Ethereum Classic retreats from multi-month high as speculative sentiments fade away

- Ethereum Classic has started a technical correction from overbought levels.

- The retreat may be extended towards SMA200 daily.

Ethereum Classic, now the 18th largest digital asset with the current market value of $881 million, reached the top at $8.17 during early Asian hours and retreated to $7.64 by the time of writing. The coin has started a correction after a strong growth during the recent days. Despite the retreat, ETC/USD is still 4% higher on a day-to-day basis. Since the beginning of the year, ETC/USD has gained over 73%.

Speculations supported by fundamentals

Ethereum Classic has been supported by several positive factors such as successful network update and Binance announcement. The Malta-based cryptocurrency exchange added ETC to the list of instruments available on Binance Futures with leverage. x75. The trading platform has been expanding its tools rapidly with XRP, LTC and TRX added since the start of the year.

Considering a strong rally on the market that affected many top altcoins, it is hard to tell it this news served as a catalyst. Most likely, positive news served as an additional incentive to buy ETC, while the major bullish run was driven by speculative sentiments

ETC/USD: technical picture

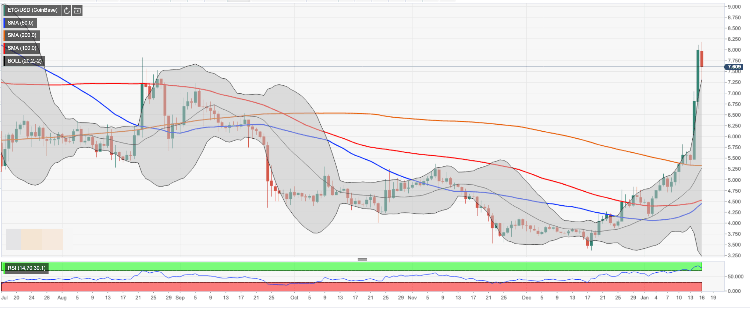

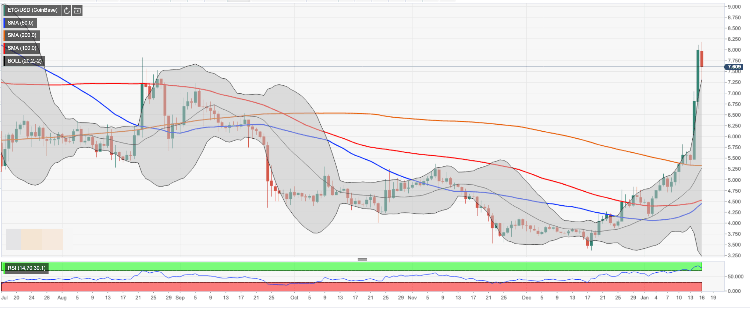

ETC/USD has retreated from the recent high of $8.16; however, the coin stays above the initial support of $7.13. It is created by the upper line of the daily Bollinger Band. Once this barrier out of the way, the sell-off is likely to gain traction with the next focus on $6.60 (Wednesday's low) and $5.30 (SMA200 daily). A sustainable move below this support will mark a reversal of the most part of the recent gains.

On the upside, ETC/USD needs to move above $8.00 for the bullish momentum to gain traction. If this psychological resistance gives way, the upside may be extended towards $9.86 (the highest level of 2019) and $10,000. The RSI on a daily chart has reversed to the downside, though it is still in the overbought territory.

ETC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst