Ethereum Classic develops bearish fakeout pattern, ETC targets $79

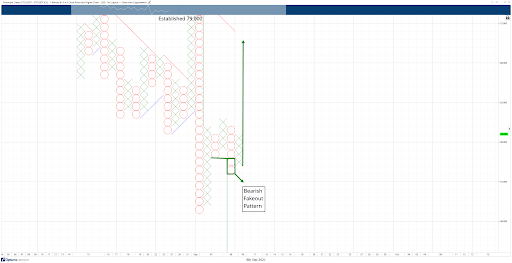

- A bearish fakeout pattern is forming on the ETC Point & Figure chart.

- The vertical profit target method in Point & Figure shows limited price movement on the bear side versus the bull side.

- ETC faces strong resistance at $63.

Ethereum Classic price has a strong setup for some significant bullish price action if it can crack above the near-term resistance at $60. Still, bulls need to be cautious about a drop toward the $43 level.

Ethereum Classic price could spike by roughly 34%

ETC price action is preparing to create one of the most potent and bullish chart patterns in Point & Figure: the bearish fakeout.

First, Ethereum Classic price moved two boxes below the double bottom at $56. Then, a three-box reversal column of Xs printed, and that is where ETC presently remains. Next, a double top will form if ETC price returns to $60.

Finally, if ETC price moves one box above the double top to $62, then a breakout move toward the $79 value area is likely.

ETC/USD $1.00/3-box reversal Point & Figure chart

Bears can easily take over and continue the sell-off that began on Tuesday if ETC price moves to $53. Slicing through this support level represents the break of a double bottom at $54. It would also be the third consecutive lower O-column.

Utilizing the vertical profit target method in Point & Figure charting, the target zone on a break of the double bottom at $54 is the $43 value area. However, the $54 value includes significant support, which includes Senkou Span A, Senkou Span B, the 38.2% Fibonacci retracement and a high volume node in the volume profile.

Author

FXStreet Team

FXStreet