Ethereum price ready to hit a new all-time high above $1,400 as buying pressure remains high

- Ethereum price suffered a correction down to $915 but managed to recover.

- The digital asset faces only one critical resistance level before the all-time high.

Ethereum hit a new three-year high at $1,348 on January 10, 2021, before Bitcoin crashed and took down the market with it. Nonetheless, Ethereum managed to recover up to $1,100 and is currently outperforming Bitcoin.

Ethereum price looks poised for a new all-time high

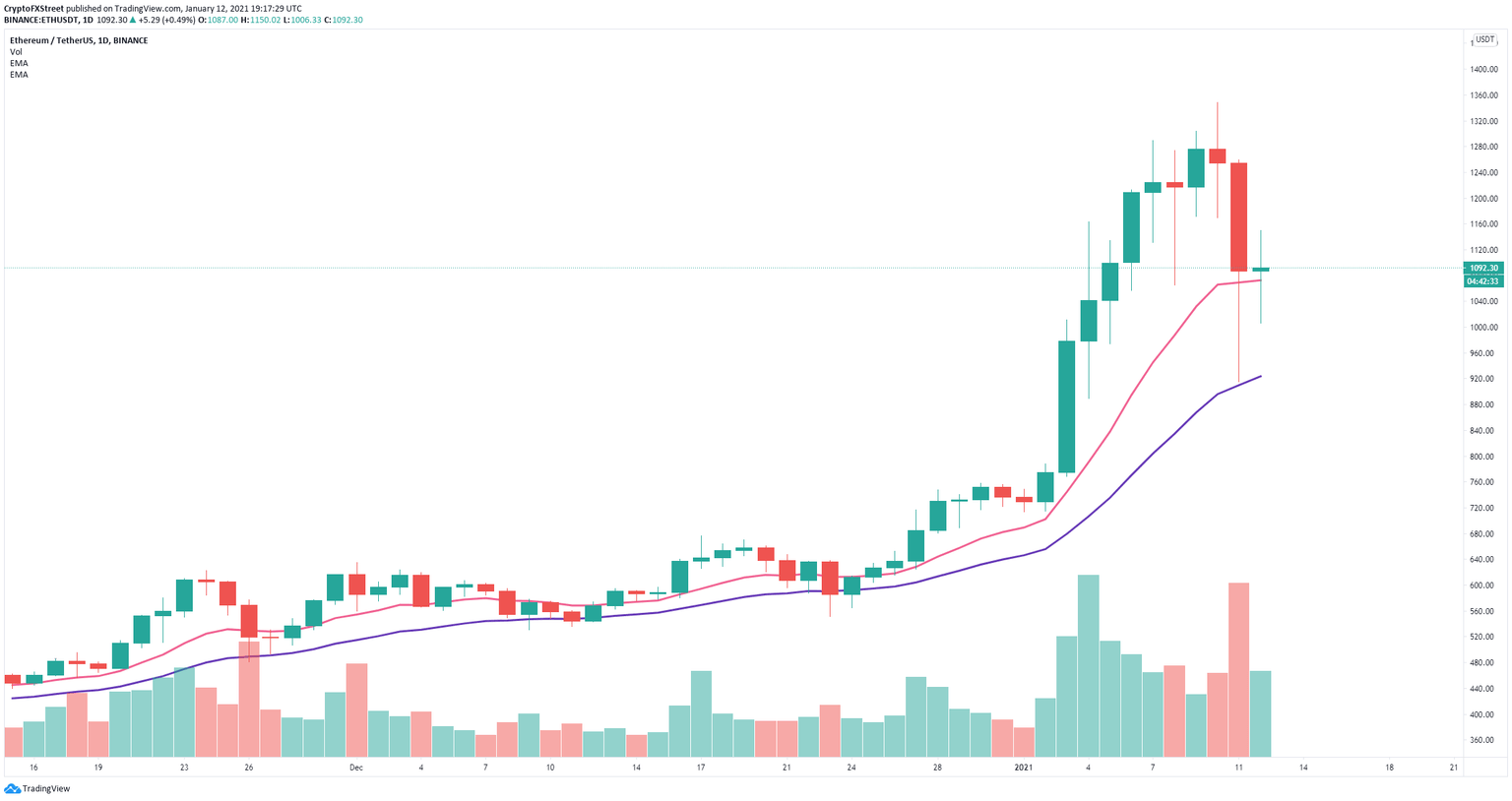

Ethereum has defended a critical support level on the daily chart in the form of the 26-EMA which has served as an accurate guide throughout the bull run. Ethereum buyers also managed to push the digital asset above the 12-EMA.

ETH/USD daily chart

Since December 15, Ethereum price has increased by more than 130%, however, the number of whales holding the digital asset did not decrease. This is a major indication that large holders are willing to buy Ethereum even at higher prices expecting it to rise even more in the near future adding a lot of buying pressure to the digital asset.

ETH Holders Distribution chart

Furthermore, the number of Ethereum inside exchanges has also dropped since December 2020 despite the rise in prices. This metric indicates that there is less selling pressure overall.

ETH Supply on Exchanges chart

One of the main reasons for this lack of supply inside exchanges is the Eth2 deposit contract address which has received over 2.42 million ETH at the time of writing worth more than $2.64 billion at current prices.

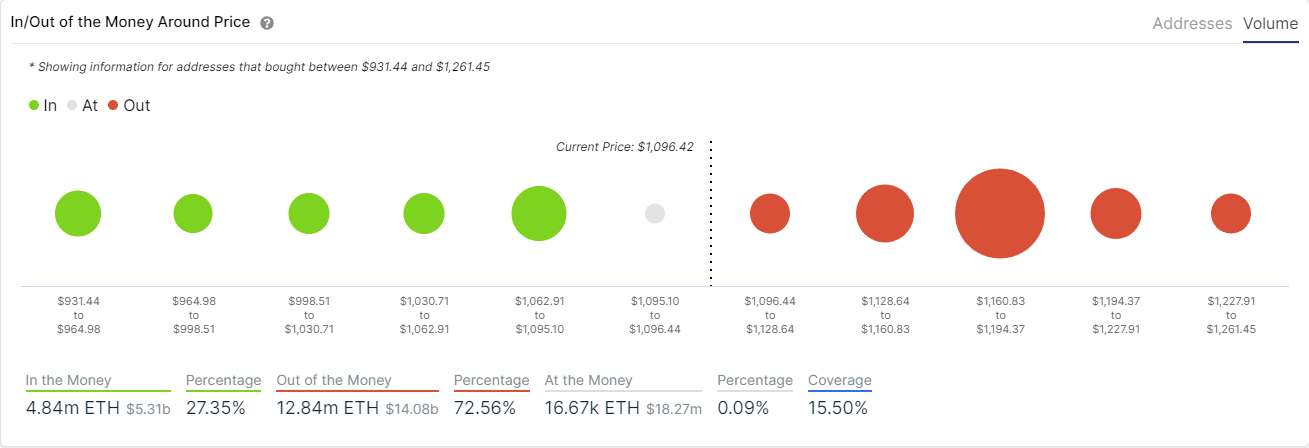

ETH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows only one significant resistance area located between $1,160 and $1,194. A breakout above this point can quickly push the digital asset up to the last high of $1,348 and potentially to a new all-time high.

However, the IOMAP model also suggests that there is very little support below the $1,080 area. Losing this level could drive Ethereum price down to $900 again.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.14.15%2C%252012%2520Jan%2C%25202021%5D-637460758648789809.png&w=1536&q=95)

%2520%5B20.14.18%2C%252012%2520Jan%2C%25202021%5D-637460758692363118.png&w=1536&q=95)