Ethereum Classic Market Update: ETC/USD recovers from the hardfork-induced sell-off

- Hardfork Phoenix was activated on ETC blockchain.

- ETC/USD recovered from the initial sell-off, further upside is limited.

An essential hardfork Phoenix was activated on the Etehreum Classic blockchain at block 10,500,839. The fork happened on May 31, 2020, ten days earlier than it was previously expected. It has been the third network update since the start of the year, focused on increasing ETC network interoperability with the main Ethereum (ETH) blockchain.

Phoenix marks the 3rd hard-fork completed within 1 year on the Ethereum Classic blockchain. The Atlantis, Agharta, and Phoenix hard-fork completed the ETC-ETH agenda making way for more valuable research and innovations to come, the team reported in the blog post.

Ethereum Classic (ETC) technical coordinator Stevan Lohja, confirmed that Phoenix had implemented all Ethereum (ETH) Istanbul features for absolute technical compatibility.

At the time of writing, OpenEthereum and Besu clients are syncing, while Coregeth and Multigeth clients are already in sync. The majority of cryptocurrency exchanges confirmed Phoenix support.

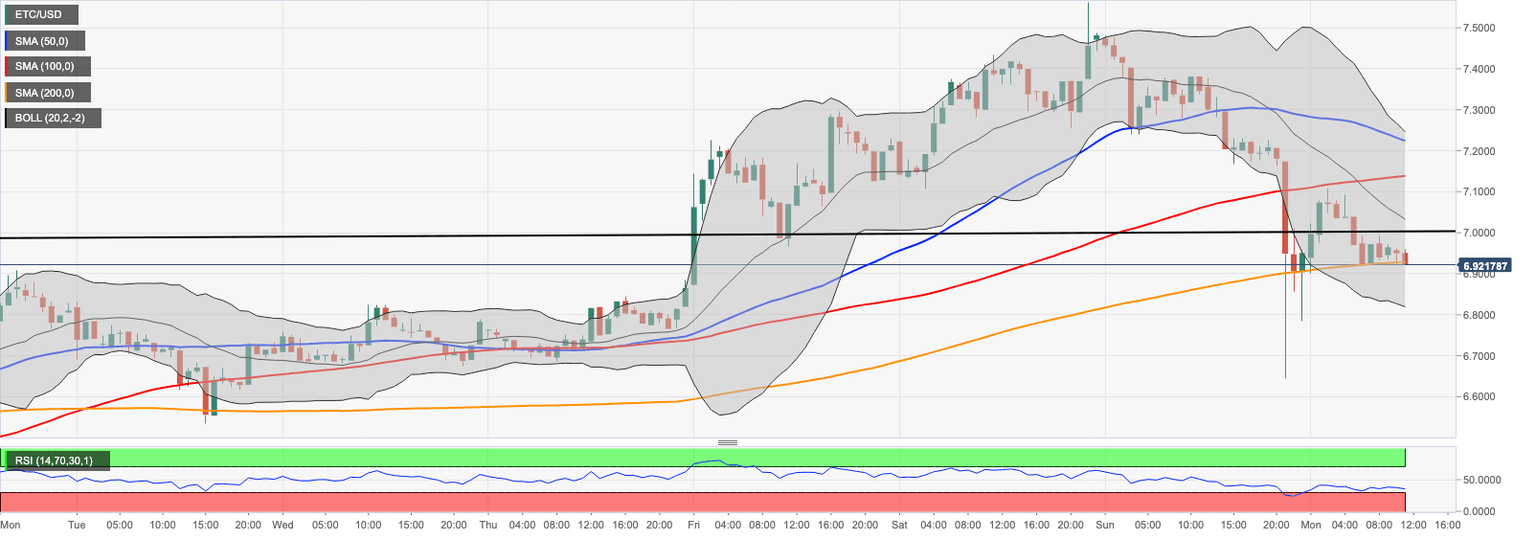

ETC/USD: Technical picture

ETC/USD dropped to $6.64 after the fork; however, by the time of writing, the coin regained some ground to trade at $6.92. The coin is moving inside a short-term upward-looking channel created by 1-hour SMA200 ($6.90) on the downside and SMA100 ($7.14) on the upside. a sustainable move above this area is needed for the upside to gain traction. And allow for a move towards $7.56, the recent recovery high.

On the downside, a move below $6.90 will worsen the short-term technical picture and push the price towards the recent low of $6.64. This support is followed by a psychological barrier of $6.60.

ETC/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst