Cryptocurrency Market Update: Bitcoin price ultimate test to $17,000

- Bitcoin narrow trading range over the last two months results in a massive breakout stepping above $10,300.

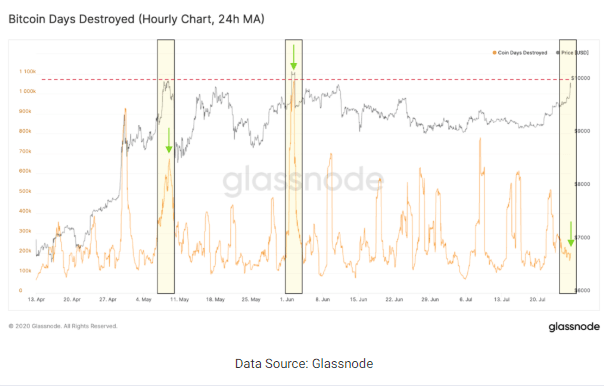

- On-chain data provided by Glassnode suggests that investors are not selling in anticipation of a rally to $17,000.

Bitcoin has for the first time in two months broken the barrier at $10,300. The breakout comes at the time when major cryptos are winning as altcoins take a beating. Prior to this, altcoins such as Tezos, Stellar and Cardano rallied while Bitcoin and Ethereum stalled.

Bitcoin’s impressive rally commenced last week by bringing down the hurdles at $9,300, $9,400 and $9,600. The weekend session saw bulls take control of the price pushing the largest cryptocurrency above $10,000. The rally continued on Monday with BTC breaking past $10,300 for the first time in eight weeks.

On-chain data suggests that Bitcoin rally is just starting

Bitcoin trading above $10,000 is not new. Throughout 2019 and 2020 BTC has traded above this zone countless times. However, the breakouts have all ended up in massive losses. At the moment, on-chain data hints that investors are preferring to hold in anticipation of higher price levels.

Note that for several weeks Bitcoin remained range-bound between $9,100 and $9,300. Therefore, such a breakout to $10,300 would see investors selling massively to cash in on profits but the scenario is different for this breakout.

Data by Glassnode, an on-chain blockchain analysis platform using the “Coin Days Destroyed” metric indicates that investors are not selling as has been the norm with past rallies. The team at Glassnode says that “in contrast to the last two times BTC hit $10,000 USD, we haven’t seen an increase in Bitcoin Days Destroyed today.” In other words, this is the number of ‘old’ Bitcoin that is leaving the market.

Investors are likely watching the market to see where this latest trend heads to owing to the fact that Bitcoin was locked in a tight range for a long period. Gains towards $17,000 are likely but first can Bitcoin take down the resistance at $10,500 and $11,000 respectively?

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren