Cryptocurrencies Price Prediction: Toncoin, Bitcoin & Crypto – European Wrap 4 September

Three cryptocurrencies likely to witness bullish breakouts like Stellar: Toncoin, Monero and Arbitrum

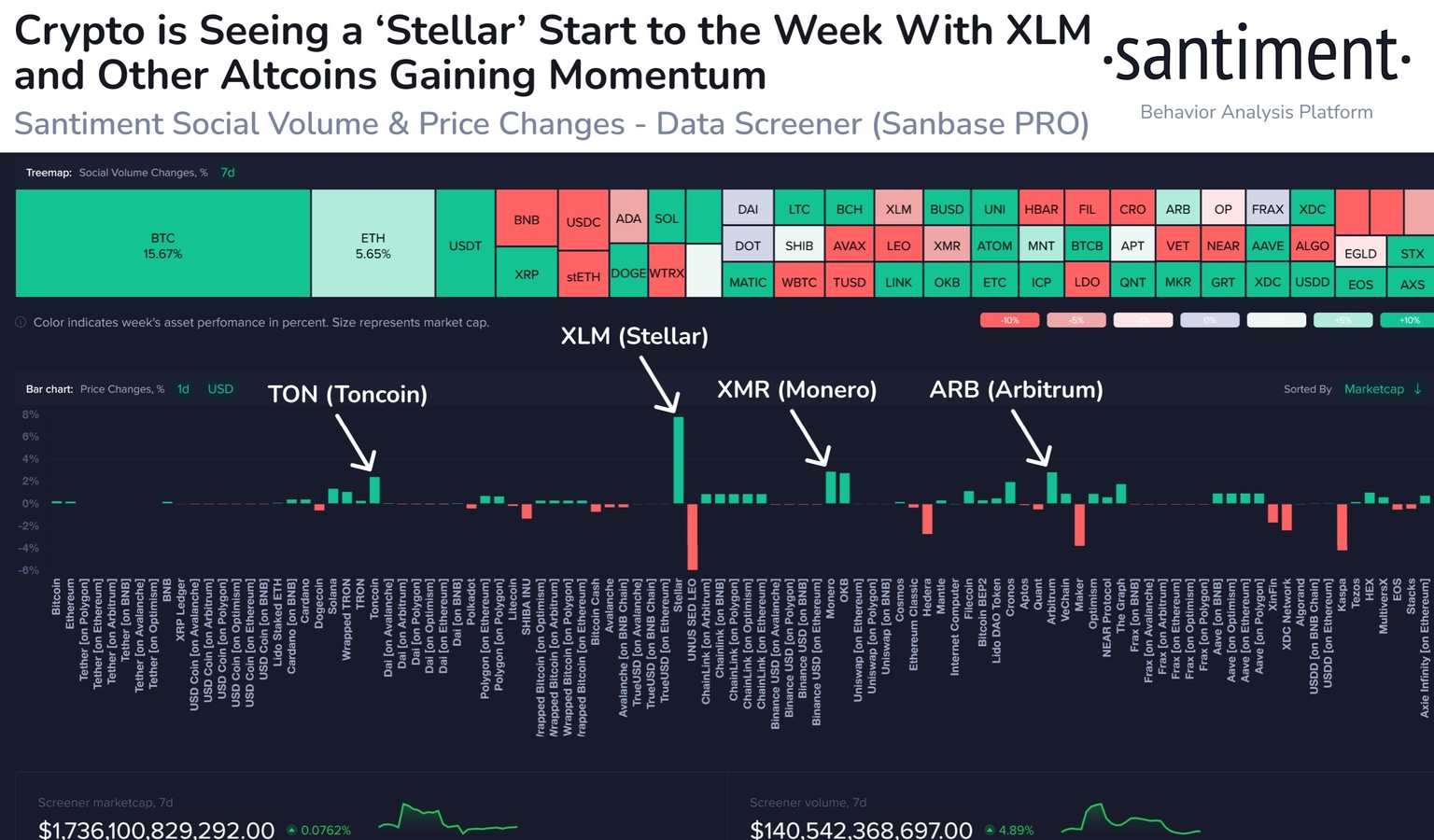

Stellar (XLM) price rallied nearly 6% on the day on Monday. On-chain analysts at crypto intelligence tracker Santiment analyzed this spike and identified three other altcoins that have a similar breakout potential.

Toncoin (TON), Monero (XMR) and Arbitrum (ARB) stood out among the top altcoins by market capitalization, according to Santiment. Using on-chain metrics like social dominance, the number of whale transactions worth $100,000 or more, and the total number of holders of the asset, the analysts concluded that these three assets are the most likely to register a price rally.

