Ethereum price analysis: a decisive move above daily SMA200 heralds ETH/USD recovery to $200.00

- ETH/USD has switched on recovery mode after a strong move above daily SMA200.

- A growing interest in stablecoins is beneficial to ETH.

Ethereum is among the winners of stablecoins rise, according to the resent research, published by blockchain analytics firm Messari. The experts noted that the interest to the stable coins has grown significantly in recent months. Moreover, this trend has been beneficial for the second-largest digital asset as a lot of tokens are built on the Ethereum blockchain.

The total market capitalization for stablecoins exceeded $8 billion and the demand is growing as investors use them as a hedge against the volatility both on traditional and cryptocurrency markets.

One winner in the growth of stablecoins appears to be Ethereum, which recently reached value transfer parity with Bitcoin. Stablecoins now account for 80% of daily transfer value on Ethereum as it has proven to be the issuance platform of choice for new stablecoins.

ETH/USD: Technical picture

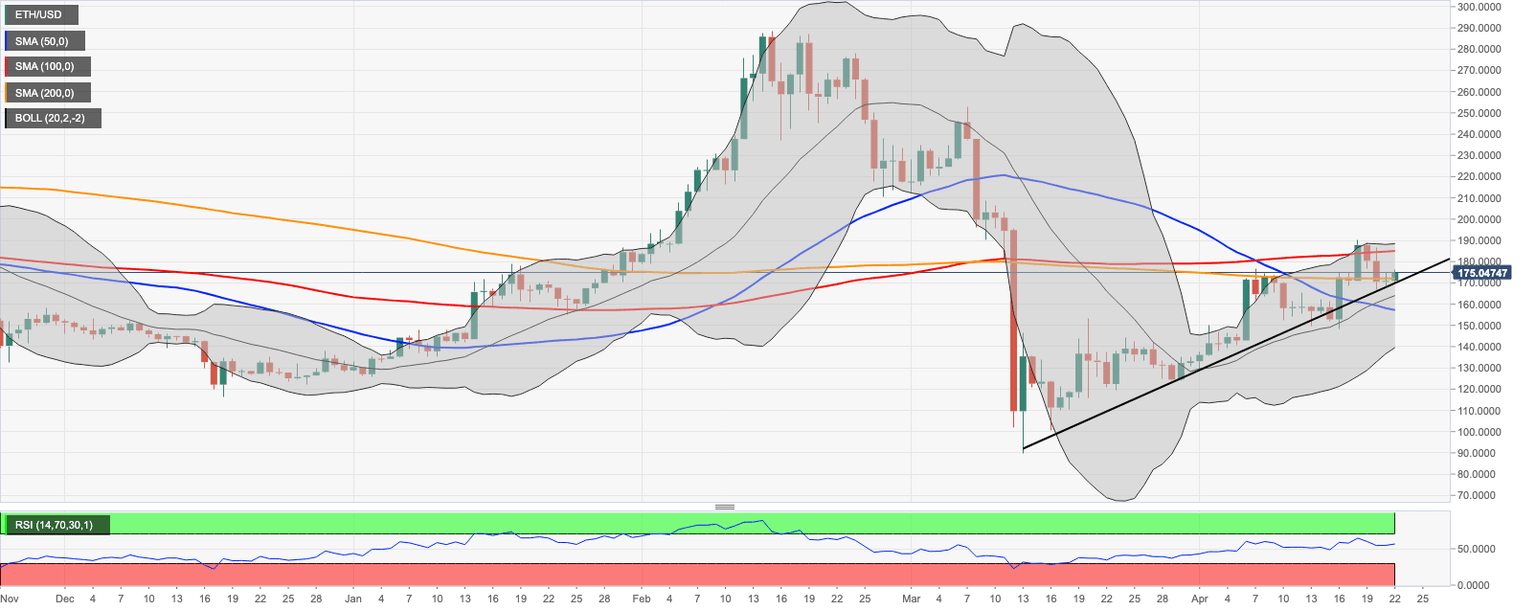

At the time of writing, ETH/USD is changing hands at $175.23 with over 2.5% gains since the beginning of the week. Ethereum is moving within a short-term bullish trend and the upside momentum is gaining traction as the price broke above critical resistance created by daily SMA200 (currently at $172.00).

The next strong technical barrier comes at a psychological $180.00. Once it is out of the way, the upside is likely to gain traction with the next focus on daily SMA100 at $185.00 and the upper line of the daily Bollinger Band at $188.50. This resistance area separates ETH/USD from a stronger recovery towards $200.00.

On the downside, a move below $170.0 may increase the selling pressure and bring the price back to Monday's low at $166.66. However, this support is reinforced by the upside trendline from March 13 low, which means, the bears might have a hard time pushing the price below this line.

ETH/USD daily chart

Author

Tanya Abrosimova

Independent Analyst