Ethereum Market Update: ETH/USD is set for a strong rally once $254.00 is cleared

- Ethereum transactions more than doubled since the start of the year.

- ETH/USD needs to recover above $254.00 to continue the upside momentum.

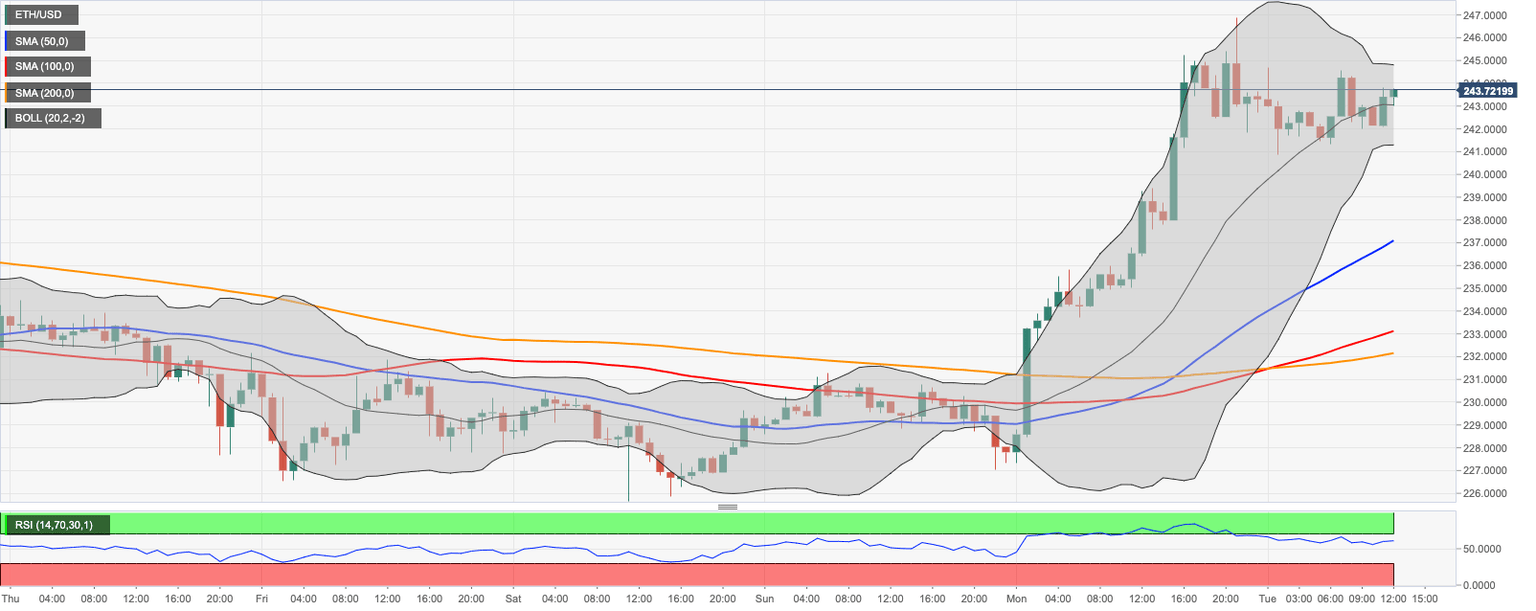

ETH/USD settled above $243.00 after a short-lived jump above $244.67 on Monday. The second-largest digital asset has gained nearly 3% in the recent 24 hours and stayed unchanged since the start of the day. At the time of writing, ETH/USD is moving withing a short-term downside trend amid low volatility.

Ethereum transactions exceeds 1 million

A skyrocketing demand for decentralized finance (DeFi) applications caused a strong growth of network activity on Ethereum blockchai, where the number of transactions more than doubled since the start of the year and surpassed 1 million for the first time since January 2018.

DeFi applications allow users lend and borrow cryptocurrency and thus satisfy their needs in passive income or in the financing. However, to start using the DeFi services, cryptocurrency holders have to send their coins to blockchain, which leads to an increased number and volume of transactions on the blockchain network.

ETH/USD: technical picture

From the short-term point of view, ETH/USD recovery is capped by $245.00. However, the price needs to clear the recent high of $244.67 and the upper line of the 1-hour Bollinger Band at $244.80. Oice it is cleared, the upside momentum will gain traction with the next focus on psychological $250.00 followed by $253.47 (June 2 high). This resistance separates the coin from a stronger bullish run towards the ultimate goal of $300.00.

On the downside, a move below $240.00 will worsen the short-term technical picture and bring the local support of $237 (1-hour SMA50) back into focus. If it is broken, the sell-off may continue towards SMA200 at $232.00 and to psychological $220.00 backed by (daily SMA50)

ETH/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst