Dogecoin price analysis: 160,000 new users buy DOGE 30 days after Trump appoints Elon Musk to DOGE advisor

- Dogecoin price fell to $0.24 on Friday, with gains from the buzz around DOGE ETFs subdued at 5%.

- The global memecoin sector faced negative sentiment this week due to the controversy surrounding the Argentina President’s link to a scam token.

- Santiment’s Total Holder metric shows 160,000 new-user wallets were created on the Dogecoin network since January 20.

Dogecoin price gained 8% in the last 3-days to hit $0.26 on Friday, fueled by the buzz around DOGE ETFs. On-chain data shows that new users continue to troop into the Dogecoin network as the global memecoin sector faced negative sentiment this week from controversy surrounding Argentina President Milei’s link to a scam meme token.

Dogecoin falls to $0.24 as LIBRA memecoin controversy nullifies DOGE ETF hype

Dogecoin (DOGE) extended its two-day losses on Friday, falling 3% to reach $0.24 amid heightened speculation around the potential launch of DOGE ETFs.

The momentum initially stemmed from the Securities and Exchange Commission’s (SEC) acknowledgment of Grayscale’s spot DOGE ETF filing on February 14, which was followed by similar filings from Bitwise this week.

However, despite the excitement, DOGE failed to push beyond resistance at $0.26 and fell to $0.24 at the time of writing.

Comparisons with Litecoin (LTC) and Ripple (XRP)—two other assets with pending ETF applications—highlight DOGE’s muted price reaction.

On Thursday, LTC surged to a 30-day high of $140 while XRP reclaimed the $2.70 level. By contrast, DOGE’s momentum has been stunted by broader memecoin market headwinds, including the LIBRA token scandal involving Argentina’s President Javier Milei.

Bearish sentiment swept through the memecoin sector this week as news surfaced of Milei’s alleged ties to LIBRA, a fraudulent memecoin project that saw its token price collapse.

The controversy dampened investor appetite for speculative assets, offsetting the positive sentiment surrounding DOGE’s ETF prospects.

This sector-wide downturn may explain why Dogecoin’s price has felt over the last two days, even as institutional interest in crypto ETFs continues to grow.

160,000 new Dogecoin wallets created within 30– days of Trump establishing DOGE

Elon Musk’s influence over Dogecoin’s market trajectory is well documented, but his impact has now entered a new phase.

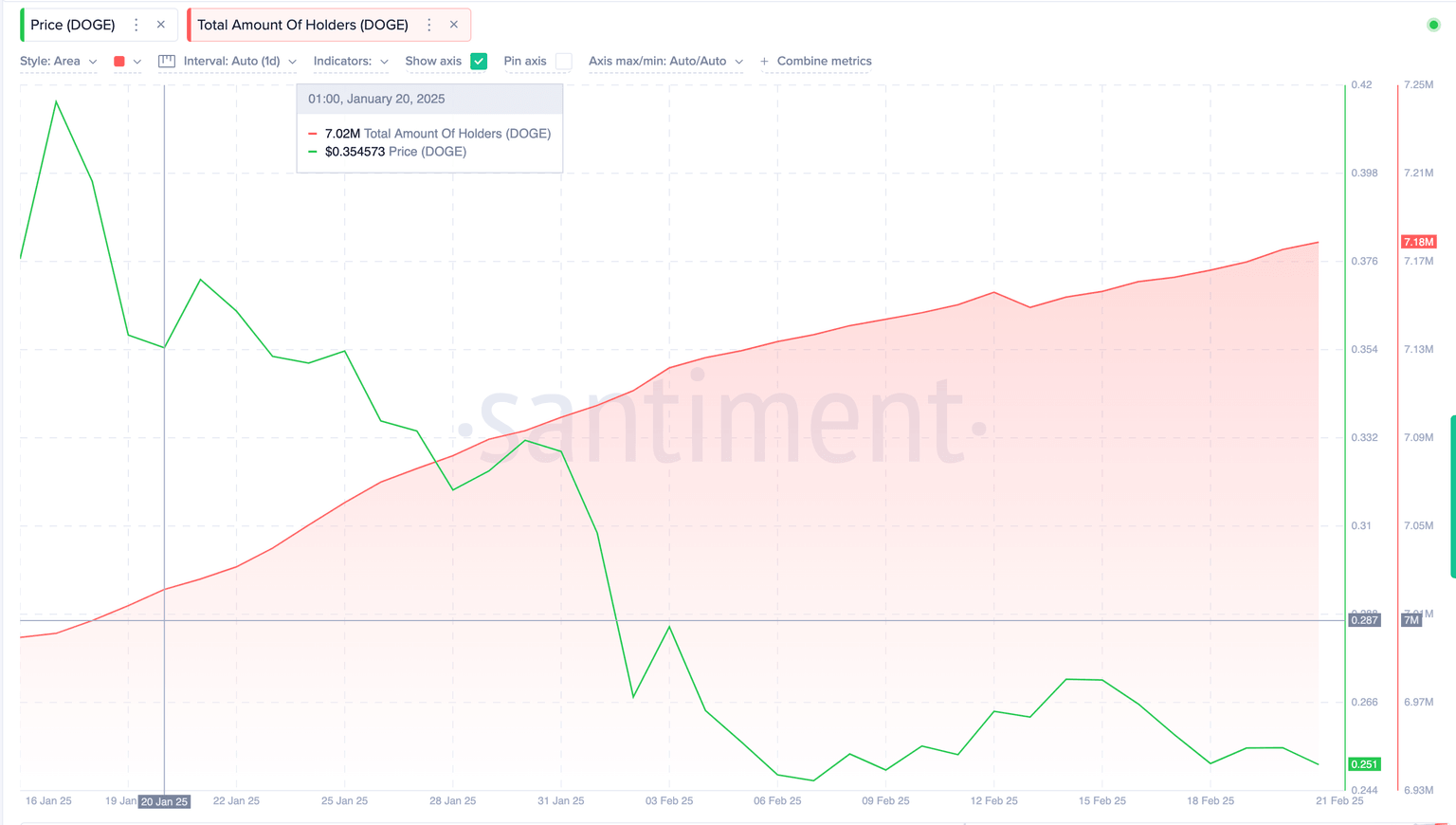

Shortly after US President Donald Trump signed a bill formally creating the Department of Government Efficiency (DOGE) on January 20, on-chain data suggests a surge in new users entering the Dogecoin ecosystem.

According to Santiment’s Total Holder metric, the number of unique wallets holding DOGE has increased by 160,000 over the last 30 days.

On January 20, the total number of wallets on the Dogecoin blockchain network was 7.02 million. As of this week, that figure has risen to 7.18 million, reflecting growing adoption in the aftermath of Musk’s official appointment to lead the DOGE oversight office.

Such a dramatic increase in new users is inherently bullish for Dogecoin price, as the broader user base enhances network decentralization, making the ecosystem more resilient to manipulation and volatility.

Additionally, an uptick in wallets signals rising demand for DOGE, which could lead to increased transactional activity on the network. If this trend continues, the expansion in Dogecoin’s user base could translate into sustained buying pressure.

Dogecoin Price Forecast: DOGE needs a stronger momentum to break $0.30

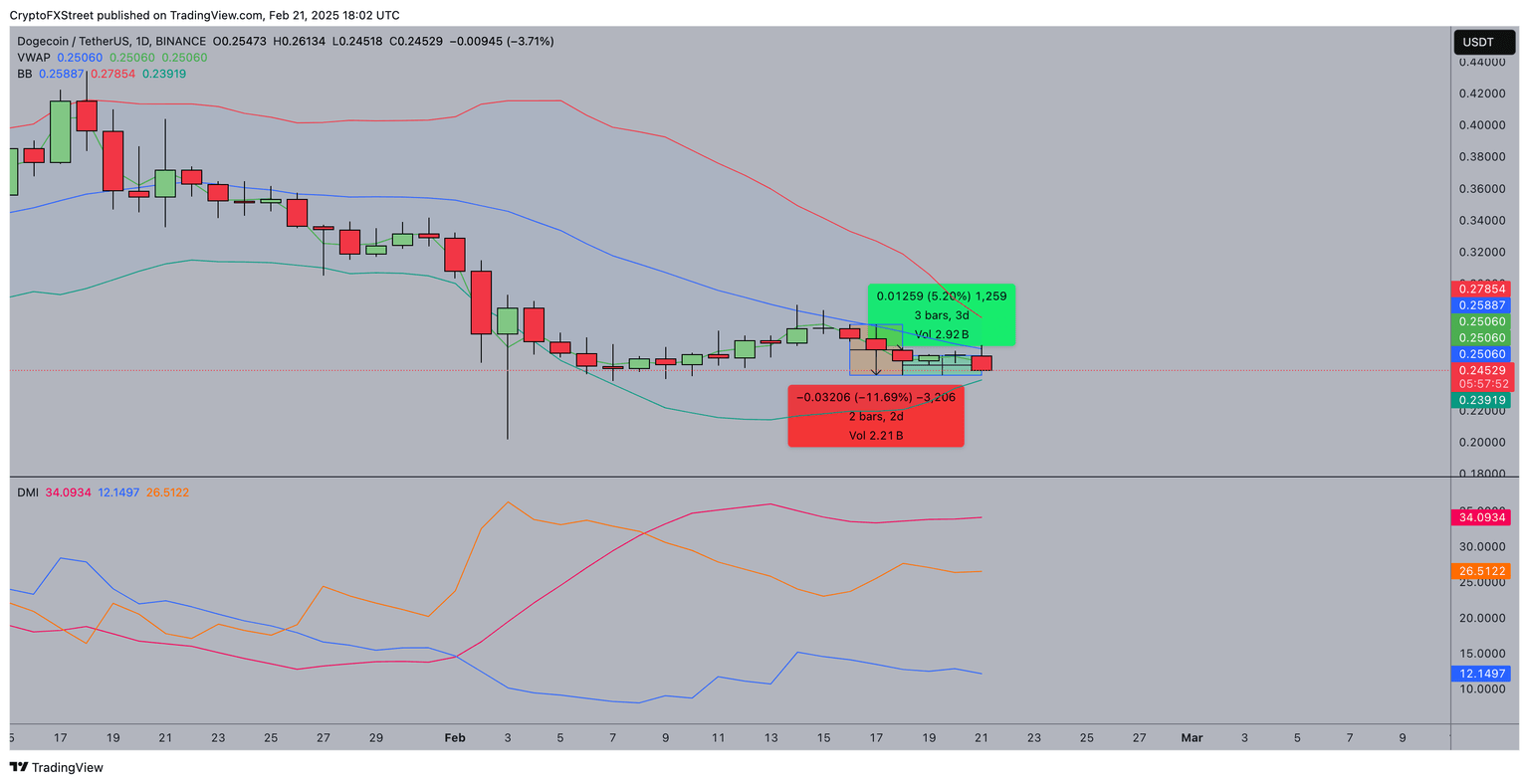

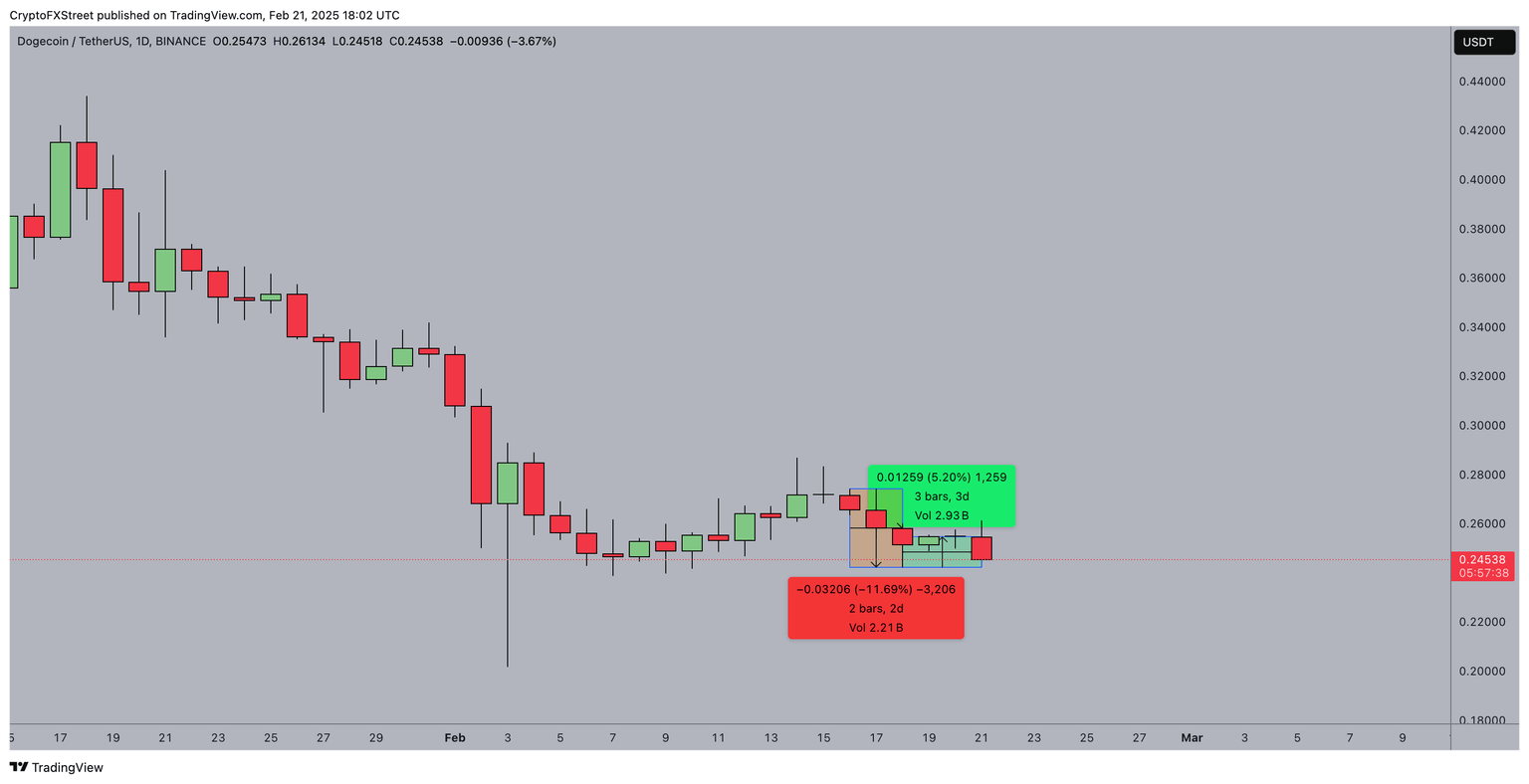

Dogecoin price forecast remains cautiously bullish, but the $0.30 resistance could prove too steep for the current momentum.

The VWAP at $0.25181 signals moderate buying interest, but with price trading below this level, bullish conviction appears weak.

The Bollinger Bands indicate contracting volatility, with the upper band at $0.27840 and lower support at $0.24, highlighting a tightening price range.

A rebound push this week saw DOGE climb 5.2% in three days. The Directional Movement Index (DMI) shows the -DI (33.58) overpowering the +DI (13.50), indicating bearish control, while the ADX (25.07) suggests the trend remains strong.

Unless buyers regain dominance, DOGE could struggle to clear the $0.26 VWAP resistance, let alone the psychological $0.30 level.

For upside continuation, DOGE must break past the upper Bollinger Band at $0.28. On the downside, failure to hold $0.24 could expose DOGE to deeper losses toward $0.22.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.