Dogelon Mars drops 6% on Monday, here is what’s driving the crash

- Dogelon Mars slips 6% on Monday, down to $0.00000022.

- Bitcoin's slide toward $91,000 triggered a market-wide altcoin correction.

- ELON lost key support and dropped closer to the January low amidst the correction.

Dogelon Mars (ELON) trades at $0.00000022 on Monday after losing key support as altcoins plummeted alongside Bitcoin in the market-wide crypto crash.

As crypto traders digest the news of United States (US) President Donald Trump’s tariff announcements and the correction in global stock markets, risk assets like Bitcoin and altcoins corrected.

Why ELON is crashing?

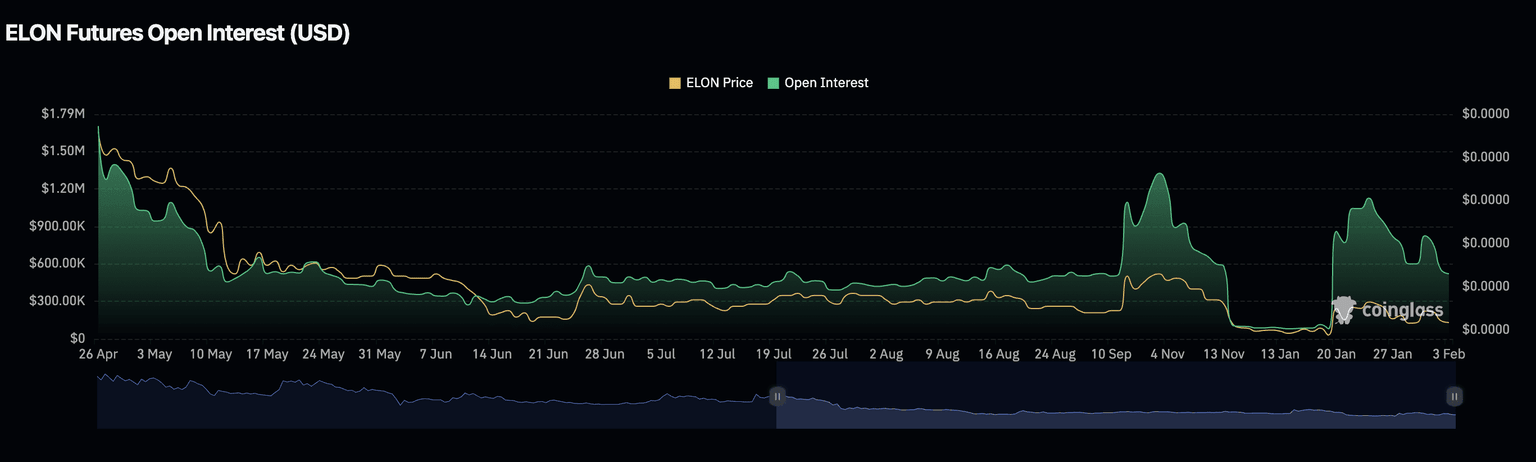

ELON market capitalization slipped to $122.24 million on Monday as the token wiped out 6% of its value in the last 24 hours. Derivatives traders deleveraged, ELON observed a 15% decline in its Open Interest (OI), a key metric.

OI is the total value of all open derivatives contracts in an asset, therefore a decline in OI is indicative of the dropping relevance and demand for the token.

ELON open interest | Source: Coinglass

The correlation between Dogelon Mars and Bitcoin is 0.73 in the 30-day timeframe as seen on TradingView. The correlation explains why Bitcoin price correction dragged down ELON, sending the token lower, under key support at $0.00000022.

Nearly $1.53 million in options were traded in ELON in the past day, according to Coinglass data. The long/short ratio across derivatives exchanges is under 1, meaning traders are currently bearish on ELON and expect the cryptocurrency to decline further.

On the 12-hour timeframe, the Moving Average Convergence Divergence (MACD) flashes red histogram bars under the neutral line, signaling negative underlying momentum. The Relative Strength Index (RSI) is in a downward trend and reads 44, under the neutral level of 50.

ELON could slip to the next low, the lowest level in January 2025 at $0.00000017, as seen in the chart below.

ELON/USDT 12-hour price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.