Cryptocurrencies Price Prediction: Ethereum, Solana & Ripple – American Wrap 07 December

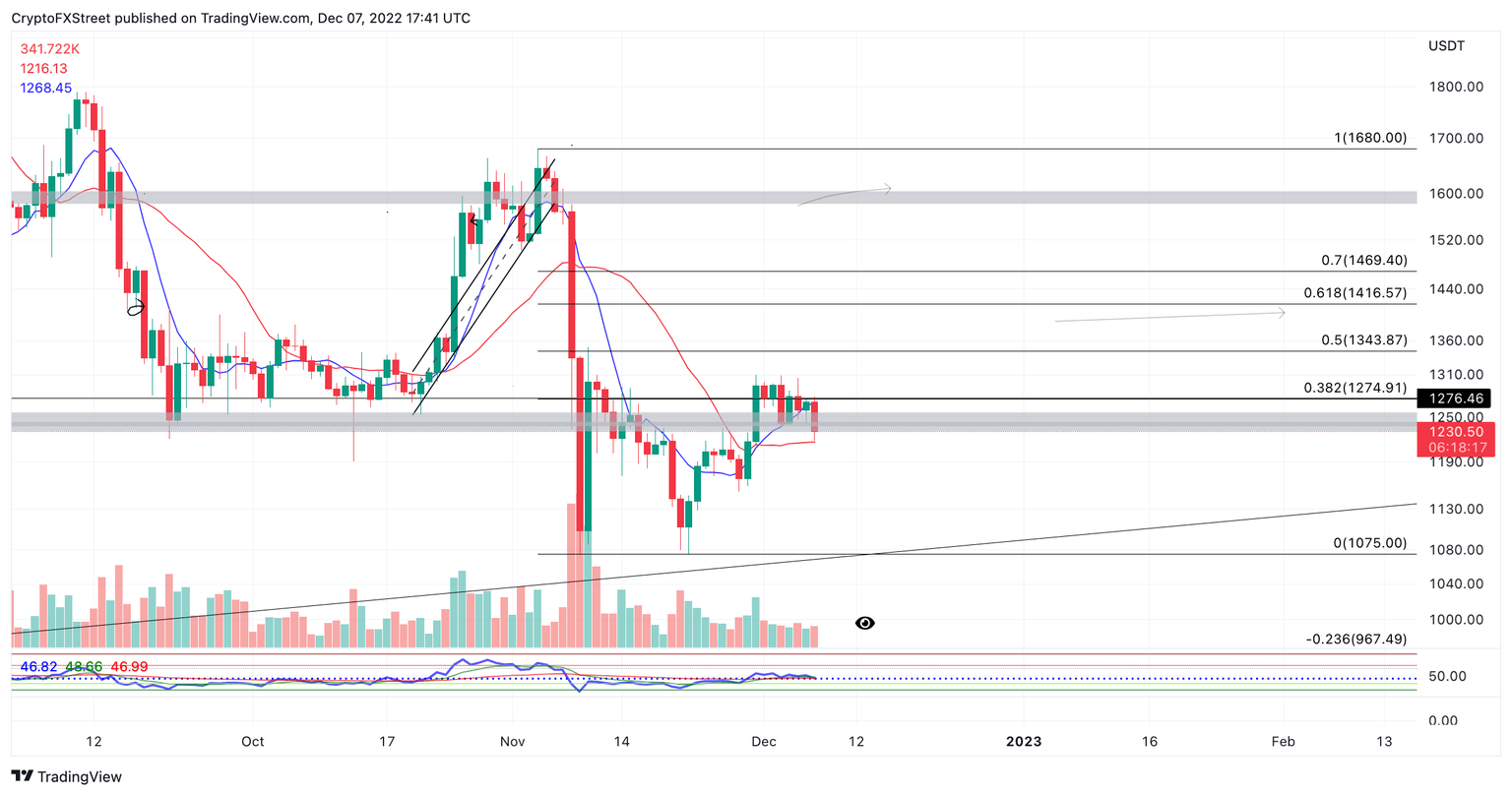

Ethereum price subject to volatility as Chainlink enables staking on the ETH network

Ethereum price has investors dialing in as Network advancements are arousing speculation. Still, the technicals will need to show forth stronger signals to justify opening a long position. Ethereum price is currently down 3% on the day as the bears have flexed a rejection near the mid $1,200 level. At the time of writing, ETH is testing the 21-day simple moving average for support and is submerged below a support zone established in October.

