Cryptocurrencies Price Prediction: Polygon, Axie Infinity & Bitcoin – American Wrap 11 October

Three reasons why Polygon's MATIC token is targeting $300

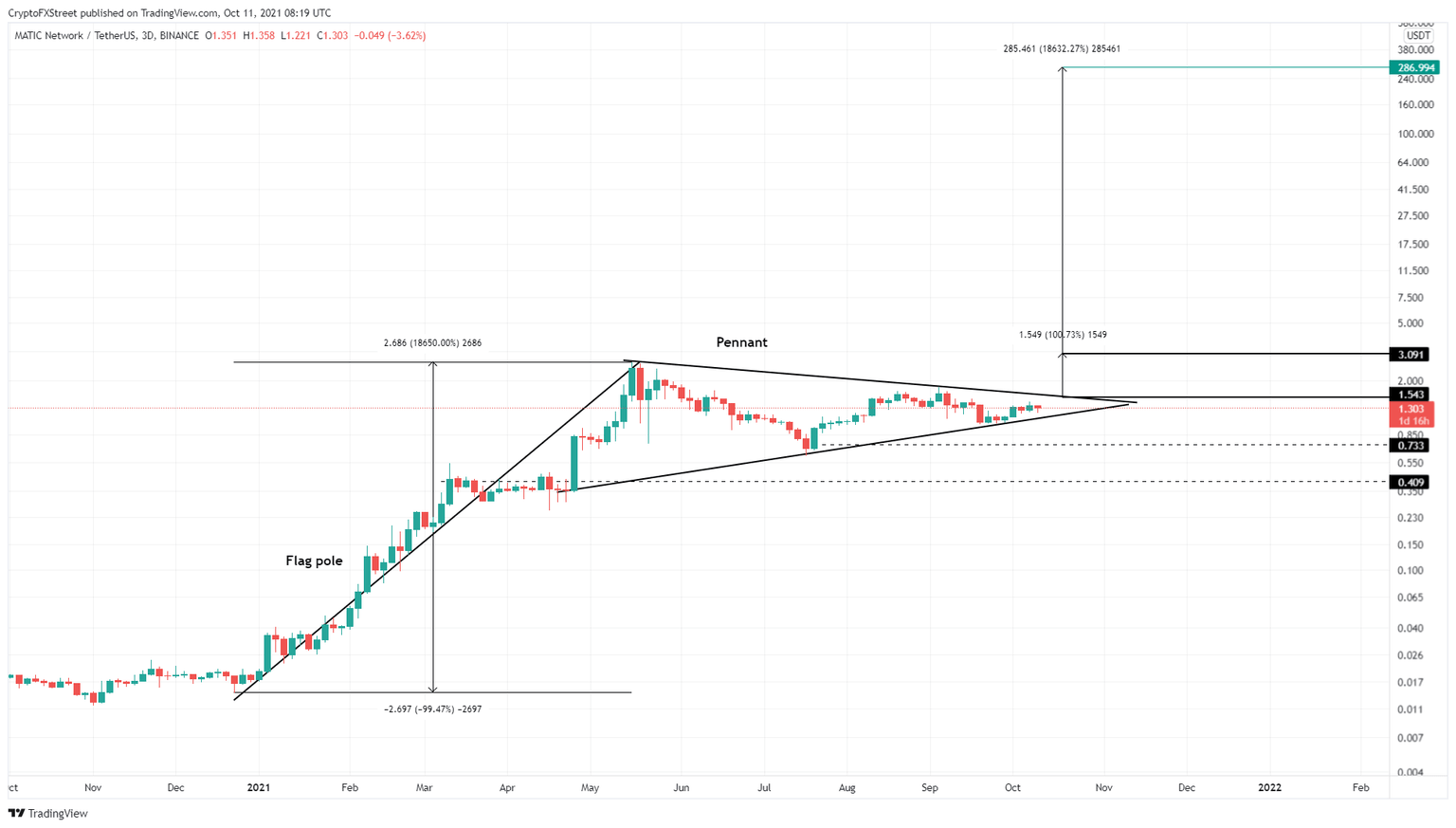

MATIC price is currently approaching the apex of the bull pennant pattern, suggesting an 18,632% advance. The RSI and MACD indicators support this bullish outlook. On-chain metrics suggest that Polygon’s ascension will not face massive hurdles. MATIC price has been in a consolidation phase for nearly four months, giving rise to a gigantic bullish pattern. As Polygon approaches a breakout point, investors can expect the altcoin to shoot into the stratosphere.

Analysts expect Bitcoin to top at $350,000 by 2022

Bitcoin ownership is not as concentrated as reported, despite consistent accumulation by whale addresses. Analysts expect four Bitcoin ETFs to hit the $6.7 trillion US ETF market in less than four weeks. On-chain analysts state that Bitcoin's end-of-year prospects are highly bullish in the ongoing bull run. Comparing the ongoing Bitcoin bull run with the 2017 rally suggests that institutional investments are on the rise. Top institutional players are transferring their Bitcoin holdings off exchanges.

Axie Infinity leads play-to-earn market with 1.8 million users and 150,000% price gains

The restriction on centralized cryptocurrency companies in China is driving investors toward decentralized alternatives in the DeFi industry. AXS's price has increased over 150,000% since its launch. Proponents believe that converting time to money is the most significant trait of Play-to-earn games like Axie Infinity. Axie Infinity has over 1.8 million daily active players worldwide, and AXS's daily transaction volume exceeds $520 million.

Author

FXStreet Team

FXStreet