Ethereum price marks 11-month high as ETH staking exceeds withdrawals

- Ethereum deposits could be seen outpacing withdrawals at one point on April 13, following the Shanghai upgrade.

- 70% of the ETH being withdrawn is from the Kraken exchange, whose staking service was recently shut down by the SEC.

- Ethereum whales reacted to the Shanghai upgrade, with large wallet holders dumping 400,000 ETH in the span of 48 hours.

Ethereum price lived up to expectations as the second-biggest cryptocurrency in the world breached a key psychological barrier on April 13. But more than the bullishness in the price action, the positivity observed in the investors' behavior surprised the market following the Shanghai upgrade.

Ethereum investors begin stake as staking withdrawal goes live

Ethereum holders were expected to begin drawing out their staked ETH from the network after the Shanghai upgrade. The hardfork enabled users to withdraw their deposits from the last year and a half, but against the market's prediction, the altcoin's holders decided to pour their money into staking again instead.

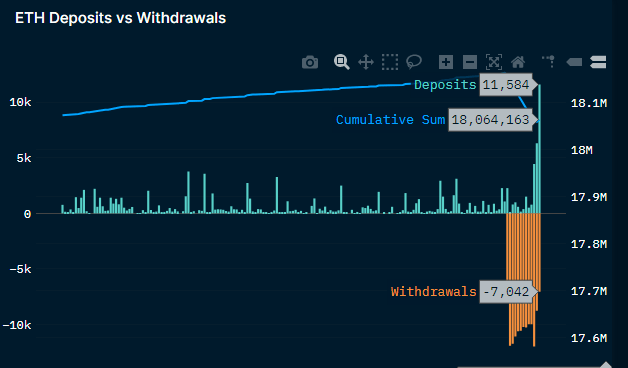

On-chain data highlighted that at one point during the day, the total number of ETH deposits exceeded the total ETH withdrawn. While the instance was only noted once when a little over 7,000 withdrawals took place against 11,000 deposits.

Ethereum staking vs withdrawal

This could go back to one of the two possibilities:-

- Ethereum holders are awaiting a bigger rally before pulling out their ETH to sell it for profits.

- The slow pace of withdrawals is resulting in deposits running higher as the bullishness for ETH at the moment will draw investors toward it.

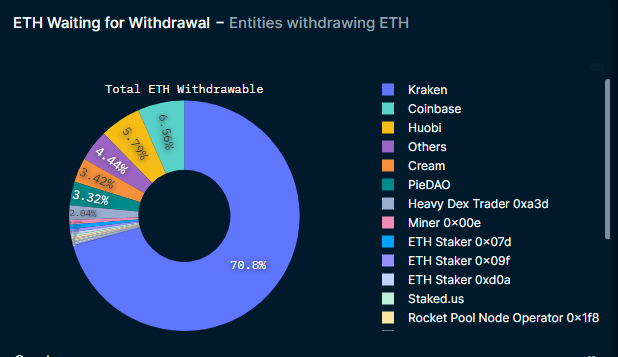

Interestingly, 70% of the withdrawals in the waiting line were coming from the Kraken cryptocurrency exchange. The reason behind this is the regulatory crackdown faced by Kraken a while ago. Back in February, the exchange was fined $30 million by the Securities and Exchange Commission (SEC) and asked to shut down its staking service.

But on-chain, investors did not fail to surprise either, as whales displayed mixed sentiments when it comes to holding ETH. The cohort with a balance of 100,000 to 1 million ETH noted an increase of over 200,000 in the span of two days.

On the other hand, the addresses with a balance of 1 million ETH to 10 million ETH declined by more than 400,000 in the same duration.

Ethereum supply distribution

Thus while retail investors and smaller whales continue to hold a bullish outlook for the biggest altcoin in the world, larger wallet holders are taking a different route.

As it is, Ethereum price has shot up beyond $2,000 in the 24 hours since the upgrade, marking an 11-month high and could continue if the investors’ sentiment sustains.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B04.35.46%2C%252014%2520Apr%2C%25202023%5D-638170247729166632.png&w=1536&q=95)