Ethereum price breaks critical resistance, bulls target $500 in the short-term

- Ethereum price has broken above a critical resistance barrier at $463.

- There seems to be almost no resistance for Ethereum until $500.

Ethereum price topped out at $468 on November 7 and seemed to form a potential double top on November 11 after hitting $466, followed by a slight rejection. However, in the past four hours, the digital asset has seen a notable breakout towards $474, negating the possible double top pattern.

ETH bulls face very little opposition to the upside

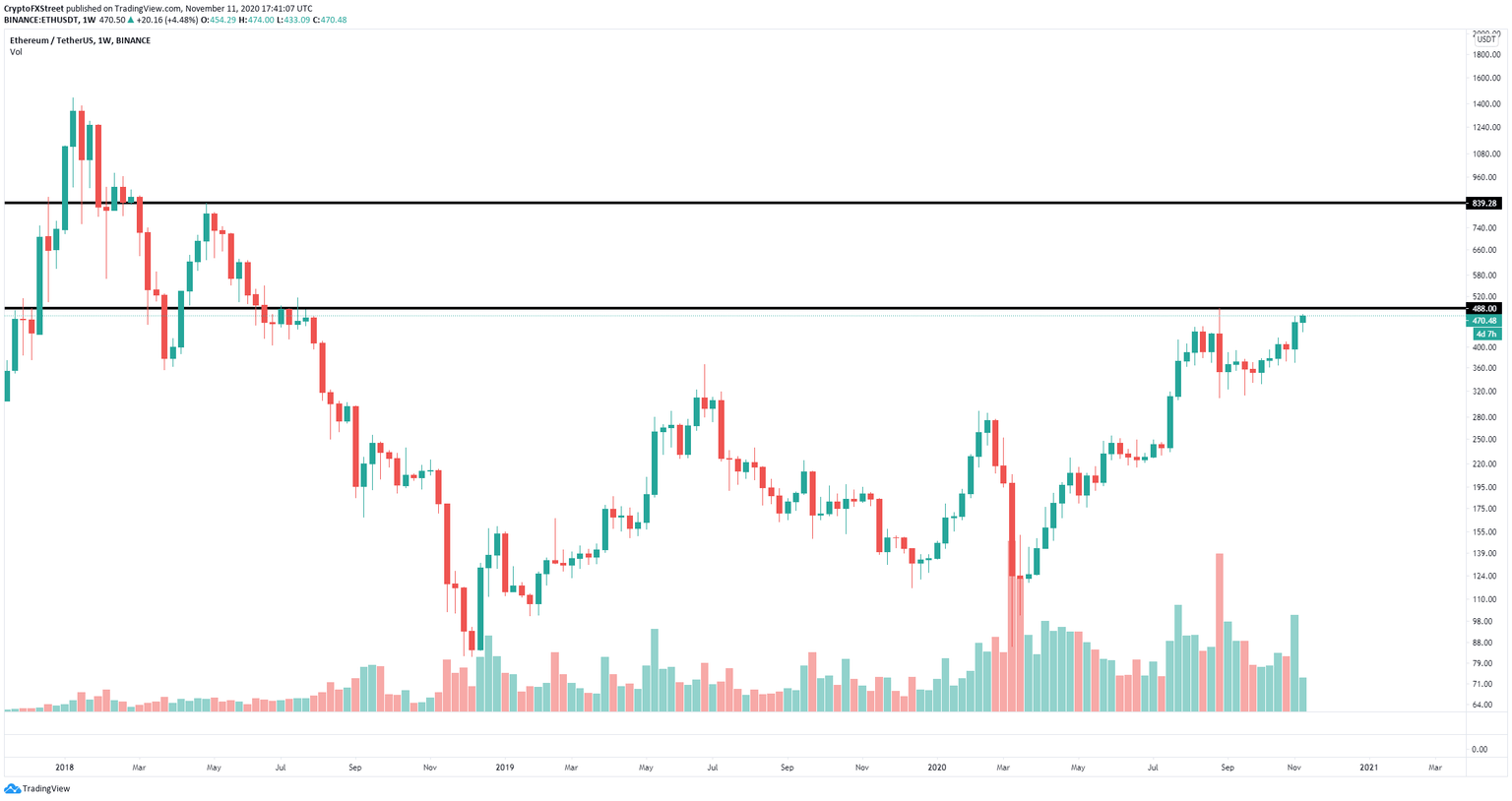

The next significant barrier seems to be established on the weekly chart at $488, which is the 2020 high formed on September 1. A breakout above this point could easily drive Ethereum towards $841.

