Cryptocurrencies Price Prediction: Bitcoin, Ripple & Yearn.Finance – Asian Wrap 18 Dec

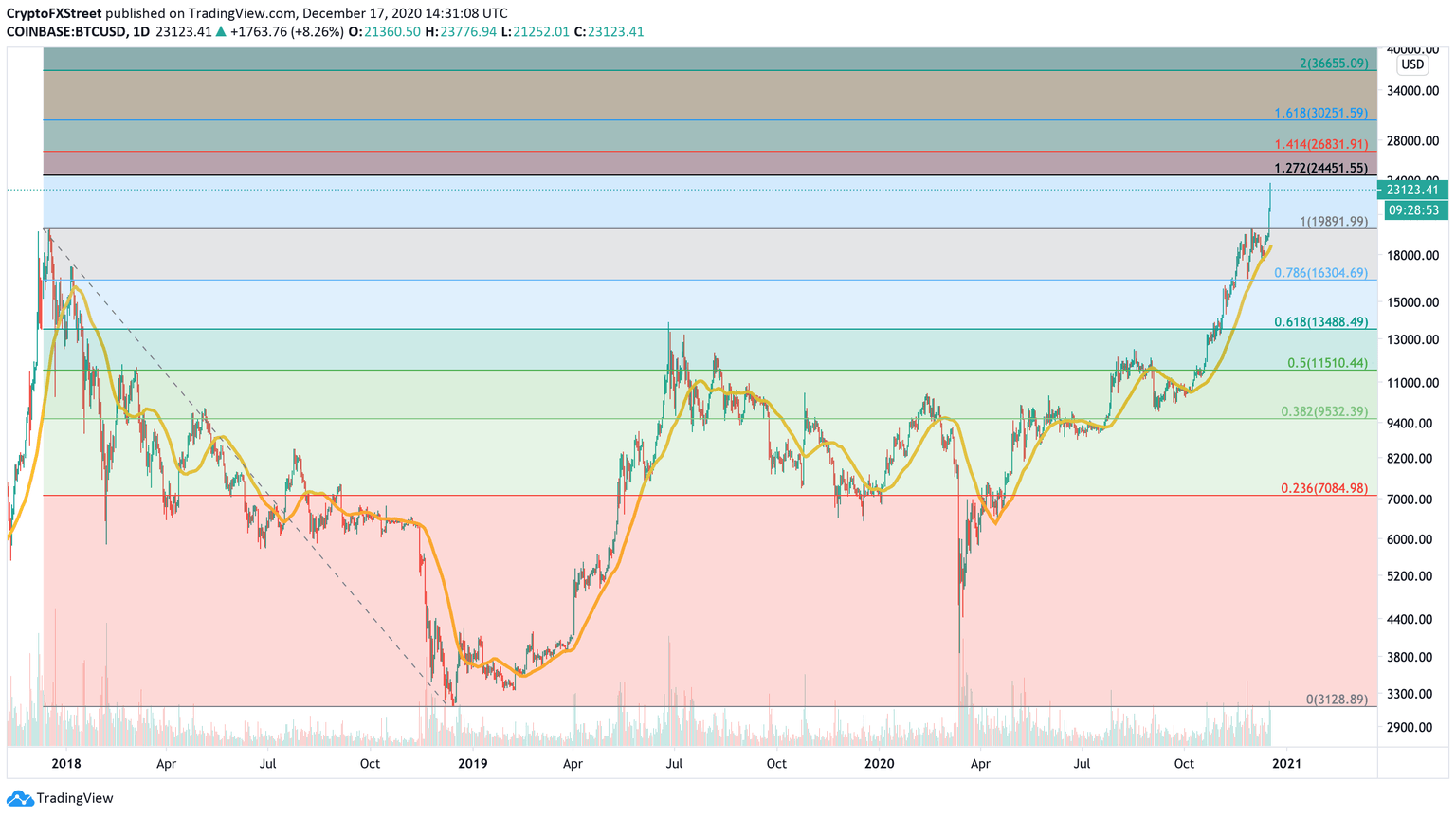

Bitcoin's bull run sends the options market to new record highs

With the growing euphoria accompanied by Bitcoin's clear breakout above previous all-time highs, different financial products related to this asset are now witnessing higher trading volume than ever before. Daily traded volume for Bitcoin options has just breached the $1 billion mark for the first time.

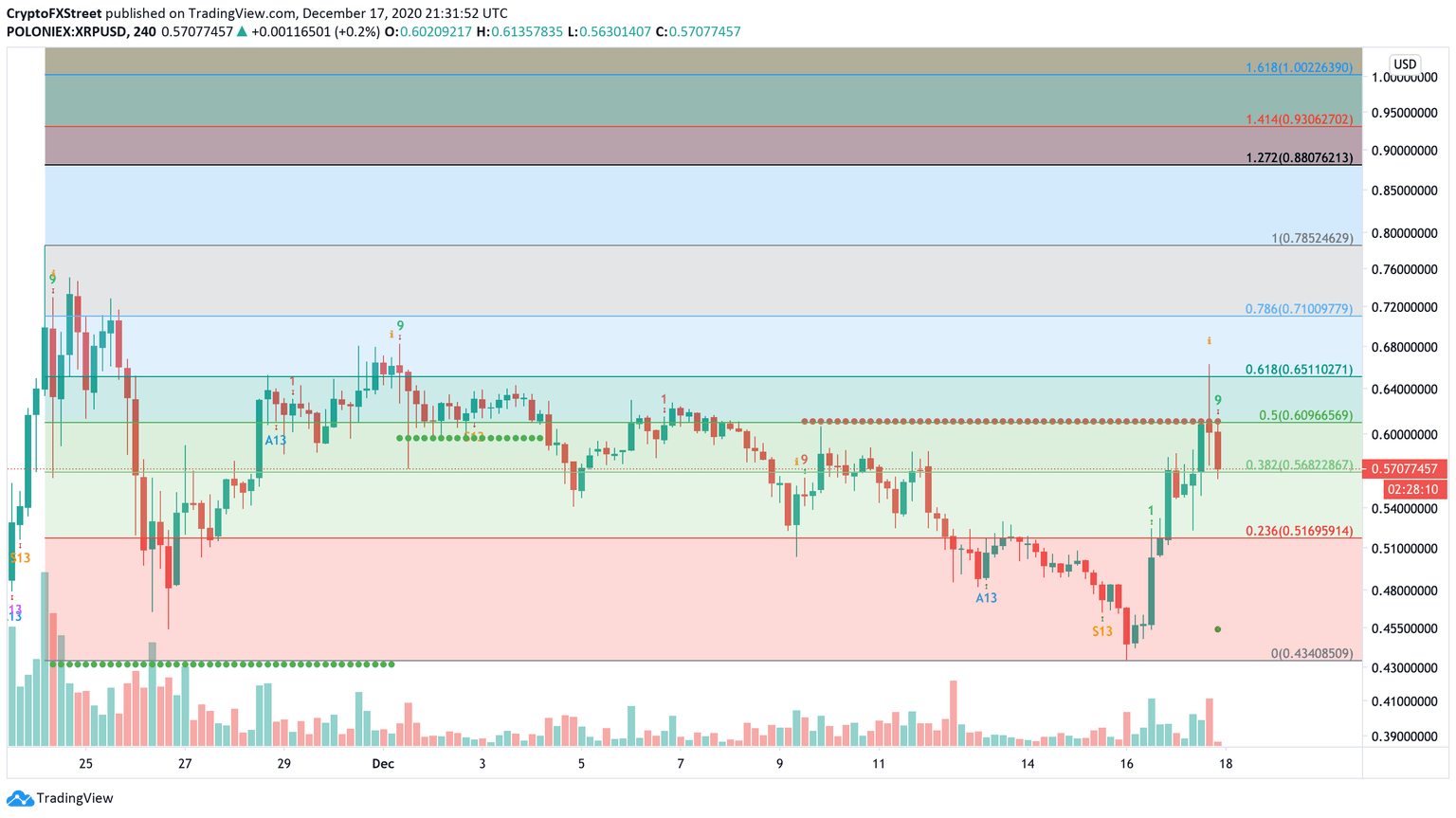

Ripple Price Analysis: XRP’s fundamentals grow strong but it seems poised to retrace

The breakout of the Covid-19 pandemic has led to a spike in the need for remittance services within the last few months. It appears this development may add to the fundamental factors that will cause XRP price to skyrocket. Technical analysis also strengthens the case of an imminent rally for the remittance token.

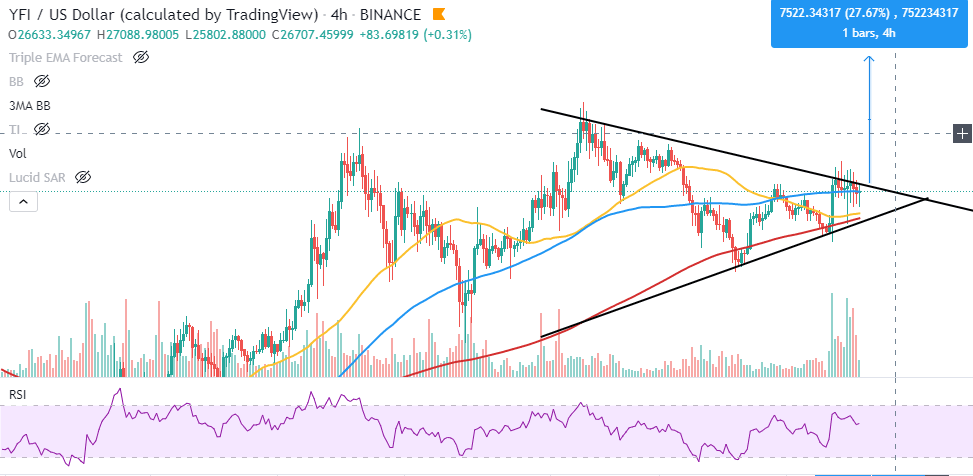

Yearn.Finance Price Prediction: YFI prepares for a 27% upswing as technicals flip bullish

Yearn.Finance is on the cusp of losing the most expensive cryptocurrency title after Bitcoin embarked on the adventurous journey to hit new all-time high after new all-time high. The decentralized finance (DeFi) token trades around $26,700 while Bitcoin appears to hold at $23,100.

Author

FXStreet Team

FXStreet