Bitcoin investors expect more downside, Vitalik Buterin sells his MKR holdings

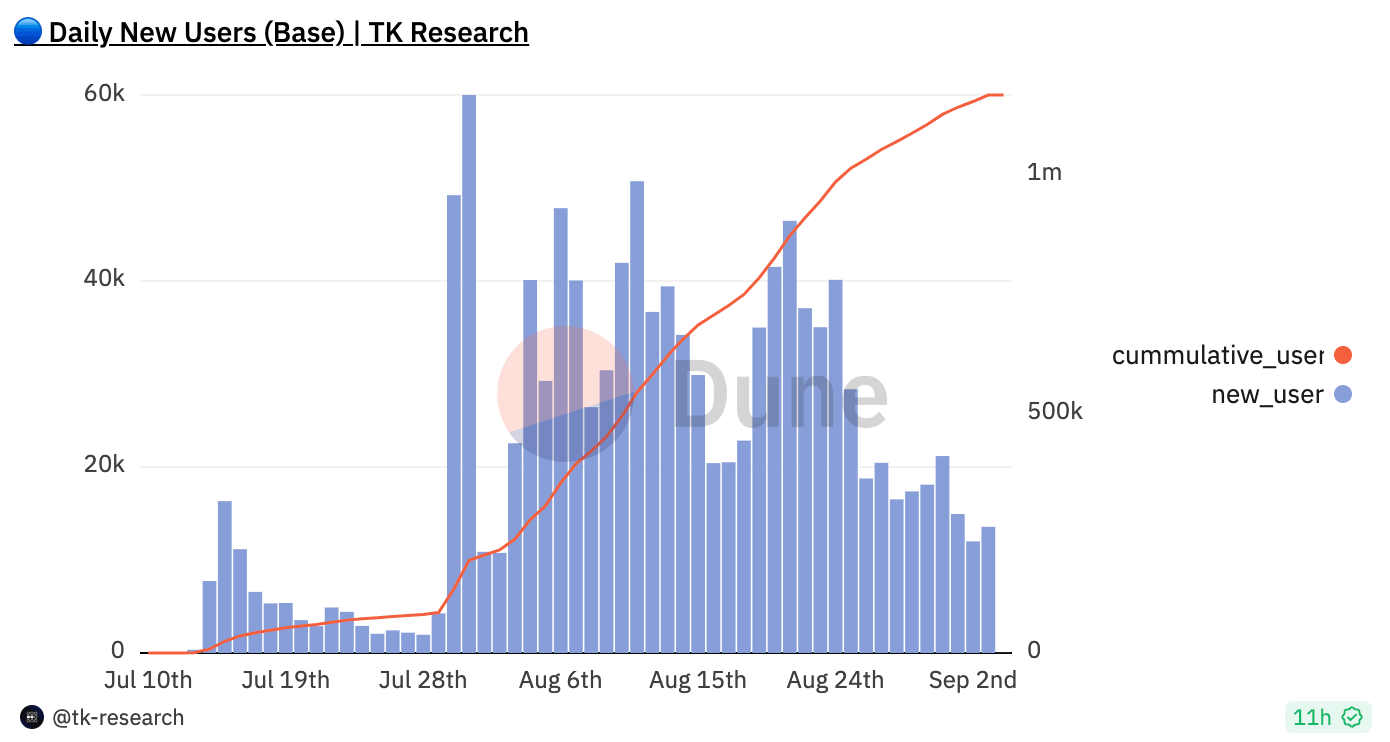

Crypto’s on-chain summer, which began with the launch of Coinbase’s Layer 2 solution BASE, seems to have slowed down. This can be seen in the chart attached below, which shows a steady decline in new users joining the network. As a result, gambling of on-chain altcoins has also dropped.

The US PCE and NFP releases last week failed to trigger a sharp move. The two significant reports were underwhelming, which caused Bitcoin prices to hover around $26,000 after the events. However, as time passed, BTC took a sharp nosedive and retested $25,300.

Death crosses in ETH and BTC

Crypto market capitalisation is almost the same level as a week ago - near 1.045 trillion. The Bitcoin pump and dump tickled the market with nerves, formally tied to events surrounding Grayscale's Bitcoin ETF fund.

Bitcoin has been pegged at $26K for more than two weeks. An attempt to move back above the 200-day average has technically encountered stronger selling, confirming that the bears are not relinquishing market control. This disposition suggests higher risks that the consolidation will end with downside momentum, potentially at $25K or even $24K.

Author

FXStreet Team

FXStreet