Cryptocurrencies price prediction: Bitcoin, Ripple & TRON – European Wrap – 13 December

Bitcoin (BTC) may jump to $9,100 ahead of Christmas

Bitcoin (BTC) has bee paralyzed at $7,200 since Thursday. The first digital asset attempted a recovery towards $7,600 at the beginning of the week. However, the upside momentum proved to be unsustainable as the price retreated to the lower boundary of the recent consolidation channel. At the time of writing, BTC/USD is changing hands at $7,202, mostly unchanged both on a day-to-day basis and since the beginning of Friday.

Ripple price prediction: XRP/USD in retreat for five days in a row– Confluence Detector

Ripple’s XRP has been sliding down for the fifth day in a row, At the time of writing, XRP/USD is changing hands at $0.2176, down about 2% since the beginning of the day and 3% in recent seven days.

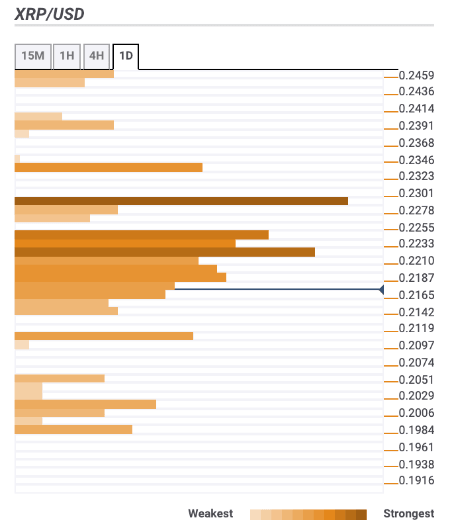

Ripple’s XRP confluence levels

Looking technically, XRP is vulnerable to further losses as long as it stays below $0.2200. If the bulls manage to push the price above this barrier, the short-term technical picture will improve with the next focus on $0.2250. Currently, there are several important levels clustered both above and below the price. Let’s have a closer look at them.

TRON's founder account on Weibo blocked, TRX/USD feels the pain

Meanwhile, TRON (TRX) has been losing ground following the news. The 14th largest coin with the current market value of $915 million, has lost over 2.6% on a day-to-day basis to trade at $0.0137 at the time of writing. TRX/USD is also down 6% on a weekly basis and over 31% on a month-to-month basis.

Author

FXStreet Team

FXStreet