Dogecoin price dips by nearly 9% in 24 hours as corrections continue due to overvaluation

- Dogecoin price is trading at $0.071 after declining by more than 25% in the span of a month.

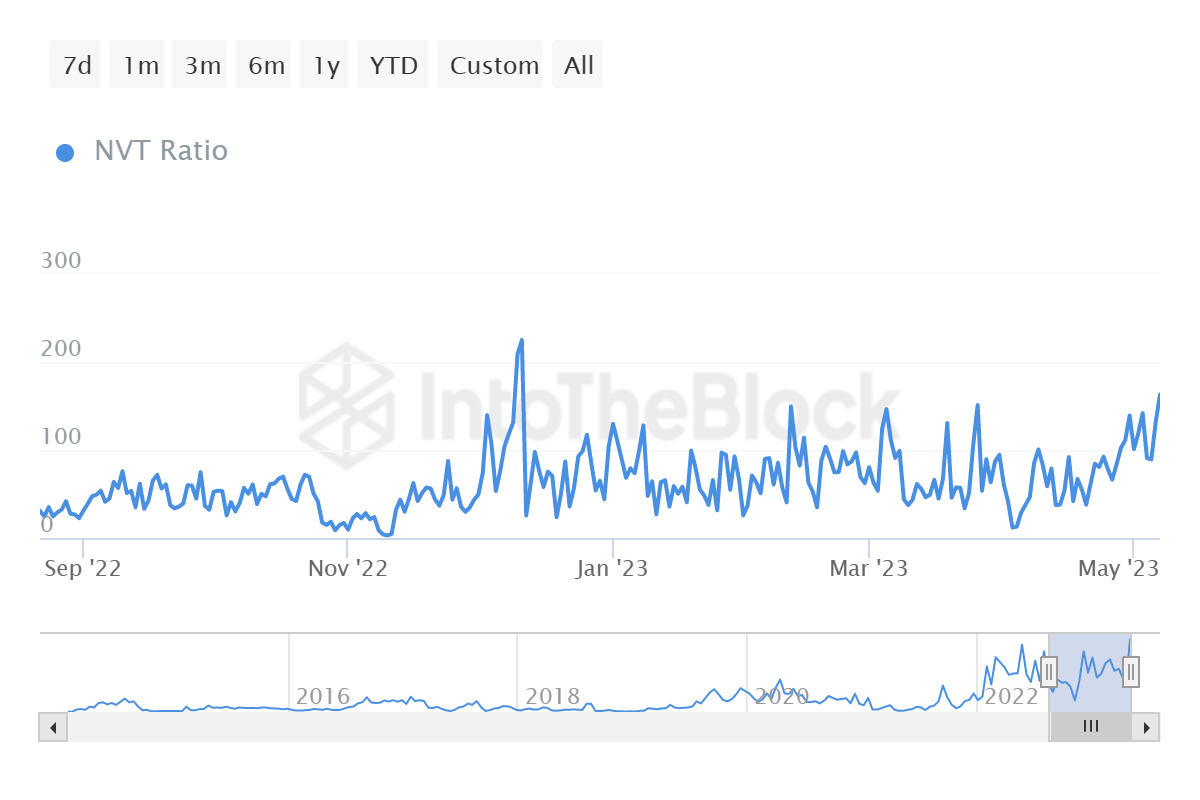

- DOGE Network Value to Transaction ratio hitting a five-month high suggests that the altcoin’s value is surpassing its on-chain transaction volume.

- The meme coin plummeting has spooked investors resulting in participation standing at a two-year low in the last 14 days.

Dogecoin price, after showing signs of some potential recovery, failed to chart gains and ended up falling to a five-week low. The investors interestingly already had it coming as signals of the same could be observed for nearly a month now.

Dogecoin price bows down

Dogecoin price at the time of writing could be seen trading at $0.071, noting a 6.3% decline over the last 24 hours. The bearishness during the intra-day trading hours rose significantly, pushing DOGE to the low of $0.069, down by nearly 9% at one point. However, the slight eventual recovery resulted in the meme coin shedding just over 25% of its value in the last month.

DOGE/USD 1-day chart

While the broader market cues did play a part in the price action, the same was anticipated, given the rise in the Network Value to Transaction (NVT) ratio. The ratio measures the network value, i.e., the market cap of the cryptocurrency, to the transaction volume and value settlement.

This helps an investor guage whether the digital asset is overvalued or undervalued. High NVT values are associated with overvaluation and note market tops or corrections, while low NVT ratios signal just the opposite.

In the case of Dogecoin, the NVT ratio happens to sit at a five-month high of 163, a figure last noted back in December 2022. Back then, DOGE ended up failing recovery and registered another 21% decline over the next seven days.

Dogecoin NVT ratio

Now since the on-chain transaction value has surpassed the altcoin’s value, some corrections would correct the discrepancy between the two.

This development has spooked investors to the point that they are refraining from participating on the network despite posting some good figures throughout early April. Towards the end of the month, active addresses dipped from 142,000 to 117,000 in the span of 48 hours.

Dogecoin active addresses

The last time the Dogecoin network noted the participation of fewer than 120,000 users was nearly two years ago, back in July 2021. This suggests that investors are set to lay low until they see some recovery on the charts.

For the same to happen, corrections would need to come to an end, which is looking likely given the Relative Strength Index (RSI) is nearing the oversold zone. This region is synonymous with recovery, and if the meme coin falls into it, some green candlesticks might be on their way.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.17.50%2C%252008%2520May%2C%25202023%5D-638191813413498045.png&w=1536&q=95)