Ethereum price analysis: ETH/USD rebounds from trend support, aims at $200.00 as Chinese court admits is as a property

- ETH/USD is back on recovery track with the next major target at $200.00.

- Chinese court says that Ethereum is a property with real value.

At the time of writing, ETH/USD is changing hands at $183.3 with over 3.5% gains since this time on Wednesday. Ethereum is moving within a short-term bullish trend and the upside momentum is gaining traction, however, it is still below the intraday high $187.19. Ethereum's market value reached $20 billion while its average daily trading volume is $19 billion.

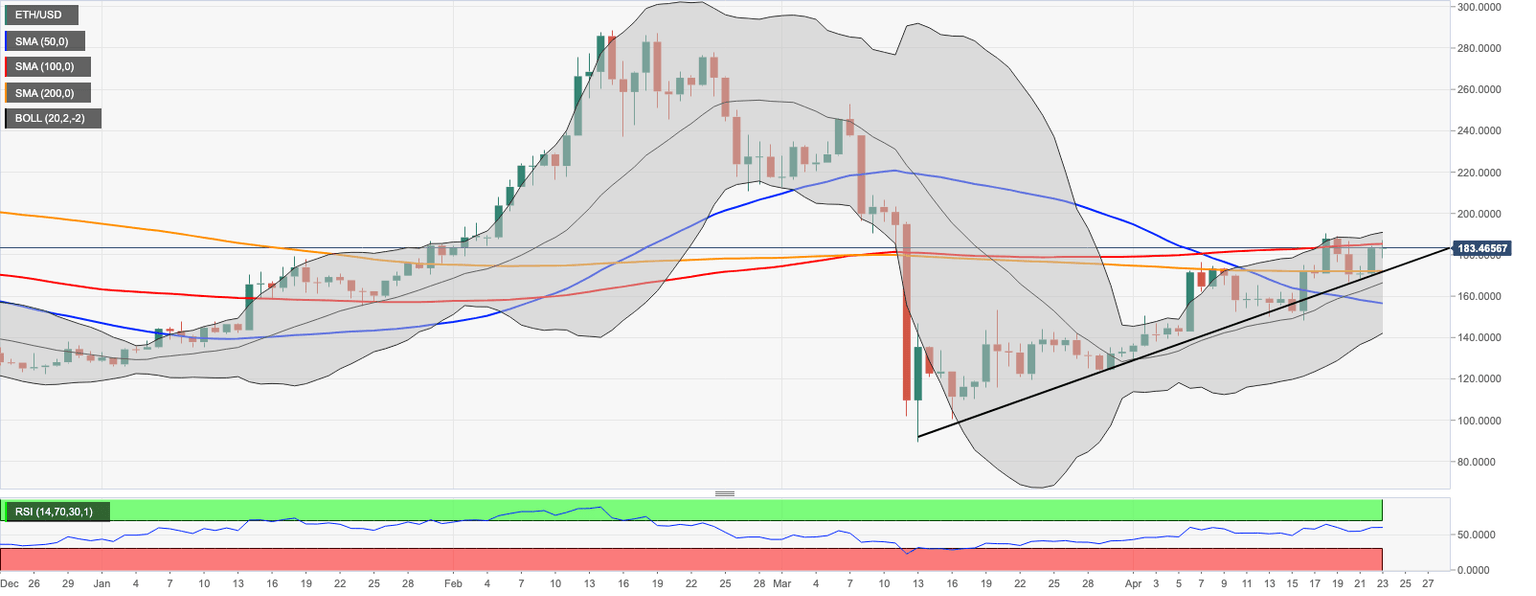

ETH/USD: Technical picture

On the daily chart, ETH recovery is capped by daily SMA100 at $185.30. A sustainable move above this resistance will open up the way to April 18 high $190.00 and psychological $200.00. This barrier may slow down the bulls, once it is cleared, ETH may experience a strong rally towards the next long-term target created by weekly SMA200 at $248.00 and $250.00.

On the downside, a move below $180.0 may worsen the short-term technical picture and attract more sellers to the market. However, the trend is bullish as long as the price stays above the upside trendline from March 13 low (currently at $171.85). If this vital support is broken, the sell-off may gain traction with the next focus on daily SMA50 at $156.50.

The daily RSI stays flat in a neutral position, which means ETH/USD may continue oscillating in the current range.

ETH/USD daily chart

The Chinese court ruled Ethereum as a property

A court in Shenzhen city ruled that Ethereum is a legal property with economic value in a recent criminal case related to Ethereum theft, the Chinese media outlet reports. A blockchain engineer of xinyijia company decided to take revenge on the firm after he was fired due to lack of competence and used his access to the the private key and payment password to steal 3 ETH и 4 million Haode tokens. The defendant was sentenced to seven months behind the bars. Also, he will have to pay a fine of 2000 Chinese yuan and refund 5536.99 Chinese yuan to the victim.

Chinese court confirmed that ETH have economic value and can be traded publicly. To define the value of compensation, the court considered real-time prices and took into the account opinions of the victim and the defendant.

Author

Tanya Abrosimova

Independent Analyst