Dollar’s sharp recovery puts Bitcoin’s $25K breakout prospects at risk

Bitcoin (BTC $22,379) investors reeling from the shock of recent cryptocurrency company failures and banking issues may face another potential problem: a recovering United States dollar.

US Dollar strength reemerges

Notably, the U.S. Dollar Index (DXY), which tracks the greenback’s performance against a basket of top foreign currencies, has risen 4% from its Feb. 3 low of 100.82, amid anticipations that the U.S. Federal Reserve will continue raising benchmark rates to cool inflation.

Inflation persists

An air of caution remains as fresh U.S. data shows a recession is not yet imminent.

That includes the latest jobless claims, which fell 2,000 to a seasonally adjusted 190,000 in the week ending Feb. 25, and stronger consumer spending in January.

Meanwhile, 90% of the U.S. manufacturers surveyed by Bloomberg complained about rising input prices despite the easing supply-chain problems.

ISM manufacturing prices paid. Source: Bloomberg

While the problem is not as severe as during the pandemic, the survey shows inflationary pressure has not gone away despite the Fed’s aggressive rate hikes.

“Recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot, and that inflation is not coming down as fast as I thought,” noted Fed Governor Christopher Waller, adding:

If those data reports continue to come in too hot, the policy target range will have to be raised this year even more.

Bank of America Global Research anticipates the Fed to raise the interest rate to almost 6% from the current 4.5–4.75% range. Theoretically, it should renew investors’ demand for the dollar by putting downside pressure on “riskier” assets like Bitcoin.

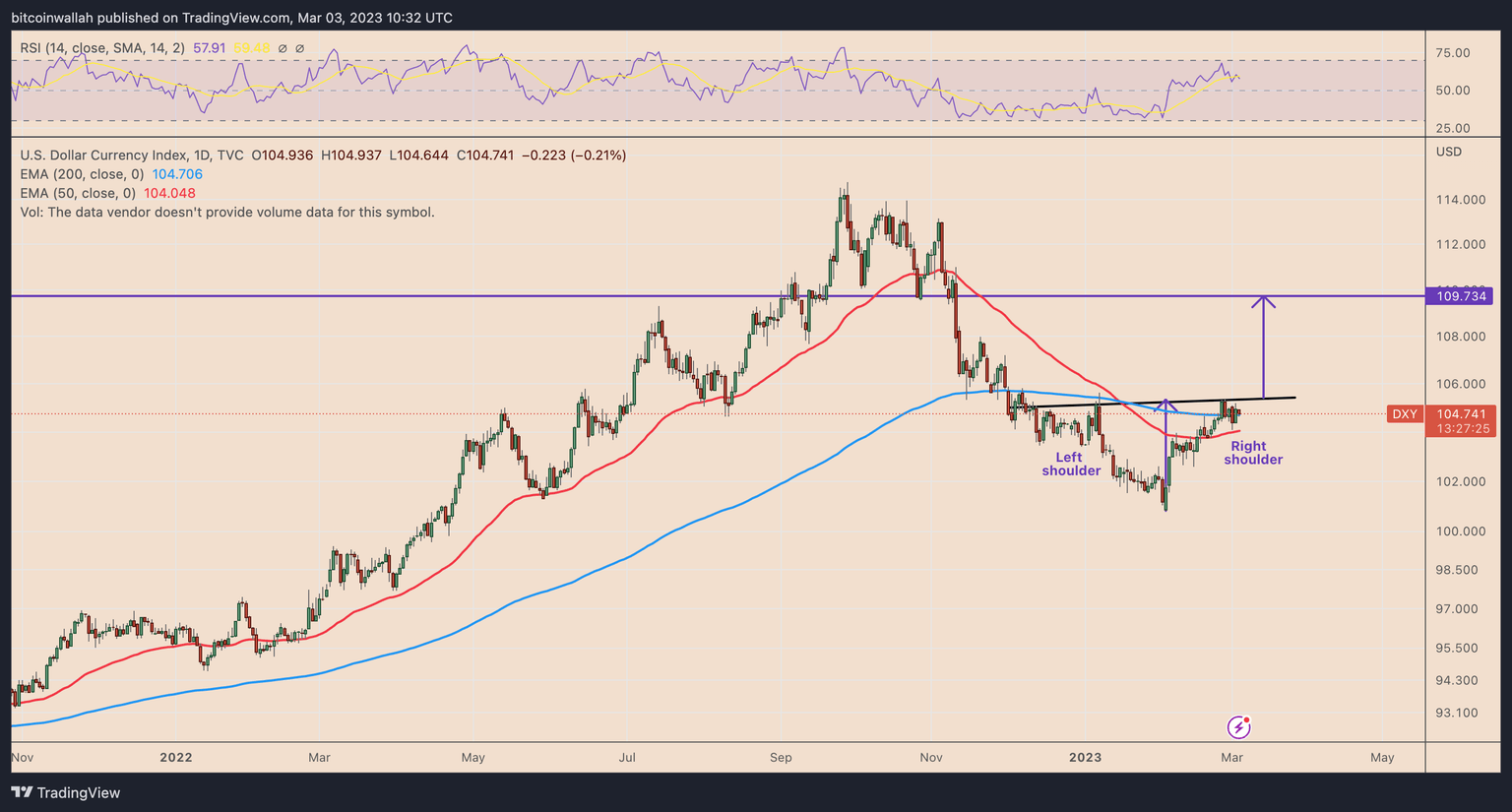

DXY chart paints inverse head-and-shoulders

From a technical perspective, the U.S. Dollar Index looks poised to rise by more than 4.5% in the coming months due to the formation of a classic bullish reversal pattern.