ETH/USD weekly chart

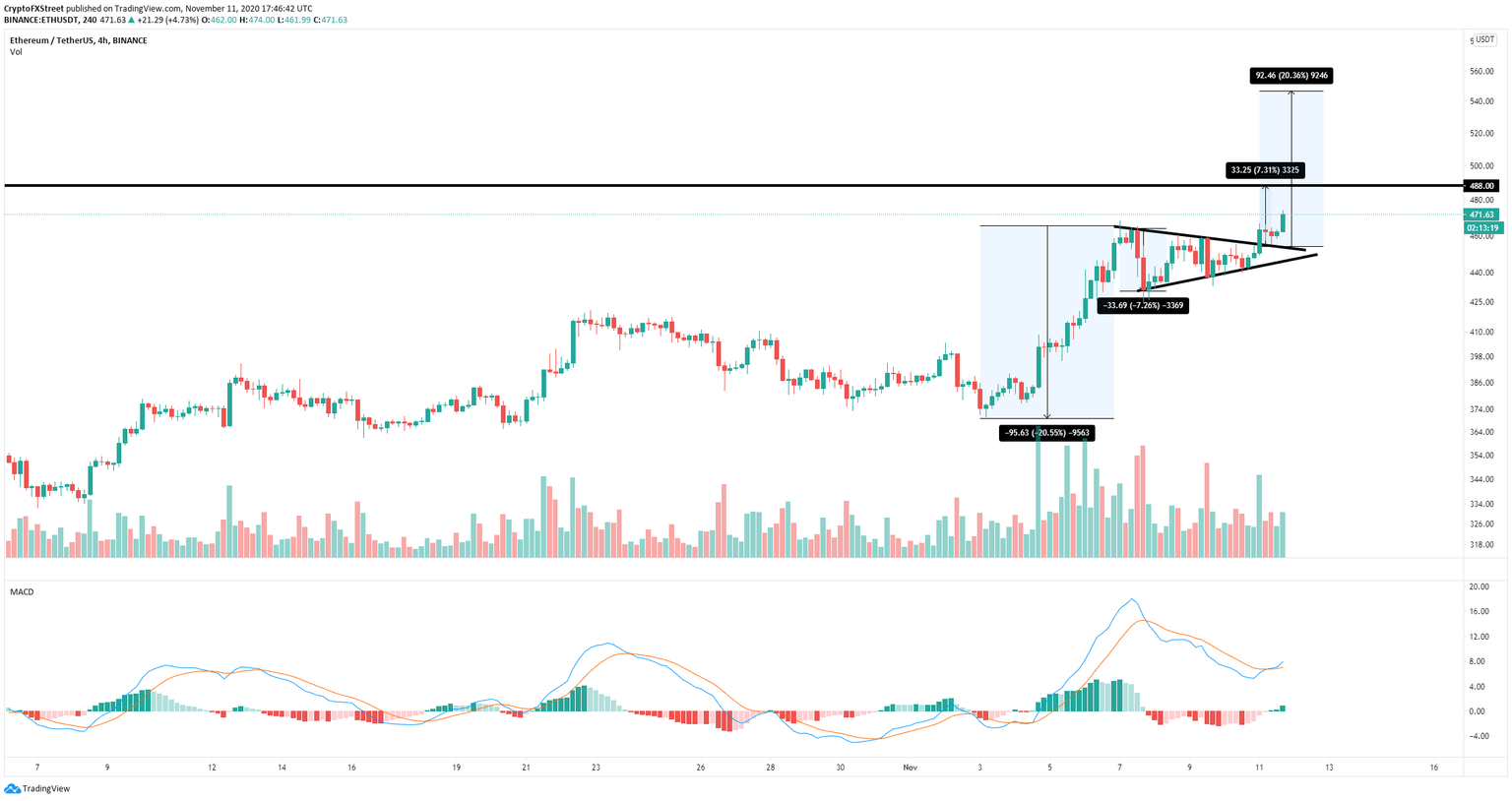

Ethereum price is inside a weekly uptrend, just like on the lower time frames. On the 4-hour chart, ETH broke out of a symmetrical triangle pattern, which gives a price target of $488, precisely the high of 2020.

ETH/USD 4-hour chart

The MACD has also turned bullish for the first time since November 4, which was followed by a 20% price explosion. A similar move would create a price target at $546, especially if Ethereum price can break $488.

However, rejection from the critical resistance barrier at $488 would form a potential double top and would likely drive Ethereum price towards $450 to re-test the upper boundary of the triangle pattern on the 4-hour chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.