Ethereum reclaims DeFi market as bots drive $480B stablecoin volume

The Ethereum network is staging a comeback in 2025 as bot-driven activity and stablecoin growth push the mainnet back into the center of decentralized finance (DeFi).

On June 4, crypto trading platform CEX.io reported that automated bots facilitated 4.84 million stablecoin transfers on Ethereum’s layer-1 blockchain in May. The volume reached $480 billion, its highest to date.

Illia Otychenko, the lead analyst at crypto exchange Cex.io, linked the activity surge to lower transaction fees in the first quarter of 2025, which helped reverse a multi-year trend of liquidity and user migration to rival blockchains and Ethereum layer-2 networks.

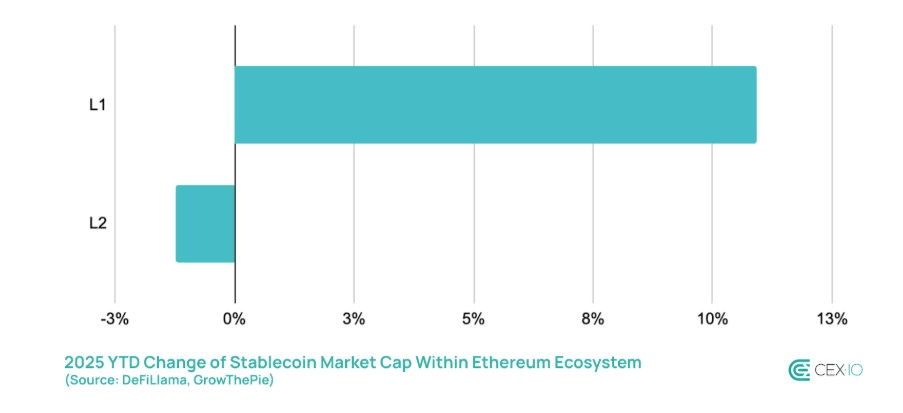

Because of this, the mainnet’s stablecoin market capitalization grew by 11% in 2025, taking market share away from its layer-2s. While the mainnet recouped stablecoin market share, the combined stablecoin market on L2s only shrank by 1%.

Ethereum stablecoin market cap year-to-date change within the Ethereum ecosystem. Source: Cex.io

Bots contribute to market efficiency and stablecoin adoption

Bots, which received a lot of criticism for controversial maximum extractable value (MEV) strategies and sandwich attacks, are now being recognized for their role in improving liquidity and efficiency on Ethereum’s decentralized exchanges (DEXs).

Cex.io said these bots pushed stablecoin swaps to the top of Ethereum DEX categories for the first time. In April, stablecoin swaps accounted for 37% of the total DEX trading volume on Ethereum and 32% in May.

The shift in trading behavior within the Ethereum ecosystem signaled a broader focus on utility and payment-driven use cases. During the shift, Circle’s USDC (USDC $0.9995) became the most-traded asset on Ethereum.

These changes indicate that Ethereum is regaining market share and pushing DeFi toward more stable and efficient mechanisms. If Ethereum can maintain a low-fee environment, the network is well-positioned to become a settlement layer for stablecoin, bots and DeFi infrastructure.

Analyst says stablecoin focus is not just a phase

Otychenko told Cointelegraph that Ethereum's growing focus on stablecoins is not just a market phase but a signal for real-world adoption taking root. “Speculative tokens come and go, but stablecoins stick because they solve real problems,” he said, pointing to rising demand for fast, reliable, borderless payments in emerging markets.

While utility-driven DeFi may cement Ethereum as a stablecoin settlement layer, the analyst warned that sustaining the lead requires more than just momentum; the network needs to address existing challenges like liquidity fragmentation.

“The network needs to solve cost and liquidity fragmentation across layers,” Otychenko told Cointelegraph. “This isn’t just a technical issue. It’s what will decide whether Ethereum leads or lags in the next phase of adoption.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.