Cryptocurrencies Price Prediction: Ethereum, Shiba Inu & Cardano – American Wrap 15 March

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto bulls continue to hold, but for how long?

Bitcoin price continues to consolidate. Ethereum price confirms, again, a major Ichimoku short entry condition. XRP price consolidation gives longs and shorts opportunities for profit.

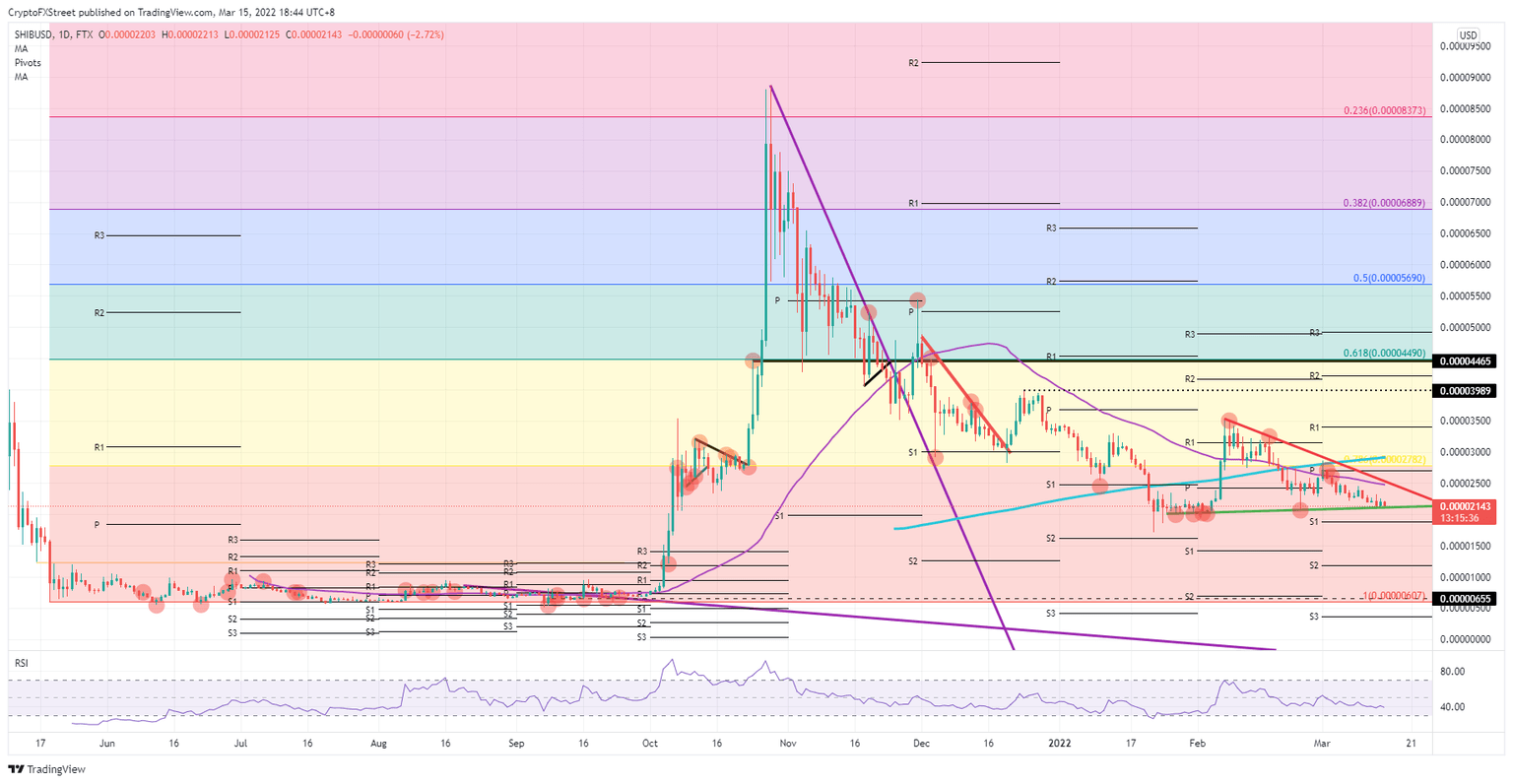

Shiba Inu price to complete the bearish pattern with a 70% drop

Shiba Inu (SHIB) price action is on the cusp of breaking out of a bearish triangle that has dictated price action over the past two months. With a break to the downside, room opens up for an almost 70% drop towards the lowest levels in its existence as investors flee cryptocurrencies overall, following more and more reports that global markets are going into recession. With this dire projection in mind, expect to see further bleeding of SHIB price action as it falls back to $0.00000655.

Cardano price constricts near support, increasing chances of a new yearly low

Cardano price continues to display substantial weakness and a lack of participation. Moreover, contrary to major wallet holders tripling their holdings, volume from retail traders is at historical lows, with some exchanges recording all-time low volume.

Author

FXStreet Team

FXStreet