Cryptocurrencies Price Prediction: Ripple, Dash & Cardano – Asian Wrap 22 Dec

Ripple Price Analysis: XRP eases within a one-month falling channel

XRP/USD drops to 0.5170 during the early Tuesday’s trading. The crypto major dropped below 200-bar SMA the previous day before bouncing off 0.4980. The latest moves have been confined between 0.5100 and 0.5300 while bearish MACD suggests further weakness.

As a result, short-term XRP/USD sellers can eye support line of a descending trend channel formation established since November 26, at 0.4308 now, during the further downside. Though, the 0.5000 threshold may offer immediate support.

Dash price dives by 15% but on-chain metrics remain heavily bullish

Dash was trading as high as $120 on December 21 before a massive sell-off down to $101.97. The digital asset is now trying to hold a critical support level to see a rebound as most on-chain metrics are still positive.

On the 4-hour chart, Dash price slipped towards the 50-SMA at $104 but managed to hold this critical support level for now. It seems that the digital asset is ready for a rebound as long as the bulls continue defending this level.

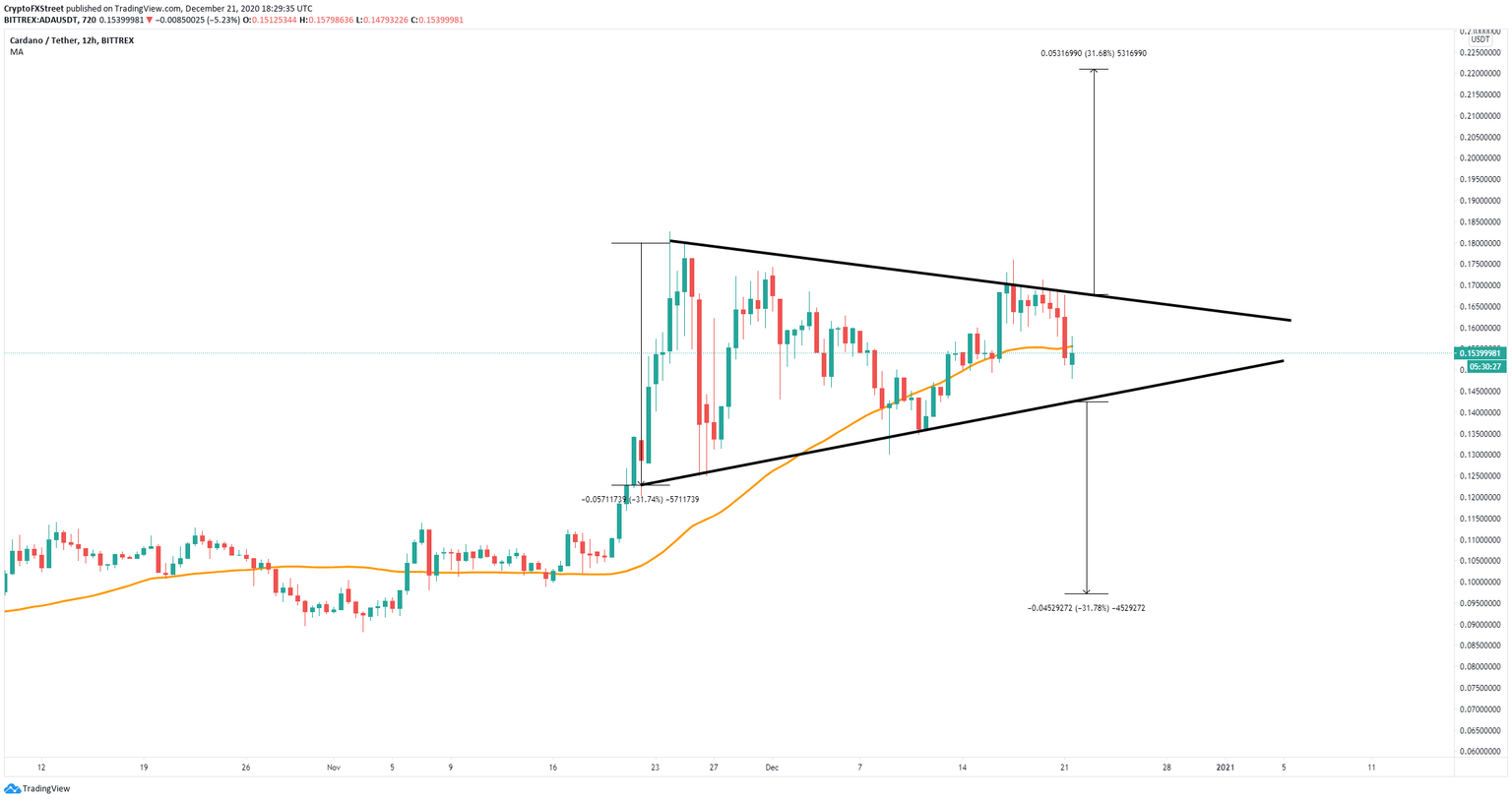

Cardano Price Prediction: ADA in no-trade zone while momentum builds for high volatility

Cardano attempted to crack the 2020-high of $0.182 on December 17, but bulls came off short and only managed to push ADA to $0.176 before a violent sell-off in the next four days. It seems that bears are pushing Cardano price towards $0.14.

ADA has formed a symmetrical triangle pattern on the 12-hour chart and it’s trading at $0.152 at the time of writing. Bulls have lost the 50-SMA support level and it seems that the next bearish price target is the lower trendline of the pattern at $0.14.

Author

FXStreet Team

FXStreet