Ethereum price expected to face corrections as ETH funding rate hits a yearly highs

- Ethereum price trading at $2,050 slid slightly over the past two days, still maintaining gains on a weekly basis.

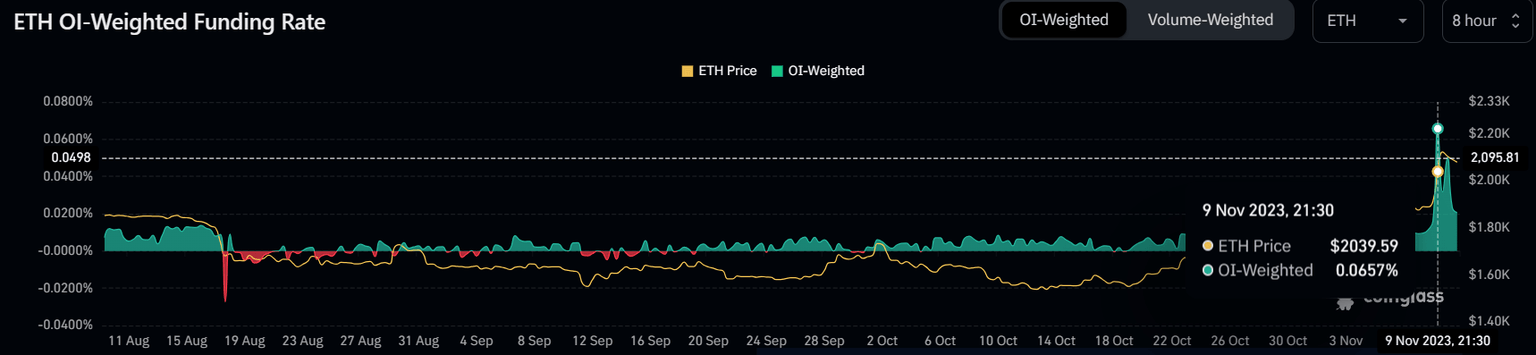

- ETH funding rate is presently at a yearly high, which suggests the market is overheated and could correct.

- At the moment, nearly 75% of all ETH holders are in profit, which historically has resulted in profit-taking, bolstering the projected outcome of ETH.

Ethereum price followed in the footsteps of Bitcoin and rose to trade above $2,000 in the past month. But the consistent rally seems to be reaching its saturation as the potential of profit-taking and correction is seemingly at its highest at the moment.

Ethereum price is nearing a decline

Ethereum price, trading at $2,050 at the time of writing, has risen by more than 8.5% in the past three days, nearing the 18-month-old barrier marked at $2,124 that has only been tested once since May 2022.

With ETH breaching the $2,000 mark, it has inched closer to $2,124, but the chances of a breach are unlikely, given the market is overheated at the moment. Thus, a failed breach would result in a drawdown, bringing Ethereum price back to $2,000, which would send it towards $1,800.

ETH/USD 1-day chart

But if the broader market cues remain bullish or Ethereum witnesses a bullish development, such as BlackRock filing for a spot ETH ETF last week, the cryptocurrency could witness a further rise. This would push ETH beyond the $2,124 mark, invalidating the bearish thesis and sending Ethereum price to tag the resistance level at $2,296.

The chances of a reversal are high

High funding rates generally signal that traders are holding more long positions than short positions and expecting a price rise. However, sustained high rates point to overheated markets, which usually are followed by slight corrections in price. Such is the case with Ethereum as well, given its funding rates are presently at a yearly high.

The funding rates peaked on November 9 when, according to analytics platform Coinglass, the OI-weighted rate hit a high of 0.0657%.

Ethereum funding rate

Furthermore, the investors are also likely to begin profit-taking given at the moment 75% of all ETH holders are at a profit at the moment. According to the Global In/Out of the Money (GIOM), about 37 million ETH worth over $75.8 billion bought at an average price of $1,936 is at the cusp of turning profitable.

Ethereum GIOM

These levels have historically witnessed profit-taking from investors and tend to result in short-term pullbacks. However, as noted by analytics platform IntoTheBlock, this does not significantly impact the long-term outlook for Ethereum, which remains bullish, unless ETH fails a breach of $2,124.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.