Cryptocurrencies Price Prediction: Ripple, Cosmos & Binance – American Wrap 18 May

Ripple vs. SEC: Pro-XRP lawyer on how “total victory” can be assured

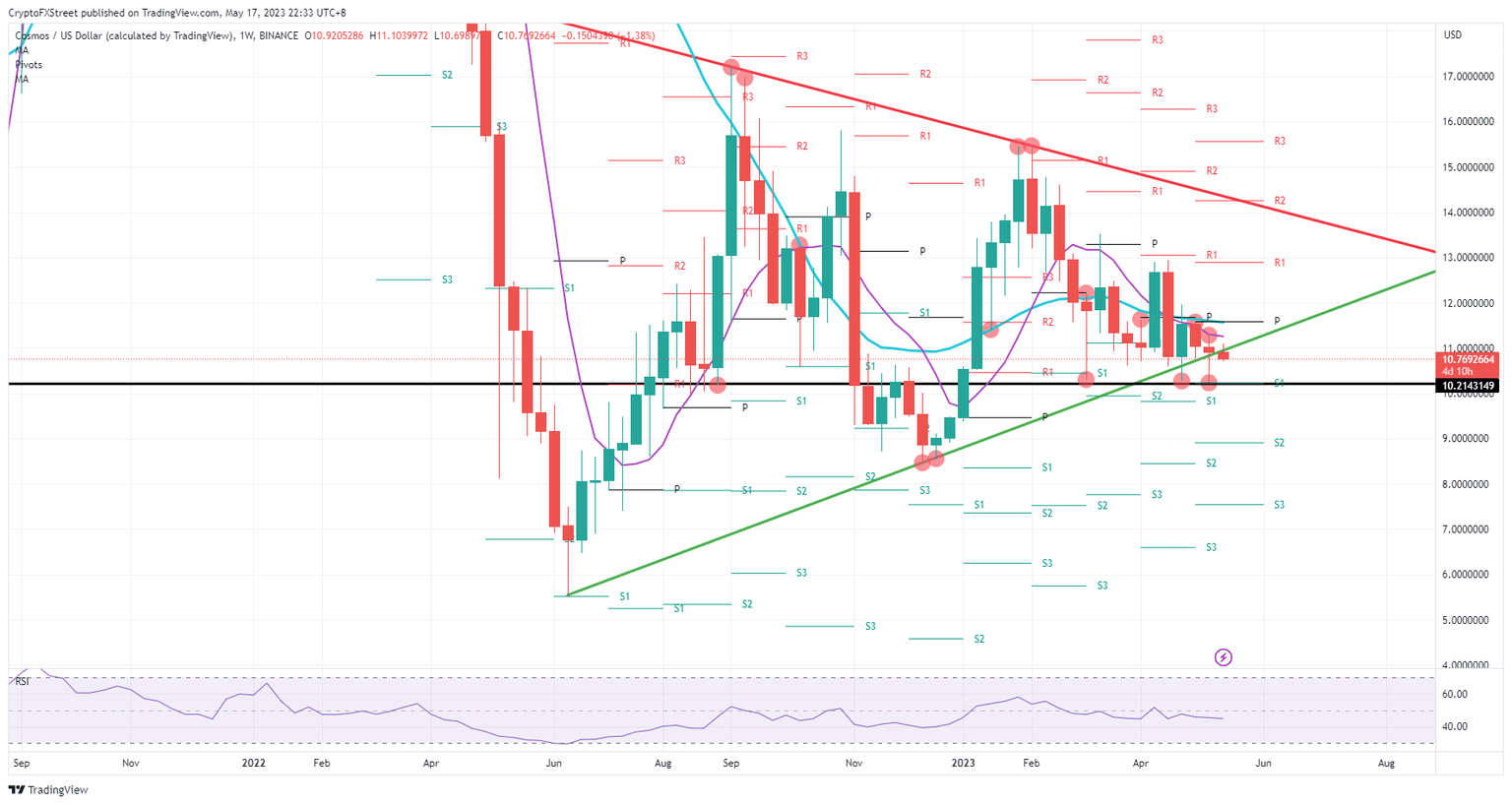

Cosmos (ATOM) price is heading further away from the important 55-day Simple Moving Average (SMA), which has acted as quite a good guideline in the past few weeks and months. As that happens, price action is as well trading outside the pennant that has been going on since 2022. Although this looks like a bear trap, bulls could end up being the ones that get pushed out of their position with ATOM dropping 20%.

Author

FXStreet Team

FXStreet