Cryptocurrencies Price Prediction: Flare, SPX6900 & Ethereum – Asian Wrap 5 June

Flare’s co-founder shares low-risk XRP staking plans amid FLR airdrop

Flare Network (FLR) is trading at $0.01778 at press time on Thursday, with no significant movement after a 2.26% drop on Wednesday. Parallel to the downfall this week, Flare Network operates an airdrop for WFLR holders while its co-founder, Hugo Philion , discusses the plans and mechanisms of XRP staking for users to earn liquid staked tokens as the next step in expanding Ripple’s XRP role in Decentralized Finance (DeFi).

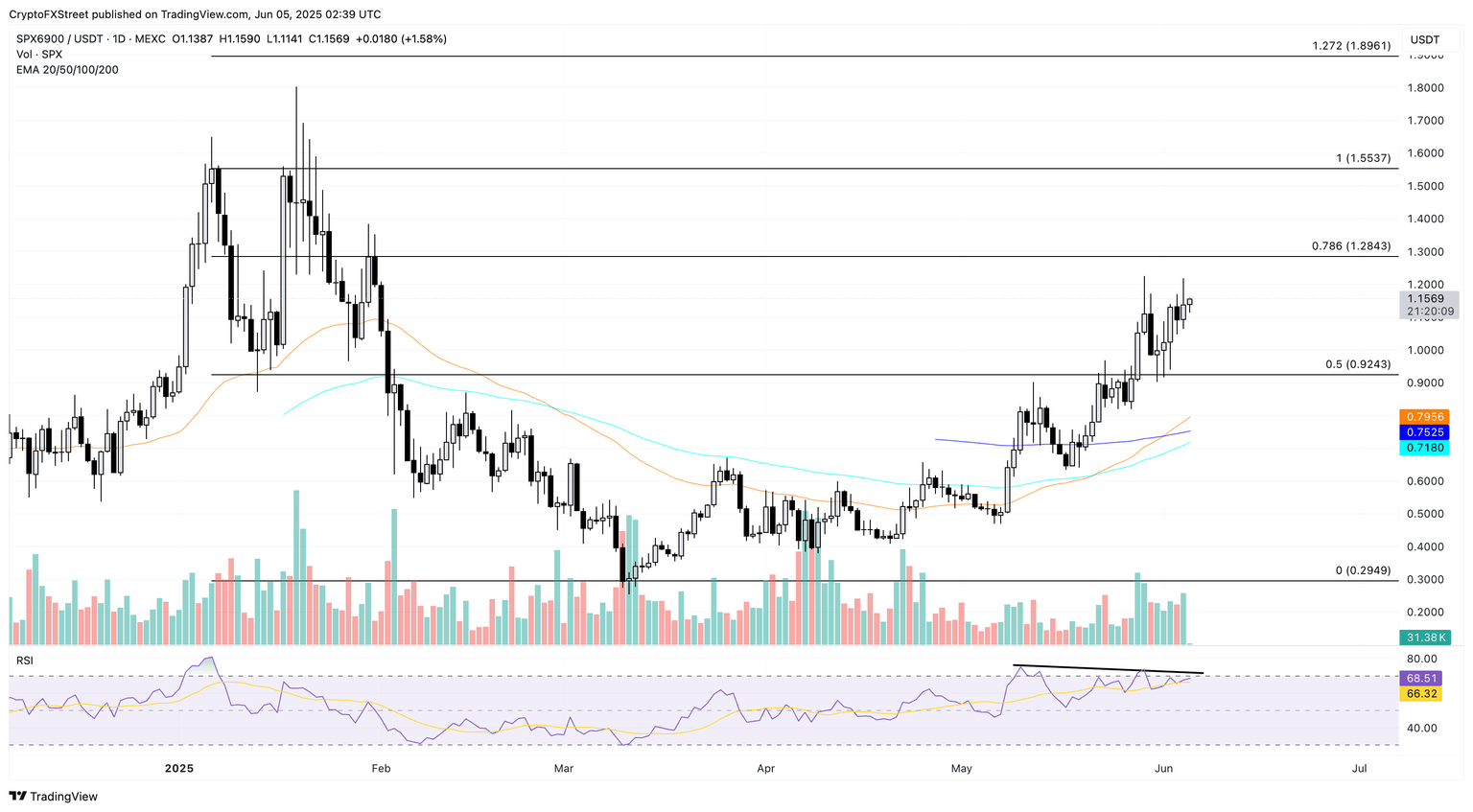

Altcoins SPX, DEXE, CAKE post gains, shrugging off Bitcoin’s fall below $105,000

The broader cryptocurrency market mirrored the bearish close in Bitcoin (BTC) on Wednesday, with the majority of the top 100 altcoins closing below their opening prices. Among the minority, SPX6900 (SPX), DeXe Protocol (DEXE), and PancakeSwap (CAKE) record mild gains as Coinbase adds CAKE to the asset roadmap, increasing the listing chances, and DEXE announces a writer’s guild program to incentivize its promotion.

Here's why Ethereum stalled despite strong ETF inflows and record-low exchange reserves

Ethereum (ETH) trades around $2,600 on Wednesday, maintaining its consolidation despite intense buying pressure across ETH exchange-traded funds and crypto exchanges. The flat prices potentially stem from rising short positions neutralizing the impact of buying pressure in the spot market. BlackRock's iShares Ethereum Trust (ETHA) led the pack on Tuesday with a single-day net inflow of $77 million. Notably, BlackRock's ETHA has accumulated 214,000 ETH since May 11, according to data posted by on-chain wallet tracker Lookonchain.

Author

FXStreet Team

FXStreet