Cryptocurrency Market Update: Bitcoin and cryptos breaking out, Bitcoin Cash consistently rising

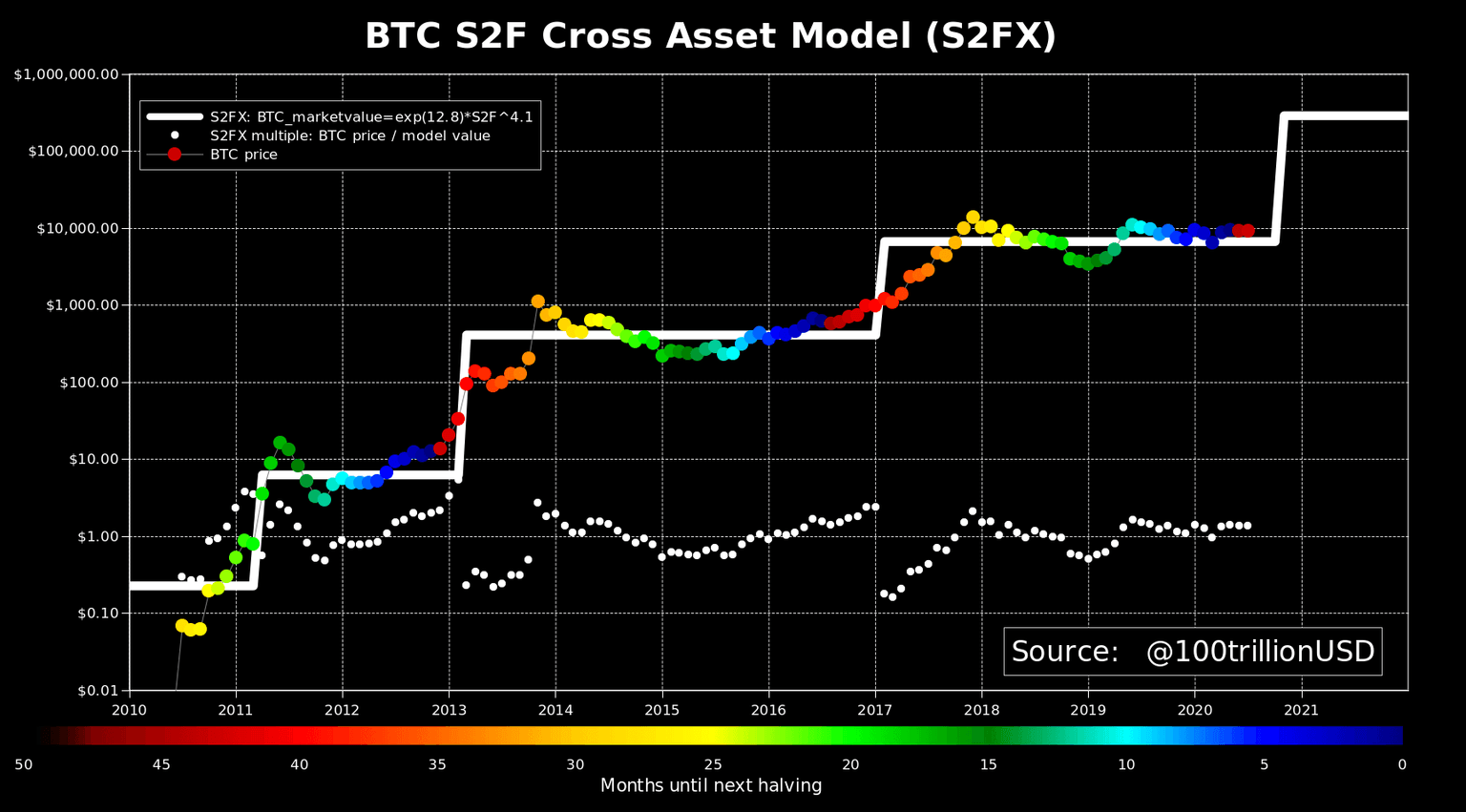

- PlanB S2FX model suggests that Bitcoin is on the verge of breaking out towards the coveted $10,000 level.

- Bitcoin Cash spike tests $225 resistance ahead of possible triangle pattern breakout.

