Cryptocurrencies Price Prediction: Ethereum, Shiba Inu & Bitcoin – American Wrap 29 November

Ethereum breaks out of bullish pennant, targets new all-time high at $5,000

Ethereum (ETH) looks to be back on track to new highs, following Friday’s speed bump as global markets pushed all risk assets to the downside. Over the weekend, investors reassessed the situation and bought the dip in several cryptocurrencies, including Ethereum. Expect a quick retake of the uptrend, brushing off Friday’s correction, and look for new all-time highs by the end of this week.

Shiba Inu price prepares for 125% breakout to $0.000089

Shiba Inu (SHIB) has been downtrending within a pattern for almost the whole of November. After hitting the low of the month on Friday, with global markets in panic mode, investors could spot buy opportunities as concerns about the new Covid variant started to ease. Expect the pick-up on the buy-side to continue further and signal the start of a new longer-term uptrend towards $0.00008870.

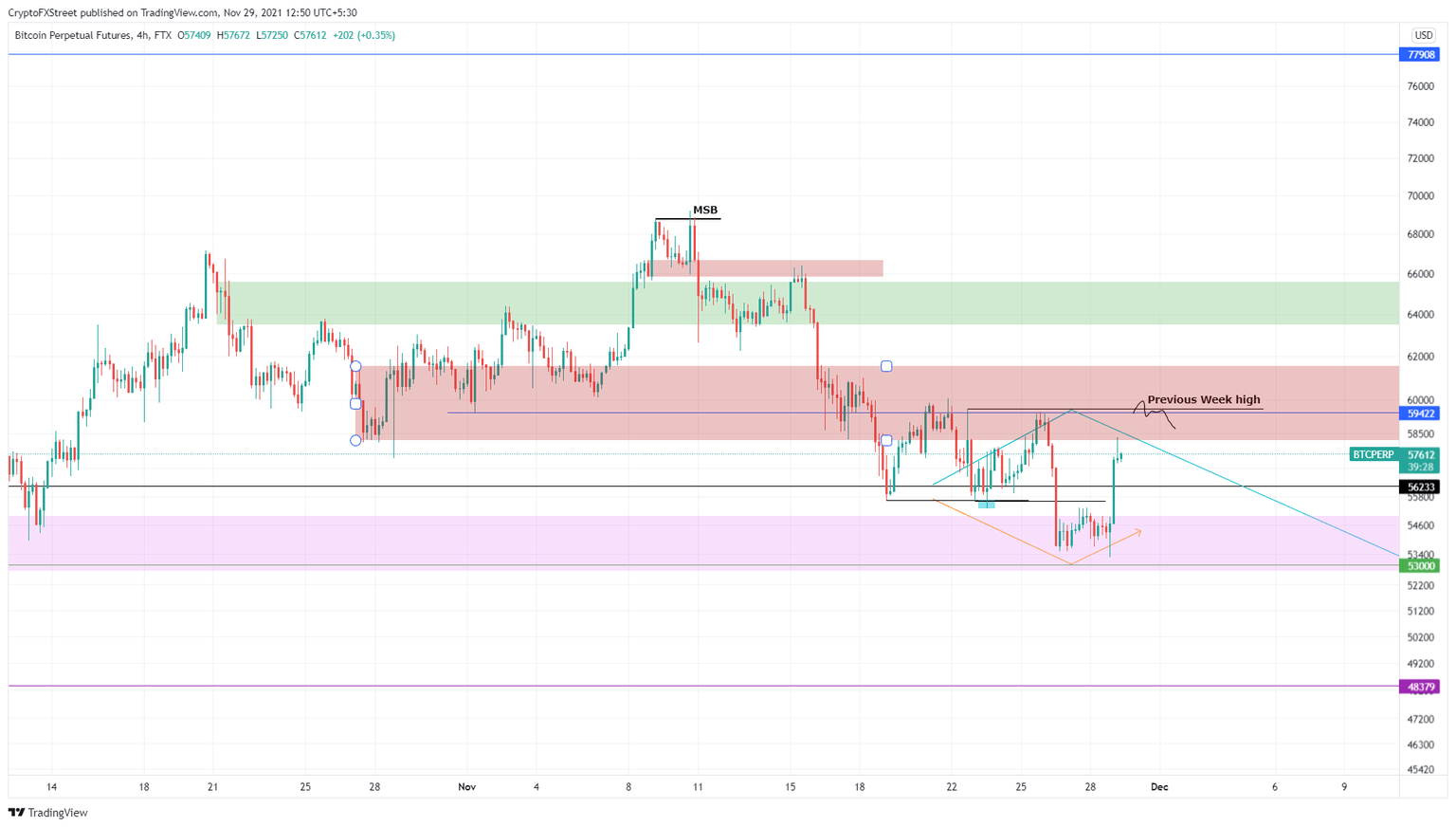

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets recover as buyers come back

Bitcoin price recovery after the COVID-induced crash seems to be going well. Ethereum and Ripple are promptly following the big crypto and are also on the path to recovery.

Author

FXStreet Team

FXStreet