Dubbed inverse-head-and-shoulders, the pattern develops when the price forms three troughs below a common resistance line (neckline), with the middle trough (head) deeper than the other two (left and right shoulders).

DXY daily price chart. Source: TradingView

An inverse-head-and-shoulders pattern resolves after the price breaks above the neckline and rises by as much as the maximum height between the pattern’s lowest level and the neckline.

If the DXY successfully breaks above its neckline of 105.25, the likelihood of an extended recovery toward 109.75 in 2023 will be higher.

Bitcoin price to retest $20K?

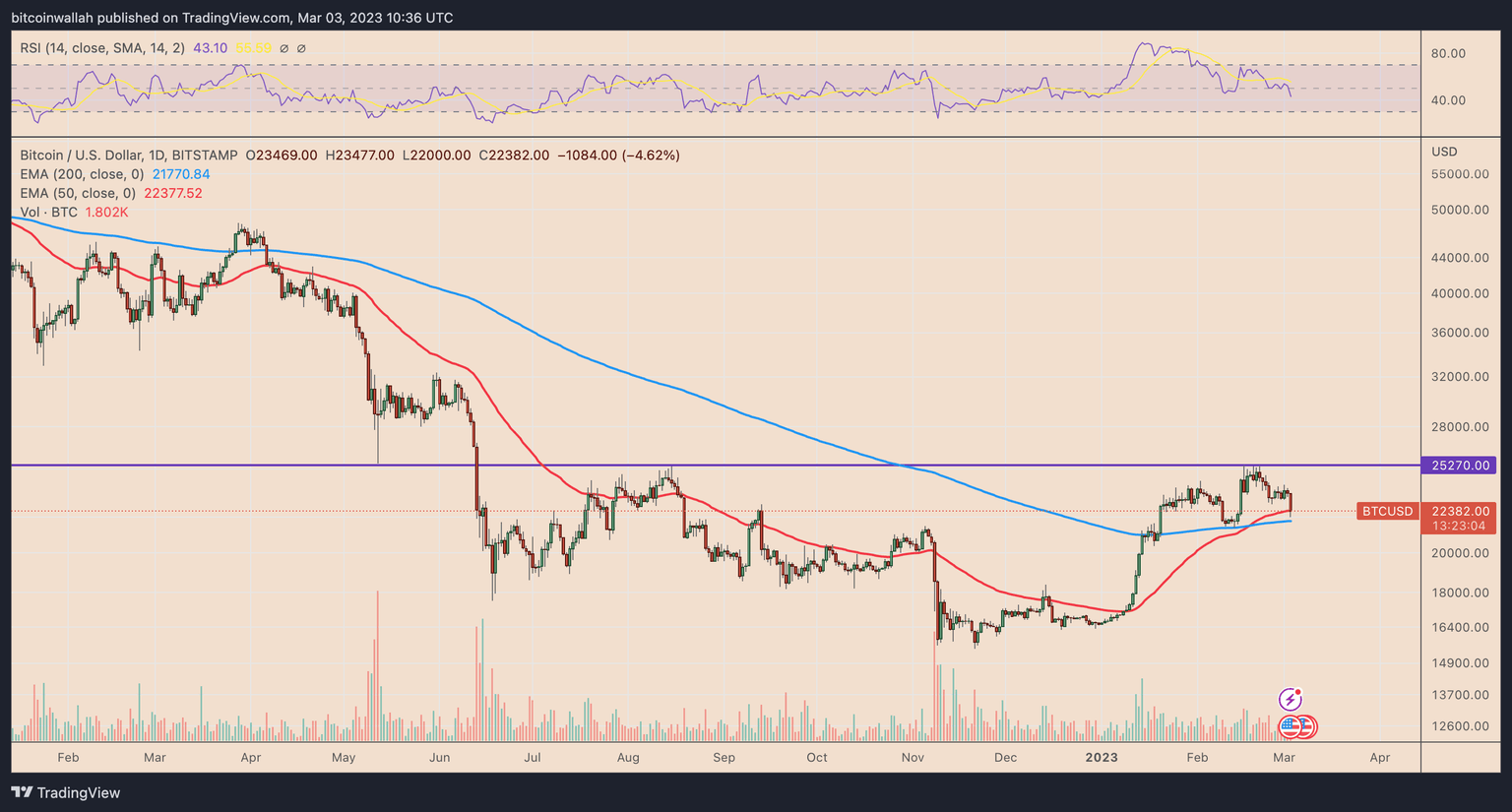

The stronger dollar prospects come as Bitcoin bulls fail to sustain the price rally in breaking the $25,000 technical resistance level. BTC’s price has tumbled by around 13% since, with macro headwinds being one of the primary reasons.

What’s more, concerns over Silvergate and potential ramifications for the industry have also kept the price in check in the past few days.

“Any liquidity concerns will have a direct impact on market conditions and may affect the access and availability of some client funds,” warned John Toro, head of trading at digital-asset exchange Independent Reserve.

Technically, Bitcoin has maintained its short-term bullish bias by holding strongly above its two key exponential moving averages (EMA): the 50-day EMA (red) near $22,500, and the 200-day EMA (blue) near $21,770.

However, traders should watch for a potential break below the EMAs, which, coupled with rising rates and additional negative news, could see the BTC price retesting the key $20,000 support level in the coming weeks.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.