Ethereum Price Forecast: ETH investors book $800 million in profits as open interest declines

- Ethereum investors have realized over $800 million in profits on Friday.

- Ethereum's open interest has declined considerably after two days of heavy liquidations.

- ETH is attempting to recover the $4,000 level after bouncing off the 100-day SMA.

Ethereum (ETH) trades around the $4,000 key level following a rise in profit realization on Friday.

Ethereum open interest declines amid increased profit realization

Ethereum saw increased profit realization on Friday, with investors booking over $800 million in profits, according to data from Santiment. The spike followed ETH's decline to $3,800 on Thursday, marking its first drop below the $4,000 threshold in over a month.

%20%5B04-1758943535893-1758943535895.22.01%2C%2027%20Sep%2C%202025%5D.png&w=1536&q=95)

ETH Network Realized Profit/Loss. Source: Santiment

Ethereum's bearish performance this week also sparked two major long liquidation events, including $401.8 million on Thursday and $490 million on Tuesday.

After weeks of strong performance, the excess leverage on ETH has decreased, resulting in a sharp decline in the monthly average open interest, particularly on Binance, according to a CryptoQuant report on Friday.

The drop marks one of the steepest open interest resets since the start of 2024, following a period of heavy market attention and elevated leverage, the report stated.

Binance experienced the largest leverage reduction, with more than $3 billion wiped out on Tuesday and an additional $1 billion the following day. Bybit's open interest fell by $1.2 billion, while OKX recorded a $580 million decline.

The heavy liquidations, alongside ETH's price decline and a drop in leverage, have led to increased caution among investors. Historically, the continuation of such a trend often results in further weak price action and increased distribution.

Despite the plunge and market behaviour, whale investors have begun to buy the dip.

Smart money tracker Lookonchain data shows that 15 wallets have accumulated 406,117 ETH, worth approximately $1.6 billion, from Kraken, Galaxy Digital, BitGo, and FalconX over the past two days.

Meanwhile, two Ethereum wallets that had been inactive for more than eight years transferred 200,000 ETH, worth approximately $785 million, to new addresses, according to Lookonchain data. The data revealed that the holder, who originally accumulated the tokens on Bitfinex, still controls 736,316 ETH, worth about $2.89 billion, across eight wallets.

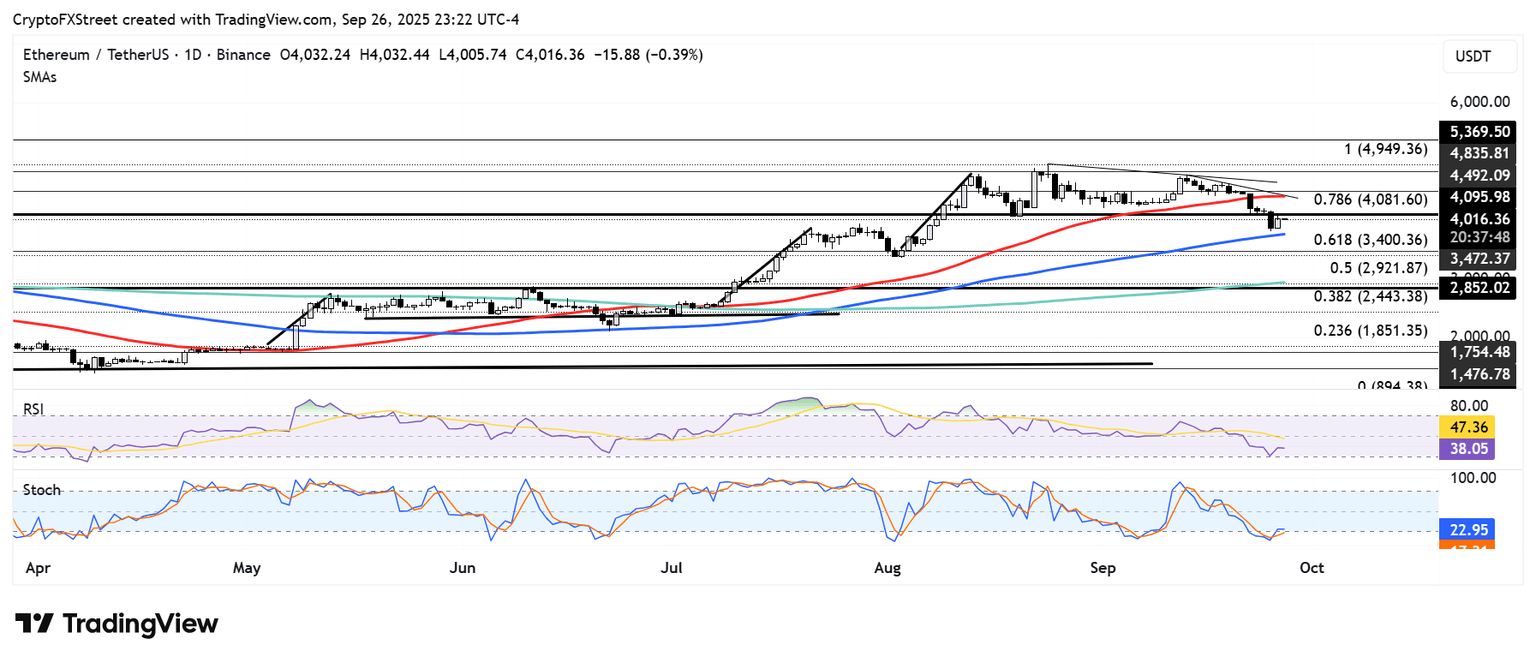

Ethereum Price Forecast: ETH eyes recovery of $4,000 key level

ETH is attempting to recover the $4,000 psychological level after bouncing off the 100-day Simple Moving Average (SMA). The top altcoin is facing resistance near $4,100, a level that has served as a critical hurdle over the past year.

ETH/USDT daily chart

A move above $4,100 could see ETH rise to test the $4,500 level, which is just above the 50-day SMA.

On the downside, bulls could continue to defend the 100-day SMA. Further down, the $3,500 could also serve as support.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi