Doge Price Analysis: DOGE/USD bulls recover price following bearish correction

- DOGE/USD experienced a surge after Elon Musk’s meme about Dogecoin.

- According to CoinMarketCap, the prices of Dogecoin have surged by 15.39% since the Tweet.

- The surge was followed by two days of bearish correction.

- The bulls regained control in the early hours of Tuesday.

Elon Musk, the CEO of Tesla and SpaceX, took to Twitter to post a meme about Dogecoin, which implies the Dogecoin standard would envelop the global financial system. The meme generated significant engagement from tech enthusiasts, financial investors and the cryptocurrency community. According to CoinMarketCap, the prices of Dogecoin have surged by 15.39% since the Tweet.

It’s inevitable pic.twitter.com/eBKnQm6QyF

— Elon Musk (@elonmusk) July 18, 2020

Dogecoin was first introduced as a sort of joke coin by its creators - Billy Markus and Jackson Palmer. This isn’t the first time Musk has commented about Dogecoin. In April last year, he tweeted about Dogecoin in response to a poll from the cryptocurrency’s official Twitter account.

Following the surge, DOGE/USD faced two straight days of bearish correction wherein the price fell from $0.003495 to $0.0032.

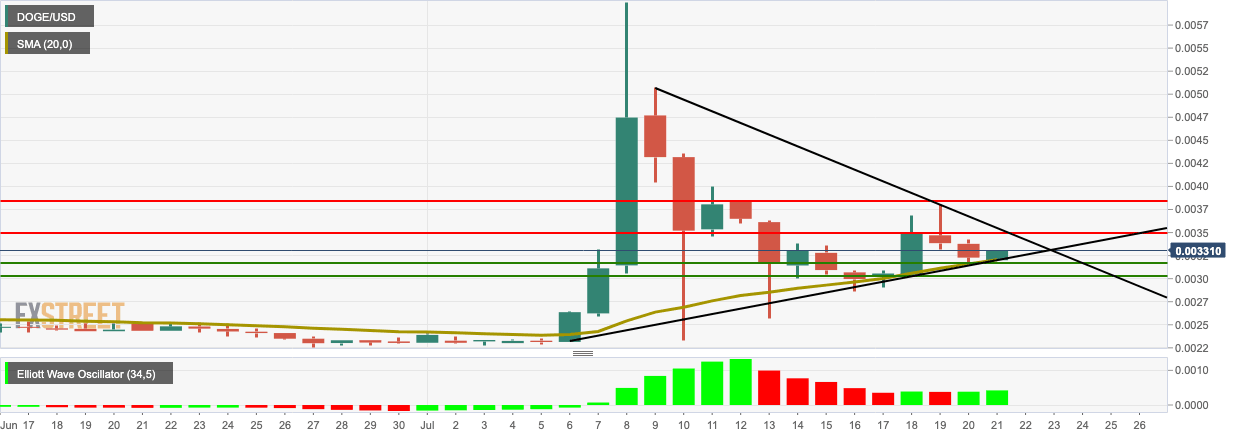

DOGE/USD daily chart

DOGE/USD bulls re-entered the market following the two bearish days and have taken up the price from $0.0032 to $0.00325. The price is consolidating in a triangle formation and has found support at the SMA 20 curve. Finally, the Elliott Oscillator has had two straight green sessions.

Support and Resistance

DOGE/USD bulls need to overcome resistance at $0.0035 and $0.00382 to continue the upward momentum. On the downside, healthy support lies at $0.003199 (SMA 20), $0.003169 and $0.003022.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.