Dash Price Analysis: DASH aims for $80 following latest update

- Dash announced protocol versioning following its latest update.

- DASH jumped up from 68.20 to 76.25 over the last two days.

Dash announces protocol versioning

Dash announced that it would be introducing several new features in its latest update, including protocol versioning. This will be Dash’s fourth update. The new features are being added to help developers to transition smoothly to a testnet and mainnet. Previously, they were forced to wipe data on Evonet and update their platform. This wasn’t the most efficient of methods, as the company pointed out:

While this approach is fine for early testing, it is not appropriate for testnet and mainnet. To handle different versions of data, nodes, and clients all working in coordination, DCG developers introduced versioning that allows for the smooth rollout of breaking changes without affecting user experience.

Other new features include binary fields definition in a data contract, improvements in the Dash Platform Name Service, the JavaScript library, distribution package and changes to the DAPI endpoints.

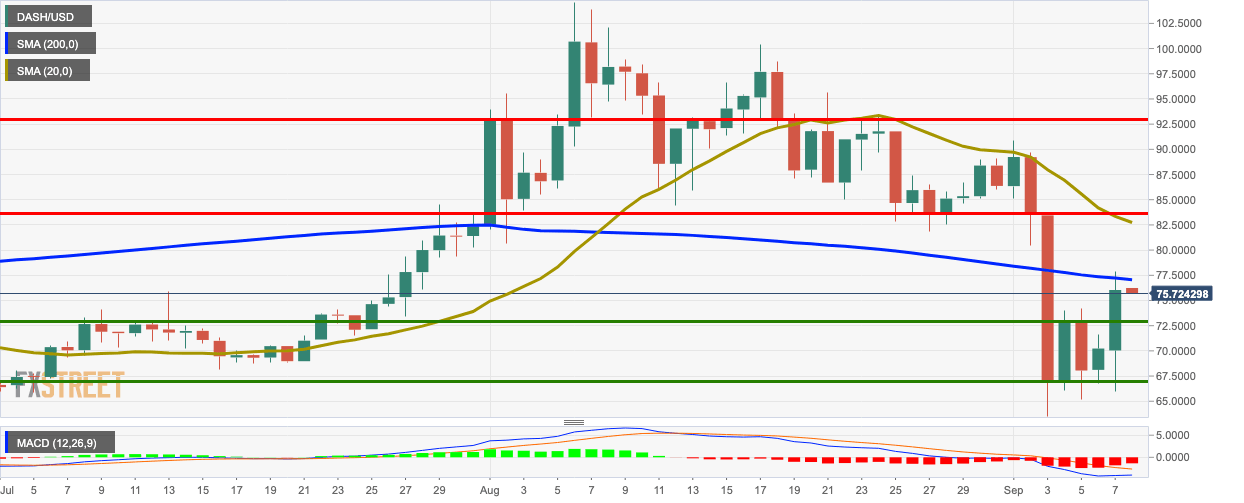

DASH/USD daily chart

DASH has gone down very slightly from $76.24 to $75.66 in the early hours of Tuesday. Before this, the bulls jumped the price up from 68.20 to 76.25, charting an impressive 11.97% growth over the last two days. If the buyers want to gain back control, they will need first to overcome resistance at the SMA 200 curve.

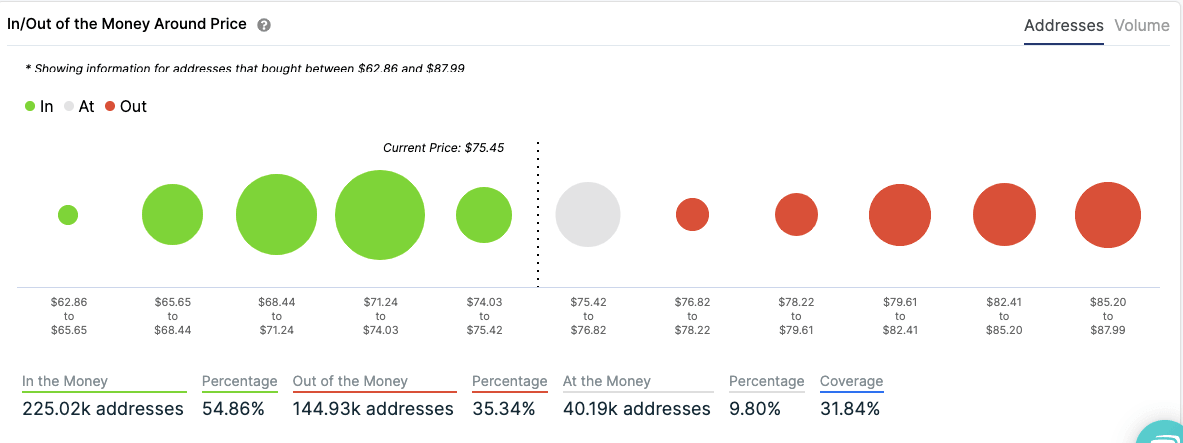

DASH In/Out analysis

As per Into the Block’s In/Out money metric, DASH/USD should be able to go up to $79.60. However, following that, the bulls will have a hard time entering the $80-zone as the next few price levels are guarded by intense resistance levels.

On the other hand, if the sellers take control, they will only be able to take the price down to $74 before encountering healthy support. As such, the downside potential for DASH looks pretty limited.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.