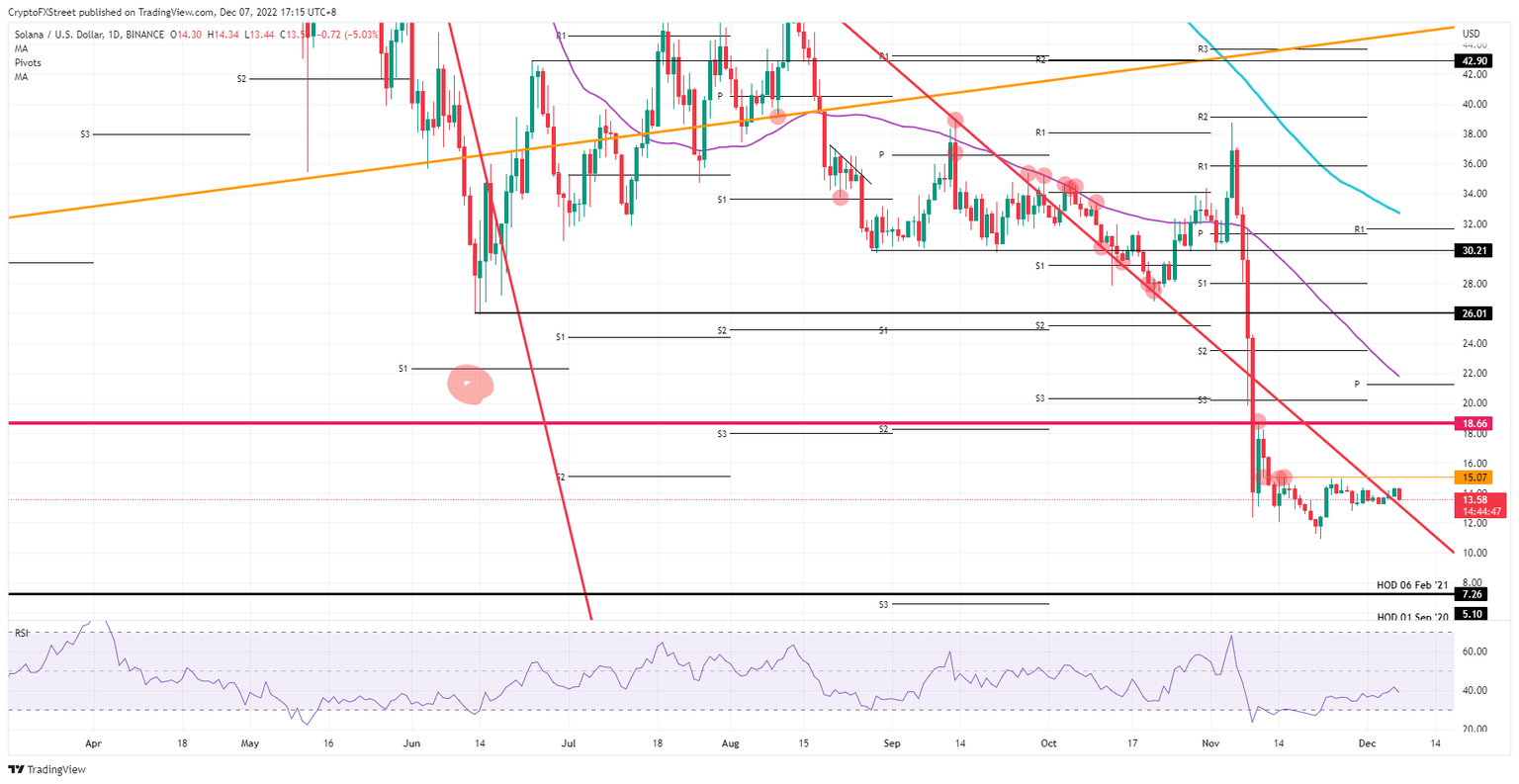

Solana price is done for as another hedge fund defaults on FTX exposure

Solana (SOL) price is tanking again after what could have been a very silent breakout after it trashed the red descending trend line on Tuesday. The drop comes as an unnamed hedge fund defaults on tens of millions of US Dollars worth of crypto loans, on top of several banks and financial institutions confirming that massive layoffs are set to kick in and much lower than expected bonuses will be paid out. With the holiday season just before the door, it looks like it will be a grim Christmas dinner for many.

