Cryptocurrency Market News: Altcoin season might be already here with coins like ERD seeing a 1,400% price increase in months

Here is you need to know on Friday, 10, July 2020

BTC/USD is not doing a lot and continues fighting to stay above the daily 12-EMA. The uptrend is still intact and bulls are looking for a bounce above $9,400.

ETH/USD just bounced from the daily 12-EMA and could resume its bullish rally towards $250 in the next few days.

XRP/USD dropped significantly towards $0.19 but managed to recover quite well and it’s back above $0.20 for the time being.

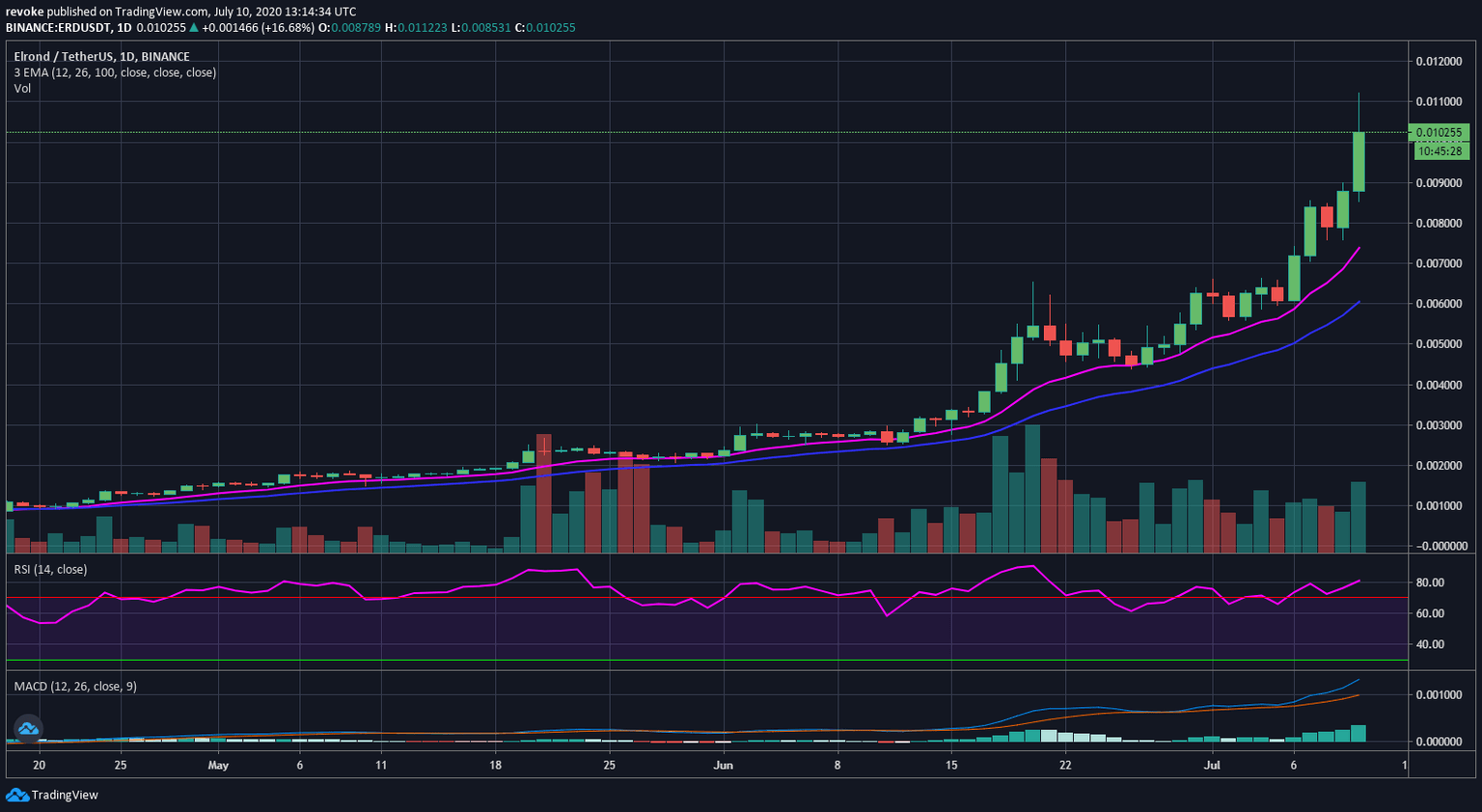

The biggest gainer today was definitely Elrond with a 50% price surge getting to top 54th by market capitalization with a $158 million cap. ERD/USD has been outperforming basically everyone and continues posting new all-time highs with increasing trading volume. Stratis is also up a lot today at $0.70 and eying up $1 without a lot of resistance nearby.

Chart of the day: ERD/USD daily chart

Market

According to Anatoly Aksakov, the head of the State Duma Committee on the financial market, regulations, and laws regarding financial assets are right around the corner stating:

If we manage to get a reaction, for example, next week, it will be possible to submit the bill for consideration in the second reading.

Chinese police have seized around $14 million in cryptocurrency assets and even some supercars in a scam about fake tokens. According to recent reports, around 10 people have been arrested. The scam was basically a scheme where people needed to send Ethereum to an address to get HT (Huobi Tokens) in return. However, instead of real HT tokens, victims received an identical token that had no value. It’s worth noting that Huobi had nothing to do with this scam.

Industry

DeFi is clearly on the rise and startups and businesses are taking advantage of it. Three crypto firms, Cosmos, Polkadot, and Terra are partnering up to launch a new DeFi service called Anchor. According to the creators, DeFi hasn’t produced any simple way of having savings outside cryptocurrency enthusiasts.

To address this pressing need we introduce Anchor, a savings protocol on the Terra blockchain. Anchor offers a principal-protected stablecoin savings product that accepts Terra deposits and pays a stable interest rate. To generate yield, Anchor lends out deposits to borrowers who put down liquid-staked PoS assets from major blockchains as collateral. Anchor’s yield is thus powered by block rewards of major Proof-of-Stake blockchains. Ultimately, we envision Anchor to become the gold standard for passive income on the blockchain.

Quote of the day

I understand the political ramifications of [bitcoin] and I think that the government should stay out of them and they should be perfectly legal.

– Ron Paul

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.