Cryptocurrencies price prediction: Bitcoin, Ripple & Neo - Asian Wrap 12 Nov

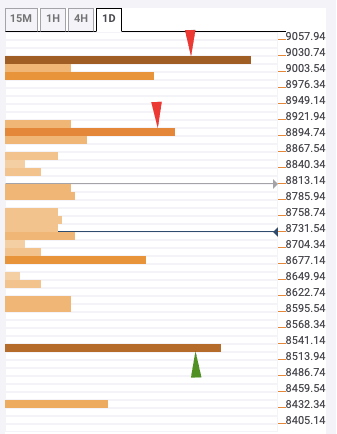

Bitcoin price prediction: BTC/USD capped by resistance levels at $8,900 and $9,025

BTC/USD has had a bullish start to Tuesday and is currently priced at $8,738.65. This follows an extremely bearish Monday wherein the price dropped from $9,035.30 to $8,721.25. The daily confluence detector currently shows two healthy resistance levels at $8,900 and $9,025.

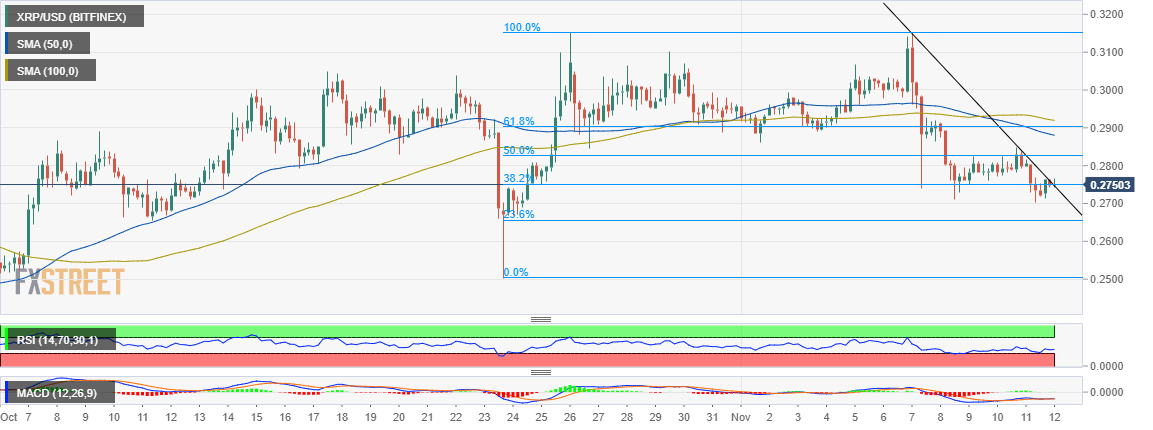

Ripple price analysis: XRP/USD dancing with the 38.2% Fibo, $0.28 is still unconquered

Ripple is forcing a recovery amid a generally bullish environment across the crypto space. Unlike Monday, the entire market is in the green. Leading the recovery on the day is NEO, EOS and Bitcoin Gold having corrected higher 2%, 1.35% and 1.23% in that order.

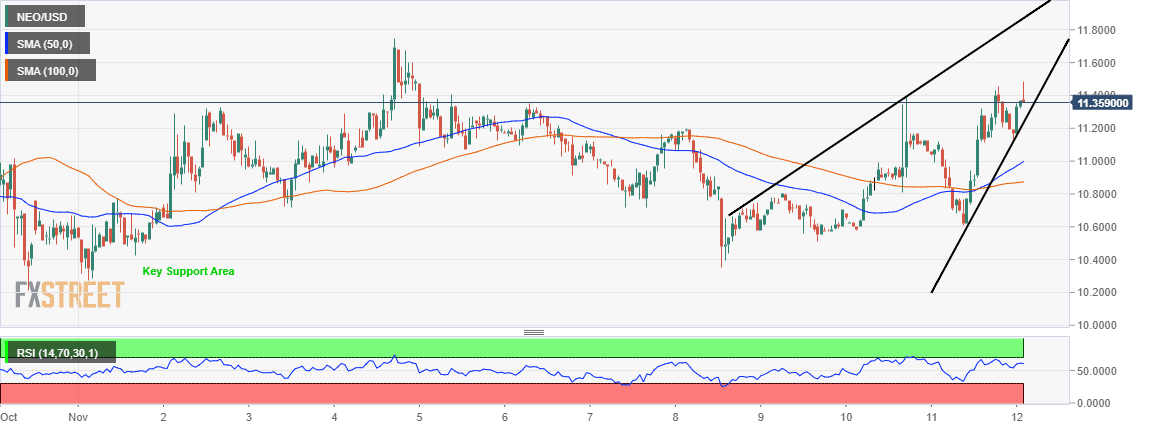

NEO price update: NEO/USD bulls wake up to lead recovery, up 2.45%

NEO bears are waking to a rude shock having found the bulls full in control of the throttle. NEO is in the initial stages of flying the bullish flag high above the crypto horizon. Besides, the price is already 2.45% higher on the day. A rising wedge pattern suggests that NEO will reverse the trend, possible stop at $11.40.

Author

FXStreet Team

FXStreet