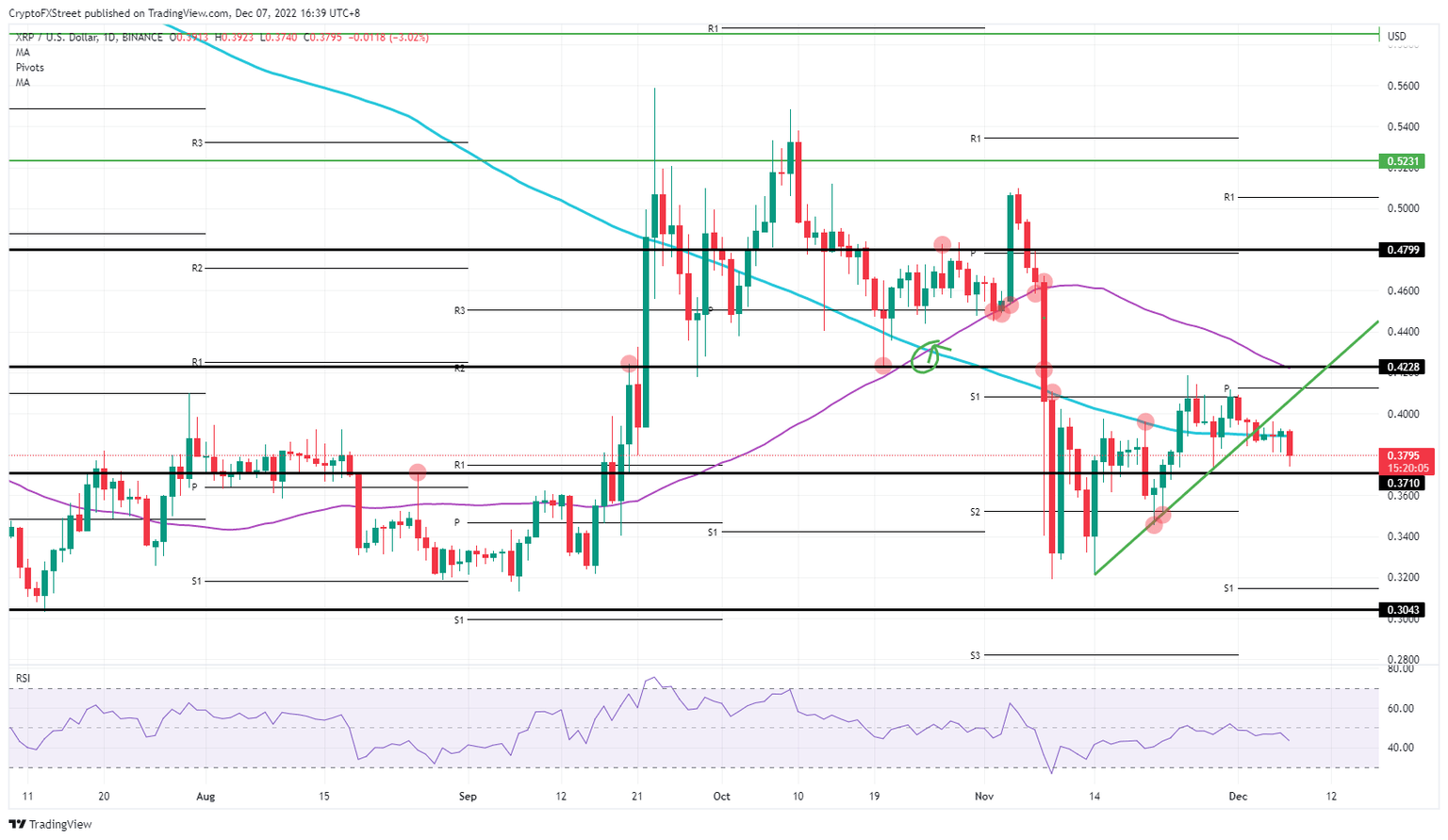

Ripple price turns as US Dollar surprises with sudden strength

Ripple (XRP) price is on the back foot again after what should have been the moment every trader was waiting for this year: the Christmas rally. Instead, the rally chokes as its worst enemy is back at it – the US Dollar’s strength. Although Halloween is over, it almost feels as if the past trading days have the writing of a scary movie where the dead corpse at the end makes one last attempt to strike before finally dying. So, US Dollar strength, will you finally die?

Author

FXStreet Team

FXStreet