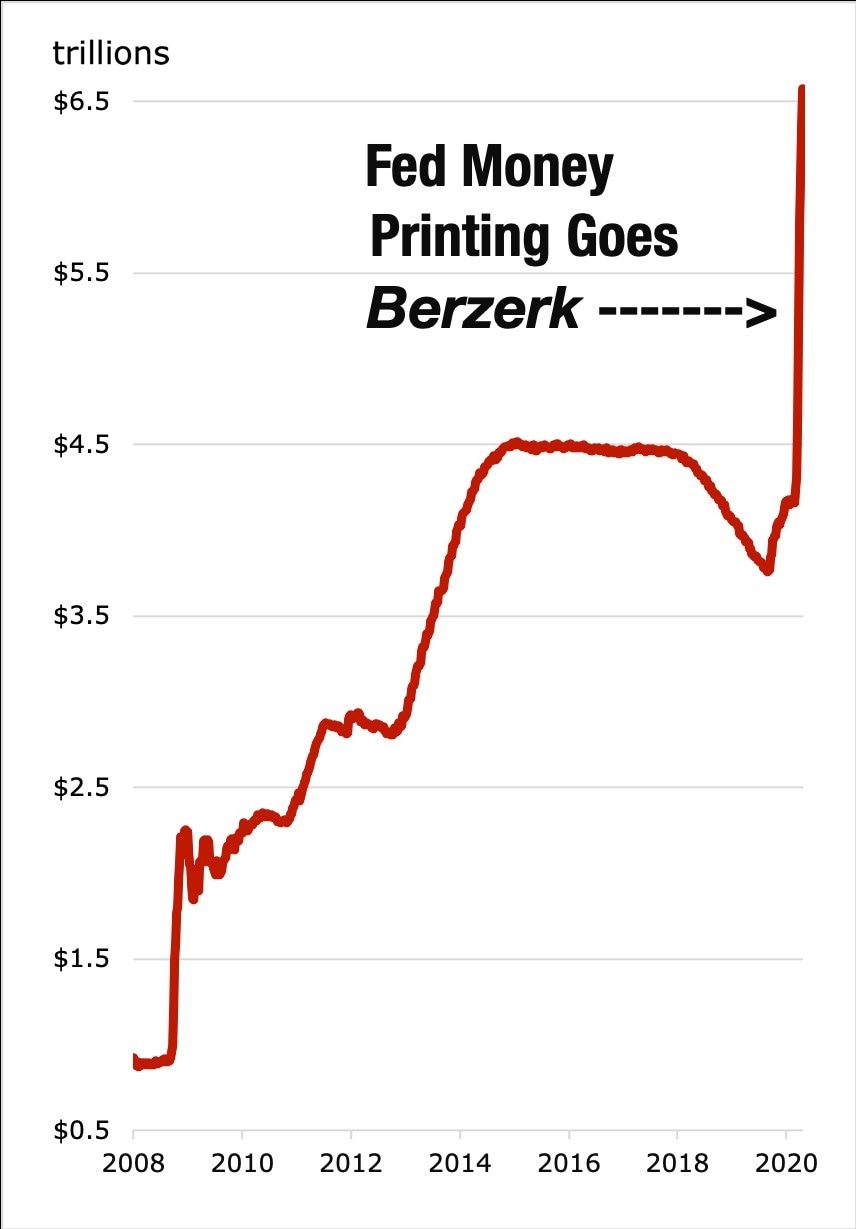

Trying to soften the blow, the Federal Reserve has just printed another more than $2 trillion. This is the fastest rate of new money creation in history.

But all that free money can't keep thousands of oil workers from losing their jobs as oil prices crash and burn.

It cannot restore lost production at locked down meat-packing and food-processing plants.

Nor can it restore output from countless factories idled because supply chain disruptions prevent deliveries of critical raw materials.

In other words, just as the supply of money in circulation shoots up almost at the speed of light, the supply of goods available for purchase is starting to drastically shrink.

More and more dollars chasing fewer and fewer goods is the textbook definition of inflation. And as inflation comes roaring back, it's going to send safe-haven demand for top-rated cryptocurrencies blasting up.

Happily, Buying Crypto Is Now Easier Than Ever

Not long ago, you typically needed one kind of crypto account to buy Bitcoin (BTC, Tech/Adoption Grade “A”). And then another kind of account to exchange some of your Bitcoin for other top-rated coins.

This made trading cryptocurrencies more cumbersome than opening an online brokerage account to trade stocks. But no more.

Now you can do practically everything through just one account. Coinbase, for example (a leading U.S.-based crypto exchange) provides essentially one-stop shopping for aspiring crypto investors and traders.

With just one easy-to-use account, you can not only buy and sell Bitcoin, but also Ethereum (ETH, T/A Grade “A”), Tezos (XTZ, T/A Grade “B-”), EOS (EOS, T/A Grade “C”) and 21 other crypto assets. Link it to your bank account to pay for your crypto purchases. Or just pay by charge card!

Overall, Coinbase has excellent liquidity and robust trading volumes — which means you should generally get better fills on your buy and sell orders.

It's quite secure due to its 2-factor authentication (2FA) process. Similar to Google’s two-step verification, this process double checks your identity by sending a PIN to your cellphone after you’ve logged on using your password.

One Final Important Point

Apart from trading accounts that we ourselves may have, neither we nor Weiss Crypto Alert has any business relationship with Coinbase (or any related entities).

We have never accepted — and will never — accept any compensation from any crypto service provider for customer referrals. Or to influence our analysis in any way whatsoever.

Whether you choose Coinbase or some other service provider, opening your first crypto account is going to be the first step into a grand adventure. Good luck.

And remember to keep up with the current top-rated cryptos in Weiss Cryptocurrency Ratings. So you always know the best coins to invest in.

Author

Juan Villaverde

Weiss Crypto Ratings

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012.