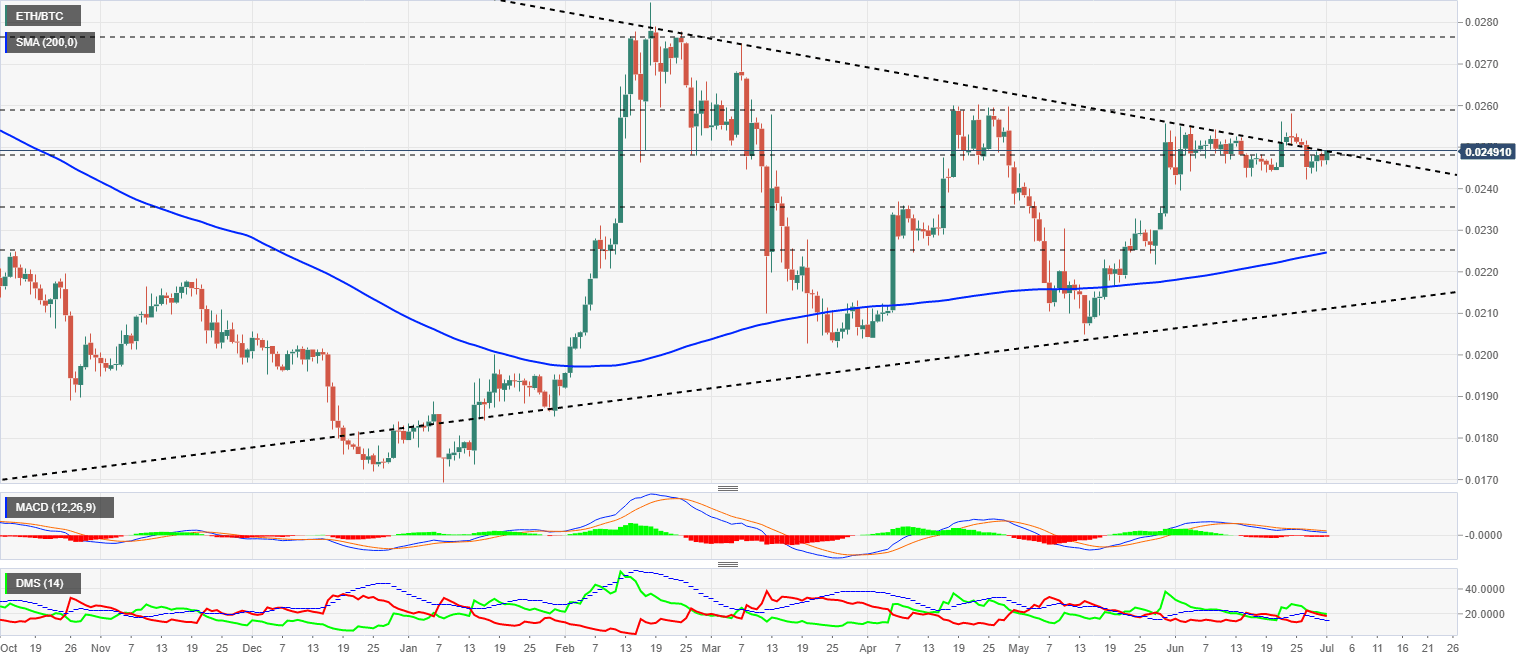

- ETH/USD trading pair is at the point of no return; gains towards 0.0300 anticipated.

Cryptocurrencies could be finally waking up following an extended period of consolidation. Bitcoin, for instance, has been trading in a wide range between $9,000 and $10,000. However, the latest Bitcoin Stock-to-Flow Asset Model (A2FX) shared by PlanB shows that the price is on the verge of a breakout. The red dot on the S2F model places Bitcoin near term price above $10,000.

Related content: Cryptocurrency Market News: Bitcoin popularity surges in the UK

ETH/USD pair starts to breakout

The ETH/USD trading pair is more than often used to signal incoming rally in the cryptocurrency market. At the time of writing, the price is trying to break above the long term symmetrical triangle resistance. Such a breakout could easily place BTC/USD on a trajectory towards 0.0300. Some hurdles expected along the way include April high at 0.0260 and 0.0270.

Bitcoin Cash market update

Bitcoin Cash has been on a consistent rise since the European session started. While other cryptos are struggling with detangling from the bearish traps that have held them hostage throughout June, BCH/USD has shown that gains are possible in a generally bearish market.

At the moment, BCH is teetering at $224 following over 1% in gains on the day. An intraday high has also been traded at $225 (marking a key resistance area). Further correction towards $230 would lead to a breakout above a rising triangle as observed on the chart below.

Bitcoin price update

Bitcoin is also in the green, although slightly. Buyers have tried to take down every inch of the ground heading to $9,200, however, an intraday high has been formed at $9,190.31. BTC/USD has since adjusted to $9,170 (prevailing market value). The factors holding the bulls back include the bearish dominance, low volatility and low trading volume. However, according to the S2F model above, it is only a matter of time before Bitcoin resumes the journey towards $10,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren