Cryptocurrencies Price Prediction: Chainlink, Bitcoin & Apecoin – American Wrap 28 July

Chainlink price recovers fueled by large transactions, whale accumulation

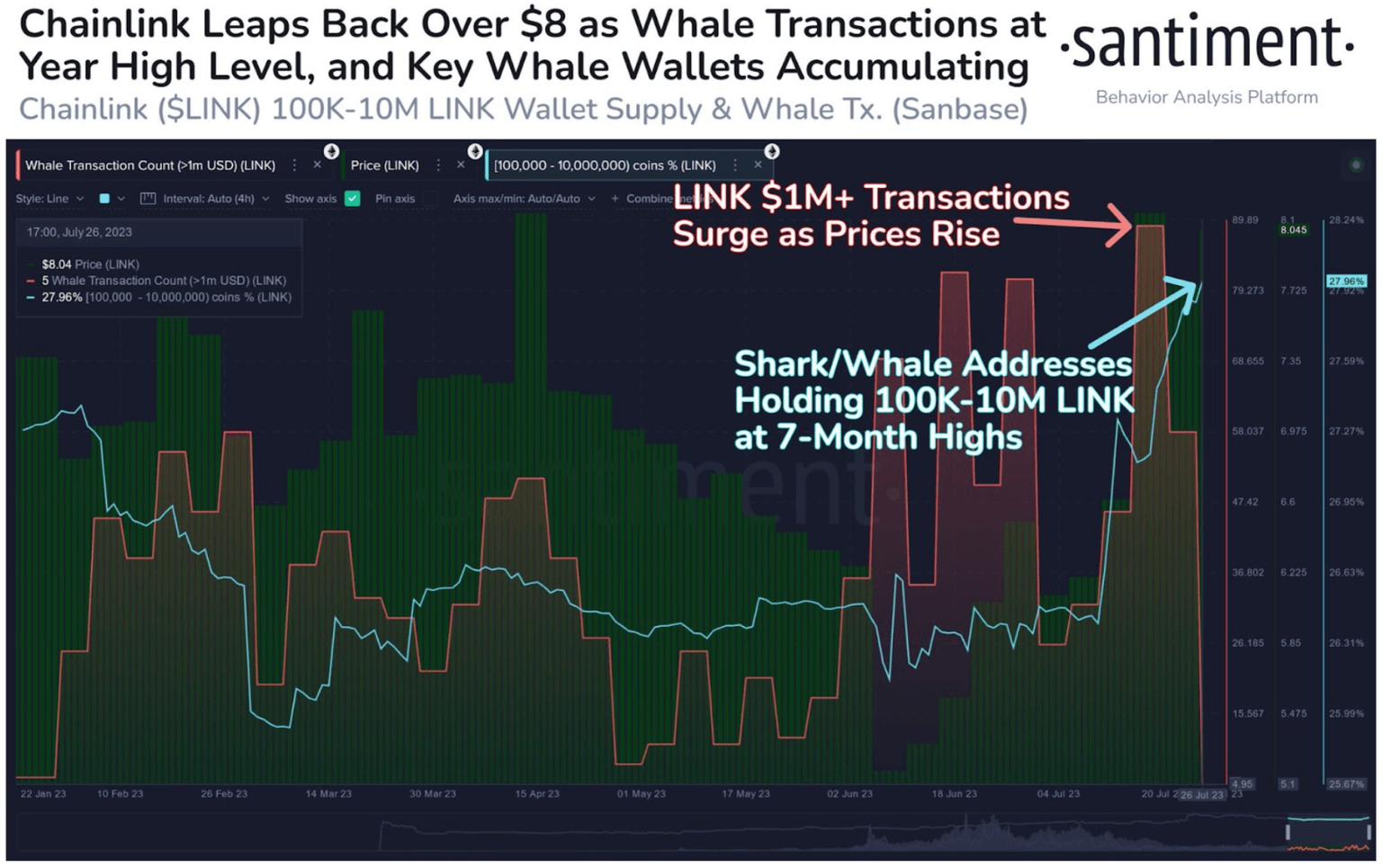

Chainlink witnessed a surge in transactions and accumulation by large wallet investors, popularly known as whales, over the past two weeks. These bullish on-chain metrics of LINK can explain the altcoin’s price hike over the last 14 days. Chainlink ranks among the top 30 cryptocurrencies by market capitalization and the token is leading the pack of altcoins this alt season in July.

Bitcoin Weekly Forecast: Can BTC reach $40k or $25k first?

Bitcoin price continues to show no signs of directional bias in the short term. But in the mid-to-long term outlook, BTC could trigger a minor downtrend that could lead to an extension of the 2023 bull run.

ApeCoin price likely to pull back as on-chain metrics flip bearish

ApeCoin, one of the largest metaverse tokens in the ecosystem, is struggling to recover as the selling pressure on the asset seems to be on the rise. The ERC-20 governance and utility token’s on-chain metrics have flipped bearish this week, signaling that a further pullback in APE price is likely.

Author

FXStreet Team

FXStreet

%2520%5B14.05.18%2C%252028%2520Jul%2C%25202023%5D-638261329754047145-638261704095232732.png&w=1536&q=95)