Ethereum Price Prediction: $2500 remains a tough nut to crack for ETH amid impending death cross

- ETH price remains on an 11-day uptrend but capped below $2500.

- Ethereum awaits the August 4 upgrade amid a recovery in hash rate.

- The coin at risk of a bearish reversal due to impending death cross on the 1D chart.

Amid sluggish trading seen across the crypto market this Saturday, Ethereum price remains trapped in a narrow range around $2450, potentially contemplating the next move.

In doing so, ETH price consolidates its ten-day winning streak, hovering close to monthly highs just shy of the $2500 mark.

The buying interest around the world’s second most traded digital asset remains unabated ahead of its upgrade, known as Ethereum Improvement Proposal (EIP) 1559, which is set to go live on August 4.

The upgrade is expected to alter the transaction costs while reducing the supply of the ether token, which could power the ETH price sharply higher. Further, the recovery in the hash rates also keeps the bullish tone intact around Ethereum.

As of writing, ETH/USD is trading at $2463, modestly flat on the day. Ethereum is gaining 14% on a weekly basis.

ETH/USD’s upside appears faltering as technical indicator warrants caution

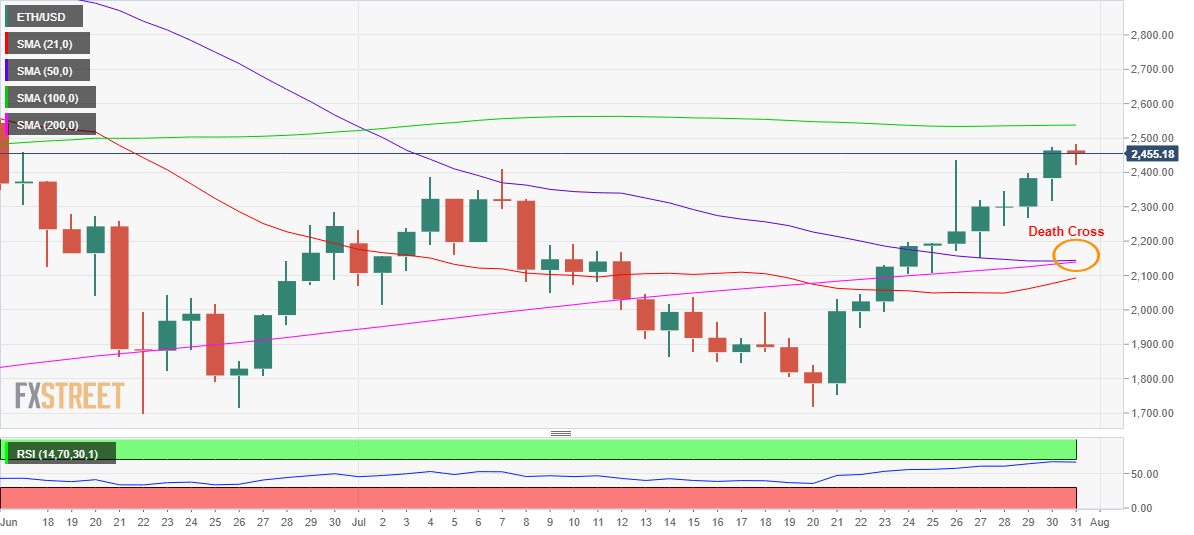

Ethereum’s daily chart shows that the price is lacking a follow-through upside momentum, as the bears are awaiting confirmation of a death cross formation.

The 200-Daily Moving Average (DMA) is set to cut through the 50-DMA from below, with a confirmation on a daily closing basis to indicate the potential for a major sell-off.

The death cross validation could call for a bearish reversal, opening floors towards the 50 and 200-DMAs confluence near $2140.

The initial support could emerge at the July 7 highs of $2411, below which Friday’s lows of $2318 could be tested.

The $2250 psychological level could come to the rescue of ETH bulls should the downside pressure intensify.

ETH/USD: Daily chart

However, with the 14-day Relative Strength Index (RSI) still trending above the midline, the ETH buyers could defy the death cross warning and resume the uptrend to retest $2500.

The next relevant bullish target is placed at the 100-DMA at $2538. ETH bulls would seek fresh entries above the latter, exposing the $2600 round number.

ETH/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.