ETH futures activity surge but analysts call price directionless

- ETH futures activity saw a significant surge since the start of September.

- Ethereum's long/short derivative positions indicate a slightly more neutral sentiment among traders.

- Ethereum's price stands to remain stagnant without new market momentum.

ETH open interest surged in September as more people have been actively trading ETH futures contracts, data from the analytics firm Kaiko revealed. However, analysts describe the market as directionless due to the neutral to negative funding rates.

Ethereum's long/short positions neutral

A substantial rise in ETH futures activity with neutral to negative funding rates reveals more about the derivative market and the price of Ethereum.

#ETH open interest has increased since the start of September.

— Kaiko (@KaikoData) October 10, 2023

Funding rates remain neutral to negative, suggesting the market lacks direction. pic.twitter.com/EHESMQMncw

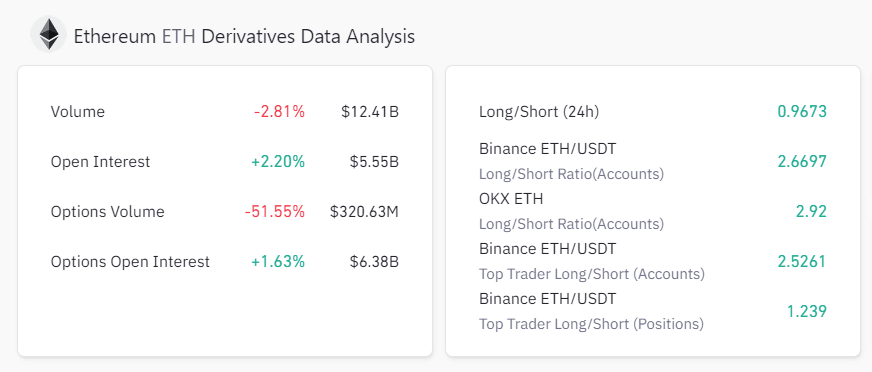

Based on Coinglass figures, derivatives volume has experienced a 2.81% increase, with a total trade volume of $12.41 billion. Open interest rose by 2.20%, reaching $5.55 billion in a 24-hour time frame. Conversely, options volume displayed a significant decline of 51.55%, with options open interest at $6.38 billion.

Ethereum's derivatives data

Within a 24-hour timeframe, the long/short ratio stands at 0.9604, suggesting slightly more long positions buyers than short positions sellers. However, the sentiment is leaning towards a more neutral sentiment at the time of writing.

Ethereum's price could remain stagnant

Venture capital (VC) firm Placeholder recently likened Ethereum to Android for its value of modularity. The firm explained that just as Android runs on a wide array of devices from various manufacturers, Ethereum operates within a vast ecosystem of blockchain projects and decentralized applications (dApps).

However, similar to the challenges Android faces, the analogy underlines that Ethereum's modularity can present hurdles in the form of interoperability.

Apart from these longer-term challenges, Ethereum faces muted price action. At the time of writing, it is trading around the $1,560 mark. ETH experienced a 5% decline in the last week, based on CoinGecko figures.

Activity in the ETH futures marker based on fund rate fails to provide price guidance as per analysts. Ethereum's long/short positions indicate a slightly more neutral sentiment suggesting Ethereum's price could face stagnation in the near term.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.