Ethereum Price Prediction: ETH bears eye $1,200 as price remains below key resistance

- Ethereum continues to push lower on the last day of the week.

- $1,200 could be seen as the next target on the downside ahead of $1,100.

- Bears are likely to continue to dominate ETH unless it manages to reclaim $1,500.

Ethereum traded in a relatively tight range on Saturday and closed the day in the positive territory but came in under strong selling pressure on Sunday. As of writing, ETH was trading at $1,356, losing 7% and 28% on a daily and weekly basis, respectively.

Near-term bearish outlook remains intact

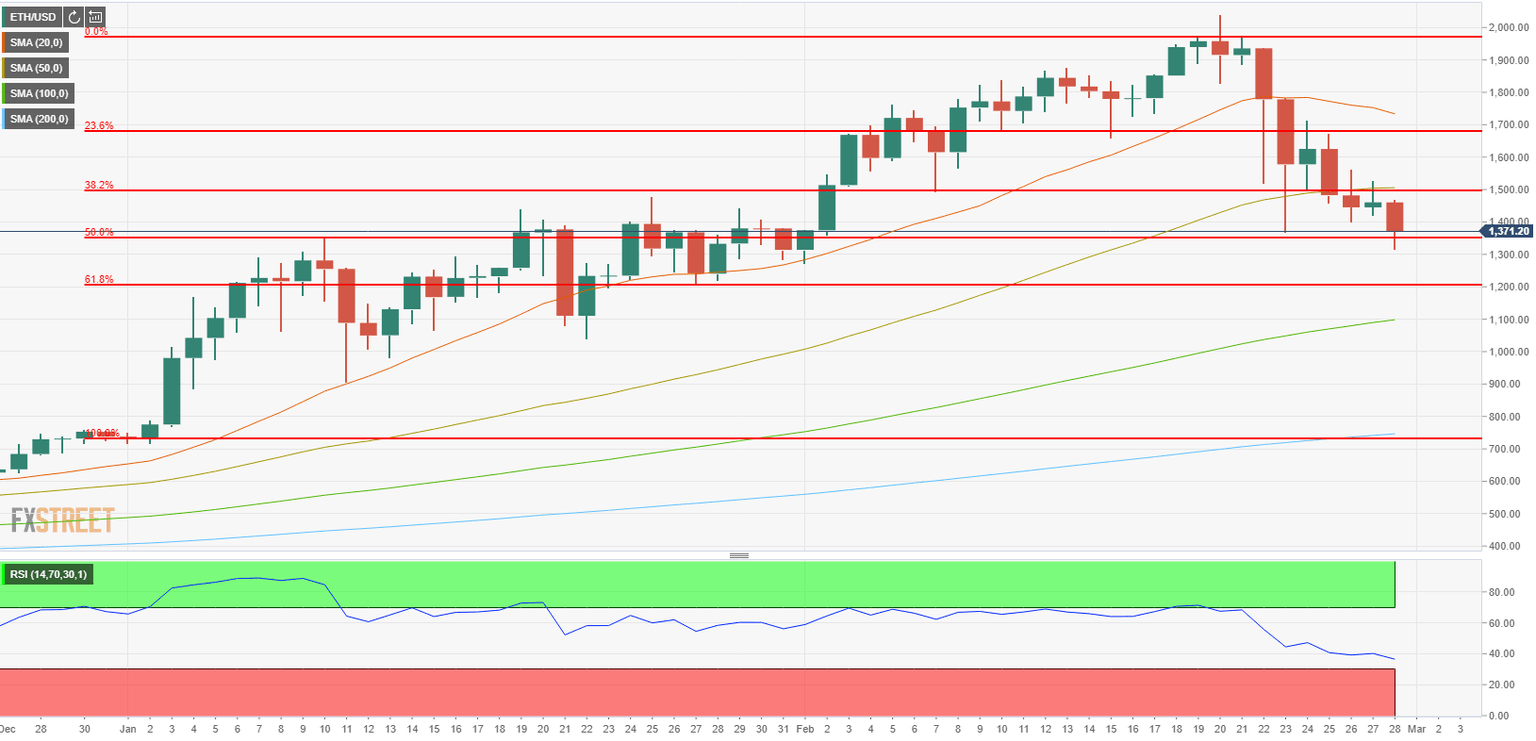

On the daily chart, the Relative Strength Index (RSI) indicator still floats above 30, suggesting that there is more room on the downside before Ethereum becomes technically oversold. Additionally, ETH closed the third straight day below the 50-day SMA on Saturday.

The next target on the downside is located at $1,200 (Fibonacci 61.8% retracement of Jan.2 - Feb. 20 uptrend). Below that level, $1,100 (100-day SMA) and $1,000 (psychological level) align as next key support levels. On the other hand, unless ETH manages to make a daily close above $1,500 (Fibonacci 38.2% retracement, 50-day SMA), bears are likely to remain in control of the price. Beyond that hurdle, $1,680 (Fibonacci 23.6% retracement) aligns as the next resistance.

ETH/USD one-day chart

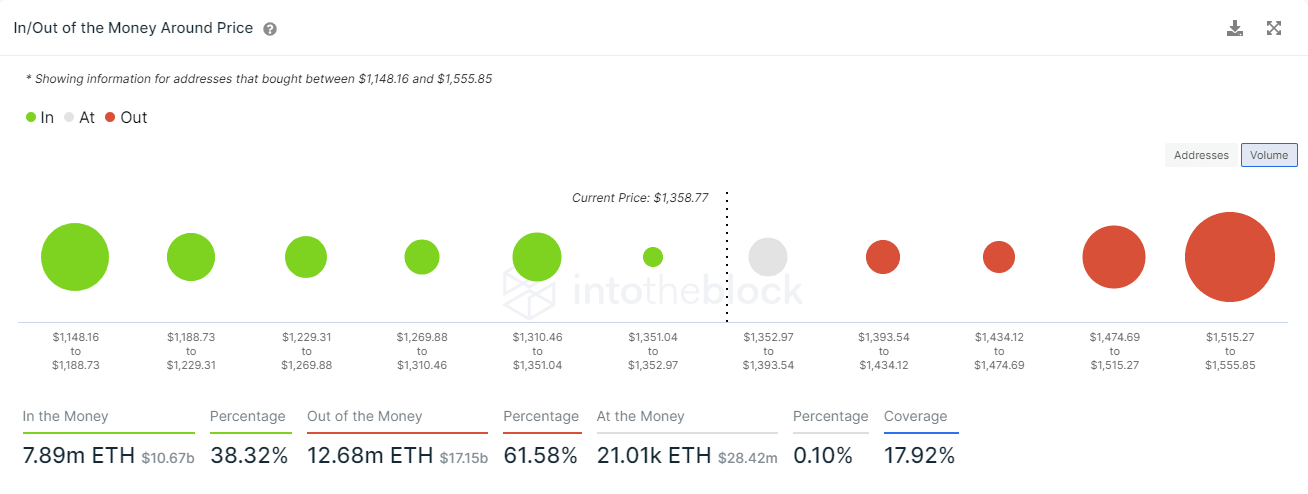

IntoTheBlock's In/Out of the Money Around Price (IOMAP) model reaffirms the significance of $1,500 as a key resistance with investors having bought more than 8 million ETH around that price. On the flip side, several medium-strength supports could be seen ahead of $1,200.

Ethereum IOMAP chart

Ethereum continues to trade below the key $1,500 area and the near-term technical outlook alongside the on-chain metrics suggests that the selling pressure is likely to remain intact. $1,200 could be seen as the next target on the downside ahead of $1,1100.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.