Ethereum Price Prediction: ETH tumbles below uptrend channel with 10% plunge amid crypto sell-off

- ETH/USD has been falling by around 10%, falling alongside Bitcoin and other cryptos.

- The fall below the uptrend channel opens the door to an additional decline.

- Tron Tether usage continues surpassing Ethereum's, serving as another bearish sign.

Is the bullish run over or only a buy-the-dip opportunity? Cryptocurrencies have been on the back foot on Thursday, and Etehereum does not seem immune. President Joe Biden has continued pushing for a multi-trillion stimulus deal, which would be bullish for digital assets – yet that may have already been priced in.

In the world of cryptocurrencies, Tether use on Tron has outpaced Etehreum for the third consecutive week, potentially due to lower fees. The influence of the stablecoin on cryptocurrency prices has been receiving growing attention.

Will the king of Altcoins recover or continue lower? The charts are showing that a fierce battle is still ongoing.

ETH/USD Technical Analysis

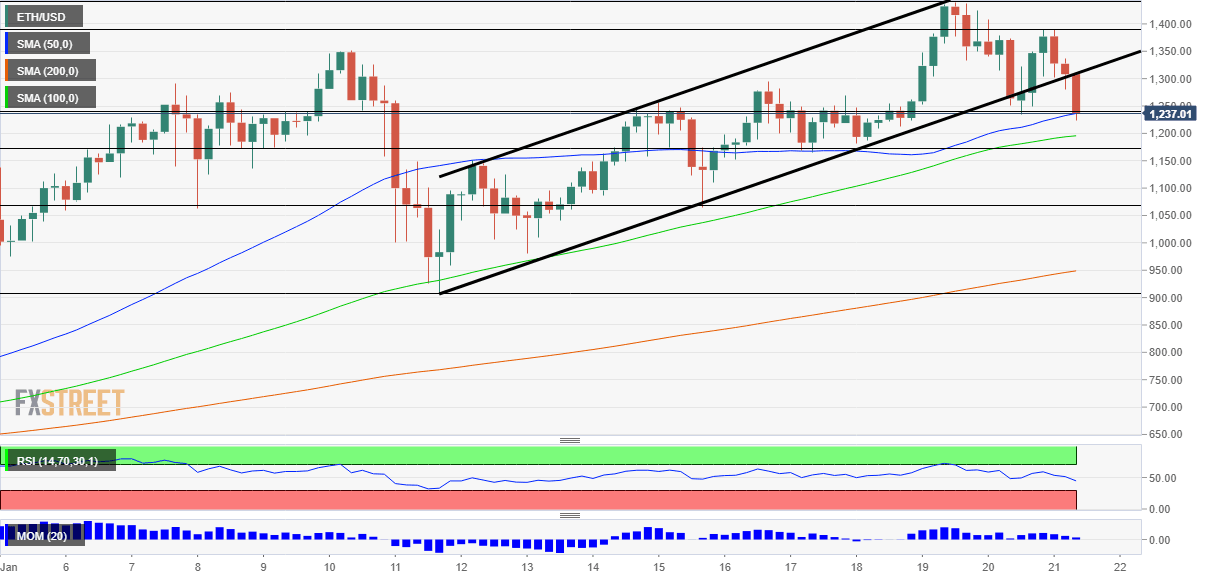

Ethereum/dollar has collapsed below the uptrend channel that has been accompanying it since last week. On the other hand, while the drop looks convincing, it seems that ETH has bounced above the 50 Simple Moving Average on the four-hour chart. Upside momentum has waned, but has yet to turn negative.

All in all, bears are gaining ground but have yet to fully take over.

If bulls weather the current storm, there is room to bounce back to toward the previous highs.

The critical level to watch is $1,240, which was a low point on Wednesday. It is followed by $1,175, which cushioned ETH/USD over the weekend. Further below, $1,060 and $905 are eyed.

Resistance is at around $1,305, which is where the broken uptrend support line hits the price. It is followed by the daily high of $1,390, and then by the all-time high of $1,440.

Ethereum Price Forecast 2021: Wind of change to take ETH to all-time high

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.